Mercer: Employers dislike ACA excise tax, ‘play or pay’ rule

Employers dislike the “play or pay” provision of the Affordable Care Act almost as much as they do the excise tax on high-cost plans scheduled to take effect in 2018, a Mercer survey finds.

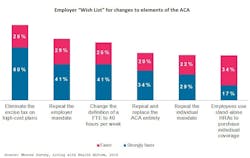

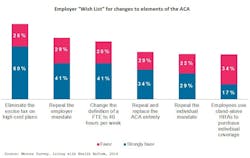

In a survey asking 644 employers what changes they’d like to see in the ACA, 85% of respondents favored repeal the excise tax.

In second place was repeal of the requirement to either offer coverage meeting ACA requirements or pay a penalty. Seventy percent of respondents favored that change.

“It’s not because they don’t want to offer coverage,” said Tracy Watts, Mercer’s leader for health reform. “It’s because proving that they offer coverage is so much work.”

The Internal Revenue Service extended to June from January its deadline for reporting 2015 coverage.

Most survey respondents indicated they offered coverage to substantially all employees working 30 hr/week or more. Only 8% thought some of their employees might qualify and obtain subsidized coverage through the health-care exchange because of plans not offering affordable contributions or meeting minimum plan-value requirements.

“This suggests that penalties are not going to amount to a huge source of revenue,” said Beth Umland, Mercer research director for health and benefits. The Congressional Budget Office has estimated employer penalties would raise $9 billion in 2016.

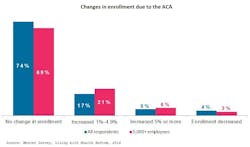

About three fourths of survey respondents said their enrollment levels hadn’t changed due to the ACA. While 22% reported enrollment increases, most said the increase was less than 5%, and 4% said enrollment had decreased.

According to Mercer, a recent CBO study reported “virtually no change in the number of people obtaining health insurance from their employer since the law was passed.”

In 2016, the consultancy reported, citing CBO data, 155 million people will receive employment-based coverage. That’s 57% of the population under age 65.

Asked about effects of the ACA on their organizations, 20% of survey respondents said they had experienced higher costs, and 29% said they had made unwanted plan-design changes to avoid excise-tax exposure.

Meanwhile, 84% said the additional administrative burden had “a significant impact,” and 51% described the impact as “very significant.”

The requirement to offer coverage to “substantially all” employees working 30 hr/week or more will toughen this year as the definition of “substantially all” increases to 95% from 70% of employees.

“Limited duration” employees, such as long-term temporary workers and interns, might trigger assessments, Mercer noted. About one fourth of the survey respondents indicated they’d trim use of those workers. A further 16% were considering the tactic.

“More than half of Americans already get their health insurance from their employer, and three out of four workers are satisfied with their health benefits,” Watts said. “Under play or pay, employers have had to modify their plans, track worker hours, manage eligibility, and report coverage to prove they are doing something they have been doing all along.”