Oil pipelines are “urgently needed” in Canada, the Canadian Association of Petroleum Producers said in its 2016 Crude Oil Forecast, Markets, and Transportation report.

“Canada’s energy future relies on our ability to get Canadian oil and gas to the people who need it,” said Tim McMillan, CAPP president and chief executive officer. “We need the infrastructure to connect Canadian energy to the global economy.”

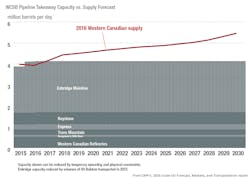

The CAPP report noted that Canada’s oil supply will soon greatly exceed its current pipeline capacity. The pipeline network can move about 4 million b/d, which “closely matched” the 2015 average supply of 3.981 million b/d.

But CAPP said more than 850,000 b/d of additional oil sands supply will be available by 2021. Between 2021 and 2030, supply from Canada’s oil sands is forecast to increase more than 700,000 b/d, requiring additional transportation systems.

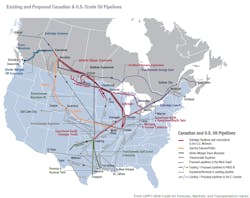

CAPP said current delays in startup dates for several oil pipeline projects mean railways will continue to complement pipeline transportation.

Production of Canadian oil—the total volume of oil before imported diluent is added—will increase 28% over the next 15 years to 4.9 million b/d by 2030, compared with 3.8 million b/d in 2015.

Supply—the total volume after imported diluent is added to production—is expected to increase 37% over the next 15 years to 5.5 million b/d by 2030. “Due to the increase in total volume, all forms of transportation are needed to get Canadian oil to new and existing markets,” CAPP said.

Oil sands remain the primary driver for growth in Canadian crude oil production, with 3.7 million b/d expected by 2030. CAPP’s forecast a year ago for 2030 was 4 million b/d (OGJ Online, June 11, 2015).

Conventional oil production in western Canada, including condensates, drops from 1.3 million b/d in 2015 to 1.1 million b/d by 2018, and is expected to remain relatively stable to 2030.

Canada, the sixth largest producer in the world in 2015, spent $17 billion in 2015 importing oil from countries such as the US, Saudi Arabia, Algeria, Angola, and Nigeria. About 600,000 b/d was imported to meet refinery needs in Quebec and Atlantic Canada.