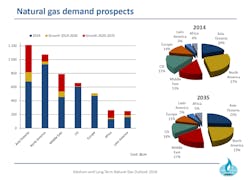

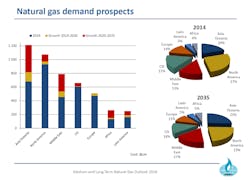

Cedigaz: Global gas demand to rise 1.6%/year over 2014-35

Worldwide natural gas demand is expected to rise 1.6%/year during 2014-35, driven by emerging markets, electric power generation, and industry, according to a recent outlook from Cedigaz.

In its Medium and Long-Term Natural Gas Outlook 2016, the international gas association highlights the increasing role of gas as a bridge fuel towards a longer-term, increasingly renewables-based energy system.

Cedigaz noted that political action is needed to promote coal-to-gas switching worldwide, given the vast low-cost coal resources. The trajectory of Cedigaz’s scenario is based on the assumption that energy-related carbon dioxide emissions increase an average of 0.3%/year, reaching almost 35 Gt over 2030-35.

“Looking forward to 2035, the total primary energy consumption is forecast to grow at a moderate rate of 1%/year in a context of increased energy efficiency. In this context, gas stands as the fastest-growing fossil fuel over 2014-35 (+1.6%/year). In contrast, the growth of oil and coal is expected to slow sharply, with respective annual rates of 0.2% and 0.1%.” Cedigaz said.

Gas will therefore increase its relative share in the global primary energy supply to 23.9% in 2035 from 21.4% in 2013.

However, the pace of gas demand growth has been revised downwards compared with the association’s Outlook 2015. Intended Nationally Determined Contributions (INDCs) ahead of Conference of Parties (COP21) have been taken into account, meaning greater efforts to meet environmental goals via the deployment of renewables and increasingly efficient technologies.

Also, according to the Outlook 2016, virtually all of the additional energy is consumed in emerging economics and 85% of gas growth comes from emerging economies. The US is the only industrialized market to record a significant growth in gas consumption in volume terms, thanks to the competiveness of shale gas and the adoption of the Clean Power Plan. China and the Middle East lead the way in gas demand growth, accounting for 27% and 25%, respectively, of the incremental volume over the projection period.

The power industry remains the powerhouse behind gas expansion. Substantial growth in gas use in manufactured industry is also expected in the Middle East, China, India, Latin America, Southeast Asia, and the US.

Interregional trade

Moreover, interregional trade will account for an increasing share of global supply.

“Net interregional (long distance) trade is forecast to grow by 2.7%/year from 398 billion cu m (bcm) in 2014 to 690 bcm in 2035, due to Asia’s (post-2020) and Europe’s growing import dependence,” Cedigaz said.

This is accompanied by a 2%/year growth in interregional pipeline flows, boosted by Central Asia and Russia’ exports to Asia, mainly China. With 30% of its total gas import being Russia, Europe will remain strongly dependent on Russian gas.

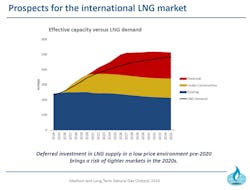

LNG will increase more rapidly than pipeline gas after 2020, according to this year’s outlook. International LNG trade is set to increase by 3.4%/year to 2035. The share of LNG in interregional flows will progress from 47% in 2014 to 53% in 2035.

North America emerges as a large-scale exporter, covering 18% of total net interregional exports by 2035, at the expense of the Middle East and the Commonwealth of Independent States.

“LNG will lead to a growing internationalization of gas markets with flexible LNG and hub pricing expanding in Europe and Asia, supported by US LNG,” Cedigaz said.

However, in Cedigaz’s scenario, the availability of low-cost US shale gas resources will be gradually restricted in the long term, leaving space for some other international LNG projects (Canada, East Africa) underpinned by fully or partially oil-indexed long term contracts.