EIA lowers US oil output estimates amid prolonged oil-price slump

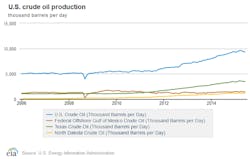

US crude oil production in June totaled 9.3 million b/d, a decline of 100,000 b/d from the revised May figure, according to the US Energy Information Administration’s Petroleum Supply Monthly (PSM) released Aug. 31. The US hit a peak of 9.61 million b/d in April.

EIA revised downward production estimates released in the PSM for January through May by 40,000 b/d to 130,000 b/d. The largest revisions in volume include decreases of oil production in Texas, ranging 100,000-150,000 b/d; and increases in the federal Gulf of Mexico, ranging 10,000-50,000 b/d.

The revisions reflect a slowing of production as crude-oil prices have plunged over the past year. US crude production for the first 6 months of 2015 averaged 9.4 million b/d. While the oil-directed rig count has risen over the past 6 weeks, Raymond James & Associates Inc. last week revised downward its rig count projections for the next few years (OGJ Online, Aug. 28, 2015).

Beginning with the June PSM data, EIA is providing estimates for crude production, including lease condensate, based on data from the EIA-914 survey. The expanded survey collects monthly oil production data from a sample of operators of oil and natural gas wells in 15 individual states and the federal gulf.

Production from all remaining states and the federal Pacific is reported collectively in an “other states” category.

EIA says the survey-based approach improves estimates by representing more than 90% of oil production in the US. Later this year EIA will report monthly crude production by API gravity category for the individually surveyed EIA-914 states.

June movement varies

During June, Texas oil output averaged 3.46 million b/d, down from 3.53 million b/d in May but still up from 3.15 million b/d in June 2014. The state peaked at 3.64 million b/d in March. North Dakota, meanwhile, reported output of 1.2 million b/d, up slightly from 1.19 million b/d in May and more noticeably from 1.09 million b/d in June 2014. Its recent peak was 1.23 million b/d in December 2014.

In its Drilling Productivity Report (DPR) released earlier in August, EIA projected that crude production in September from seven major US shale plays will decline 93,000 b/d to 5.27 million b/d (OGJ Online, Aug. 10, 2015). A bulk of recent shale oil declines have come in the Eagle Ford and Bakken shale plays.

According to the PSM, production from federal waters in the Gulf of Mexico during June reached 1.45 million b/d, up slightly from 1.44 million b/d in May and more noticeably up from 1.41 million b/d in June 2014. EIA earlier in the year forecast crude output would reach 1.52 million b/d in 2015 and 1.61 million b/d in 2016—or respectively 16% and 17% of total US crude production during each year (OGJ Online, Mar. 3, 2015).

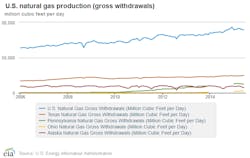

US gas production fell in June to 89.5 bcfd from 89.6 bcfd in May, but represented an increase from 86.6 bcfd in June 2014. Output in Texas increased during the month to 24.92 bcfd from just fewer than 24 bcfd in May and 23.52 bcfd in June 2014. Pennsylvania monthly production fell to 12.35 bcfd in June from 12.46 bcfd in May.

Ohio and Alaska reported the most significant monthly changes of the major gas-producing states. Ohio’s 2.85 bcfd in June represented a 12.6% increase from 2.53 bcfd in May, while Alaska’s 7.45 bcfd in June represented an 11.6% decrease from 8.43 bcfd in May.