IEA expects world oil demand growth to slow in 2016

World oil demand growth is forecast to ease closer to a long-term trend of 1.2 million b/d in 2016 as supportive factors that have recently fueled consumption—such as post-recessionary bounces in some countries and sharply falling crude oil prices—are expected to fade, noted the International Energy Agency in its monthly Oil Market Report for November.

Global oil demand growth in 2015 is expected at 1.8 million b/d, a 5-year high. According to IEA, global demand growth, dominated by gasoline, is likely to have peaked in the third quarter of 2015 at 2.1 million b/d on a year-over-year basis and is expected to ease to 1.5 million b/d in the last quarter. Gains in Europe and non-OECD Asia—notably India, and to a lesser extent China, are particularly strong.

Supplies

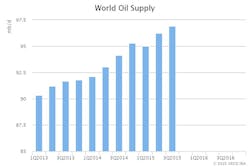

Global oil supplies, including biofuels, breached 97 million b/d in October as output outside the Organization of the Petroleum Exporting Countries rebounded from reduced levels a month earlier, .

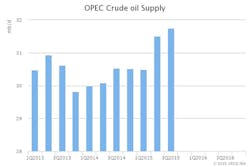

OPEC crude oil output held steady in October at 31.76 million b/d with declines in Iraq and Kuwait offset by higher supply from Libya, Saudi Arabia and Nigeria.

“Overall OPEC output stood 1.1 million b/d above a year ago as Saudi production remained in excess of 10 million b/d for an eighth straight month and Iraq continued to pump near record rates above 4 million b/d,” IEA said.

The outlook for non-OPEC supply growth in 2016 has dimmed since last month’s report with steeper declines foreseen for US light tight oil. Non-OPEC supply is now expected to contract by more than 600,000 b/d next year to 57.7 million b/d, despite resilient production in a number of countries.

“Continued declines in US drilling activity suggest steeper drops in US LTO output lie ahead,” said the US Energy Information Administration. Producers pulled another 36 rigs out of service in October, to 578, while the number of new wells completed dropped to 800, the lowest rate since the start of 2011. As a result, EIA forecast US LTO production to contract by 600,000 b/d next year compared with declines of 400,000 b/d expected previously.

According to the latest official statistics from the EIA, the US Gulf of Mexico became the largest source of supply growth in August as onshore production gains eroded.

However, “output outside of the US continues to defy expectations, posting healthy gains in spite of lower prices and spending cuts”, EIA said.

Despite signs of accelerated decline at mature fields, the outlook for Russian oil supply has been lifted versus last month’s report. China, Vietnam, Oman and the North Sea are other producers that have been able to boost output. Brazil, a significant contributor to growth earlier in the year, is seeing its output gains ease.

OECD stocks, refining

The pace of global stock building slowed during the third quarter to 1.6 million b/d from 2.3 million b/d in the second quarter but remained significantly above historical averages. OECD commercial stocks accounted for nearly 60% of this as they continued to build at close to the same rate as during the previous two quarters to touch a record near 3 billion barrels by end-September.

Global refinery throughput sank by 1.2 million b/d in October to 78.2 million b/d, with seasonal maintenance in full swing. Runs are expected to return to much higher levels in November and December - 79.8 million b/d and 81 million b/d, respectively - as maintenance finishes.