OTC: Bidding opens for blocks off Nova Scotia

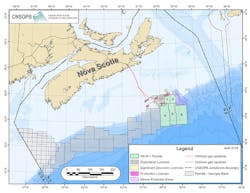

The governments of Nova Scotia and Canada have opened closed, competitive bidding for exploration licenses to six blocks off the province, officials reported at an Offshore Technology Conference press briefing.

Three blocks are in shallow water close to existing production in the Sable subbasin of the Scotian Shelf. The others are on the Scotian Slope downdip from the Sable Delta.

The Canada-Nova Scotia Offshore Petroleum Board, an independent joint agency of the federal and provincial governments, posted four of the blocks. The others were nominated by oil and gas companies.

The CNSOPB is accepting bids through Oct. 27, 2016. It offers results of a geological and geophysical assessment as well as seismic and well data on a dedicated web site.

Exploration licenses have 9-year terms and include the exclusive right to obtain a production license, which is based on a negotiated royalty. Bidding for exploration licenses is based on work expenditure.

One of the shallow-water blocks on offer, Parcel 1, encompasses a 1972 well that encountered 52 m of net gas pay in Late Cretaceous Wyandot chalk. The block also includes the Cretaceous Chebucto Canyon, which accommodates sediment transport to deepwater parcels. Water depths in the block approach 400 m.

Parcel 2, on which exploration has been limited, features thick Cretaceous and Jurassic sediments of the Sable Delta complex, heavily faulted as the delta prograded seaward and the Sable subbasin subsided.

Parcel 3 lies south of a production license between discoveries designated Glenelg and Chebucto. Water depths are less than 400 m.

Main exploration targets of Parcels 4—6, in 150-4,000 m of water, are believed to be deepwater turbidite deposits of Cretaceous age.

The CNSOPB says its resources assessments have identified “numerous shelf margin canyon systems throughout the Cretaceous that erode sand-prone systems on the shelf and potentially have delivered reservoir-quality sands to this region.” It says, “This implies that the risk of encountering reservoir-quality sands is low to moderate within these parcels.”

One of two wells drilled on Parcels 4-6, Marathon Annapolis G-24 drilled in 2001, encountered 27 m of net gas pay.