IEA: Oil outlook darkened by demand growth slump, production rise

In its September Oil Market Report, the International Energy Agency said a slowdown in global oil demand growth, coupled with rising global oil production and swelling inventories, means the world oil market may take longer than expected to return to balance.

Oil demand growth has eased to 800,000 b/d in this year’s third quarter from 1.4 million b/d in the second quarter. Demand growth in China and India are wobbling. Global oil production is still expanding, with the loss from nonmembers of the Organization of the Petroleum Exporting Countries more than making up that from the cartel’s producers.

“Supply will continue to outpace demand at least through the first half of next year. Global inventories will continue to grow,” IEA said.

This month’s report marked a sharp change in IEA’s view of the oil market. In last month’s OMR, the agency forecast supply and demand broadly in balance over the rest of this year and expected inventories to fall.

Demand

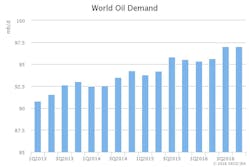

Global oil demand is forecast to grow by 1.3 million b/d in 2016, a downgrade of 100,000 b/d on a previous forecast due to a more pronounced 2016 third-quarter slowdown. Momentum eases further to 1.2 million b/d in 2017 as underlying macroeconomic conditions remain uncertain.

Since peaking at a near 5-year high of 2.3 million b/d in third-quarter 2015, year-over-year global oil demand growth has steadily decreased, easing to 1.6 million b/d in this year’s first quarter and to 1.4 million b/d in the second quarter. Third-quarter year-over-year growth has plunged to 800,000 b/d due to dwindling demand growth by Organization for Economic Coordination and Development members, as well as a marked slowdown in India and China.

“Chinese demand growth all but disappeared as the economy continued to restructure and slow, while heavy flooding curbed gains in road transport and ‘blue sky’ policies ahead of September’s G20 meeting restrained industrial demand,” IEA said. The agency noted that India’s expansion continued to slow sharply, with growth easing to a 16-month low.

In Europe, demand contractions have been seen in July, particularly in Italy, France, Austria, and Finland. Growth momentum in the US has also slowed.

Supply

Global oil supplies dropped 300,000 b/d year-over-year in August on lower non-OPEC output, averaging 96.9 million b/d. Near-record OPEC supply just about offset steep declines from non-OPEC.

Crude oil output from OPEC rose to unprecedented levels in August as Middle East producers ramped up and lifted overall supply to 33.47 million b/d. The biggest increases were from Kuwait and the UAE, which pumped at their highest levels ever. Output from Saudi Arabia held near an all-time high and production from Iran bumped up to 3.64 million b/d. Overall OPEC crude output stood 930,000 b/d above a year ago. Including NGLs, OPEC production was an impressive 1.1 million b/d higher than a year earlier.

Saudi Arabia’s vigorous production has allowed it to overtake the US and become the world’s largest oil producer.

After two consecutive months of rising supplies, total non-OPEC oil production declined by 300,000 b/d in August to 56.4 million b/d, according to IEA data.

“The US accounted for most of the loss, while maintenance at the [ExxonMobil Corp.]-operated Sakhalin field dropped Russian output to its lowest in more than a year. The massive Tengiz field in Kazakhstan was also operating at reduced levels. North Sea loading schedules indicate that output eased after a bumper month in July,” IEA said.

Stocks

OECD total inventories built 32.5 million bbl in July to a new record of 3,111 million bbl. As refinery activities reached a summer peak, crude oil inventories refused to decline until an exceptional storm-related draw hit the US in late August.

Gasoline has started the journey towards more normal levels, at least in the US, while the diesel overhang appears to have stopped growing in the west as barrels move eastwards.

LPG markets are in a glut of their own, with other products—mainly propane—struggling to find outlets in a globally oversupplied gas liquids market.

Chinese implied crude balances showed another strong build in August, after having eased during June and July, as customs data showed exceptionally high crude imports.