Survey: Outlook improving for US Eleventh District oil, gas firms

Oil and gas companies in Texas, southern New Mexico, and northern Louisiana reported improved business activity for the second quarter and thus a more positive outlook for the rest of the year onward, according to executives responding to a quarterly Dallas Federal Reserve energy survey.

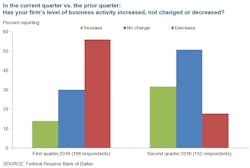

The business activity index—the survey’s broadest measure of sentiment among Eleventh District energy firms—turned positive at 13.8, up sharply from -42.1 in the first quarter. Positive readings in the survey generally indicate expansion, while readings below zero generally indicate contraction.

Data for the survey were collected from 152 energy firms. Of the respondents, 67 were exploration and production firms and 85 were oil and gas services firms.

“I think a key word here is ‘stabilization’ in business conditions,” commented Michael D. Plante, Dallas Fed senior research economist. “A little more than 50% of respondents said that their business activity levels were the same as they were in the first quarter. That’s a marked difference from what we found in the first-quarter results, when more than half of survey respondents said that business activity levels actually declined.”

E&P firms reported oil and gas production fell again in the second quarter, but at a slower pace than in the first. The oil production index was -19.7, up from -49.4, and the natural gas production index rose 23 points to -24.7.

Oil and gas services firms reported that declines in equipment use largely abated in the second quarter, with the equipment utilization index rising more than 50 points to come in just below zero at -1.2.

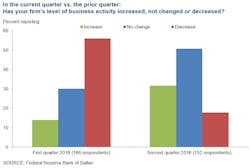

Outlooks 6 months out improved, with the index coming in at 19, a pronounced reversal from the -24.5 reading in the first quarter. Outlooks were particularly optimistic among E&P firms, with nearly half reporting their view had improved. Reflecting this, the index of expected E&P capital spending in 2017 jumped 40 points to 25.4, suggesting producers have revised upward their expenditure estimates for next year.

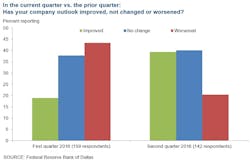

Around a third of respondents think the global oil market will likely balance this year, and more than 70% believe it will balance by second-quarter 2017. Ninety percent indicated balance would take place by yearend 2017, with 10% expecting balance in 2018 or later.

The average expected West Texas Intermediate crude oil price for yearend 2016 came in at $54.80/bbl. Price expectations ranged $35-70/bbl, with most respondents anticipating the price will be higher than its current level.

The average expected Henry Hub natural gas price for yearend 2016 came in at $2.63/MMBtu. Price expectations ranged $1.50-3.50/MMBtu.