Sustained E&P spending cuts may lead to underinvestment, report warns

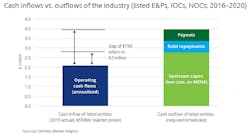

Competing cash priorities during depressed oil and gas prices could increase the risk of long-term underinvestment, a recent Deloitte Center for Energy Solutions report warns.

“When prices are depressed, the No. 1 move in most companies’ playbooks is to cut capital expenditures. We may see a huge capital migration out of the industry,” said John W. England, vice-chairman and US oil and gas leader at Deloitte LLP.

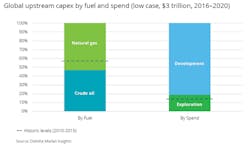

Simply keeping reserve levels flat takes 80% of a company’s production budget, England told reporters on June 21 during Deloitte’s 2016 Washington Energy Conference. “Companies will prioritize, so the emphasis will be on developing their established reserves and less on finding new resources,” he said.

Maintaining sufficient oil and gas reserves is a good strategy for exploration and production companies, but a lot of development capital will need to be spent to bring them into production, England said. “So many projects have been deferred or canceled in this low-price environment that there’s a potential for tighter supplies around 2018,” he said.

Emphasizing development over exploration could result in other long-term consequences, another Deloitte official cautioned. “If a capital-constrained sector focuses on spending more on development for too long, major potential resources off Brazil and elsewhere will be kicked to the back of the queue,” said Andrew Slaughter, who is the Center for Energy Solutions’ executive director.

E&P companies have reduced their spending drastically already, the report noted. “In fact, after reducing capex by about 25% in 2015, the global upstream industry (excluding the Middle East and North Africa) has announced further cuts of 27% in 2016,” it said. “These cuts have reduced spending to below the minimum required levels to offset resource depletion, let alone meet any expected growth.”

England said, “We think about $600 million/year will be needed for the next 5 years to reach the necessary $3 trillion the global E&P industry needs to ensure its long-term sustainability. Companies are expected to budget about $2 trillion. The rest will need to come from additional debt. There will be other calls on cash flow, such as dividend payouts, which could increase their deficits.”

Contact Nick Snow at [email protected].

About the Author

Nick Snow

NICK SNOW covered oil and gas in Washington for more than 30 years. He worked in several capacities for The Oil Daily and was founding editor of Petroleum Finance Week before joining OGJ as its Washington correspondent in September 2005 and becoming its full-time Washington editor in October 2007. He retired from OGJ in January 2020.