Rystad Energy: Improving oil prices could help shrink DUC inventory

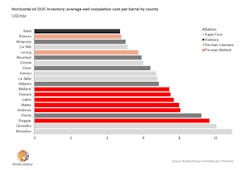

The heart of the Denver-Julesburg (DJ) basin exhibits the most commercial drilled but uncompleted (DUC) backlog, said a Rystad Energy study that estimated the DUC inventory in Weld County, Colo., was economic to complete at an average light, sweet crude oil futures price of $30/bbl.

Other counties that exhibit favorable economics are Reeves County, Tex., in the Permian basin’s Delaware and McKenzie County, ND, in the Bakken formation, said Artem Abramov, Rystad senior analyst in Oslo. He believes much of the US shale DUC inventory is commercial given current oil prices.

“Significant support to the US Lower 48 oil supply can be expected in the near months as market sentiment gradually moves in a positive direction,” Abramov told OGJ.

Weld County topped Rystad’s DUC ranking list by inventory size with almost 600 oil wells awaiting completion crews.

Intentional completion delays by Anadarko Petroleum Corp. accounted for much of the Weld County DUC inventory. Anadarko operates almost half of the DUCs in Weld County. PDC Energy, Noble Energy Inc., and Whiting Petroleum Corp. each operate about 10% of the Weld County DUC inventory, Rystad Energy said.

Hydraulic fracturing is the most cost-intensive part of shale well completions. Economics vary considerably across a play.

For example, the Permian basin represents a collection of some outstanding acreage positions such as the Northern Wolfcamp acreage. But it also has less prospective drilling spots, which are now far from commerciality threshold.

Within the Permian, Delaware acreage exhibits slightly better well economics than Midland acreage.

In the DJ basin, the DUC inventory is concentrated in the basin’s core, Weld County. Anadarko intentionally delayed completions primarily during the second half of 2015 because the company had a strong balance sheet and was financially able to wait until commodity prices improved.

“Essentially, these wells were not delayed because it was uncommercial to complete them as it was the case in some other plays,” Abramov said. “However, as we entered 2016 with an extremely low price environment, the company decided to focus on completing these DUCs rather than new drilling because a significant part of new drilling turned uncommercial.”

During this year’s first quarter, Anadarko completed 46 DUCs and drilled only 26 new wells so the DUC inventory started going down.

“The trend is likely to persist in the second quarter 2016,” Abramov said. “The pace of the DUC inventory contraction is likely to accelerate as we are already at the $45-50/bbl crude oil price level. DUCs will provide a significant support to the US shale oil production.”

Contact Paula Dittrick at [email protected].

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.