BHI: Recent downward shift continues for US rig count

The US drilling rig count fell 4 units to 838 rigs working during the week ended Sept. 25, marking the fifth straight week of declines, according to data from Baker Hughes Inc. (OGJ Online, Sept. 18, 2015).

Since the recent peak during the week ended Aug. 25 that followed a small summer rebound, the count has dropped 47 units. It’s now down 1,093 units year-over-year.

Canada’s rig count fell for a sixth straight week, dropping 6 units to 176, down 253 year-over-year. Since a recent peak after its own summer rebound, the count has declined 35 units, of which all but 1 have been oil-directed.

Oil-directed rigs in Canada this week fell another 4 units to 66, down 180 year-over-year. Gas-directed rigs dropped 2 units to 110.

Low crude oil prices have caused firms to substantially reduce their rig fleets over the past year to save cash. French multinational firm Total SA has slashed its global fleet nearly in half since 2014 in a move that’s “adapting rig count to activity levels,” according to a presentation delivered this week at the company’s investor day (OGJ Online, Sept 23, 2015).

US oil rig losses continue

Oil-directed rigs also fell 4 units this week, and now have fallen 35 units over the past 4 weeks. They now total 640, down 952 year-over-year. Gas-directed rigs edged down 1 unit to 197. One rig considered unclassified came online this week, representing the only one in operation.

Land-based rigs dropped 6 units to an even 800, down 1,058 year-over-year. Rigs engaged in horizontal drilling lost 11 units to 629, down 718 year-over-year. They’ve dropped 48 units since a recent peak on Aug. 21. Directional drilling rigs, meanwhile, gained 3 units to 86.

Light activity this week in the major US oil- and gas-producing states was led by a 3-unit loss in Texas to 363, down 534 year-over-year. The state has now fallen 26 units since a recent peak on Aug. 14.

The Eagle Ford posted losses for a sixth straight week, dropping 3 units to 85, down 122 year-over-year. The Permian also dropped 3 units, settling at 250, down 306 year-over-year. In neighboring Louisiana, the Haynesville lost 3 units to 26.

Oklahoma, North Dakota, and Arkansas each edged down a unit to 106, 66, and 3, respectively. Arkansas’ total is its lowest in a decade, while North Dakota’s total is its lowest since 2009.

Diminishing US offshore activity

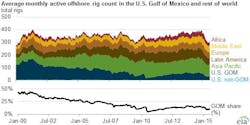

While rigs drilling offshore the US posted one of the few increases this week, gaining 2 units to 33, the total is down 29 units year-over-year. In an energy update this week, however, the US Energy Information Administration noted that the number of working offshore rigs in the US Gulf of Mexico has declined more rapidly over the past year compared with the rest of the world.

Worldwide offshore rigs fell 20% between August 2014 and August 2015 while gulf rigs during that time fell 46%. Over the past 15 years, the gulf’s share of active offshore rigs worldwide has declined significantly from almost half in 2000 to fewer than 20% since 2008.

The number of active offshore rigs in the gulf fell from 122 in January 2000 to 41 in January 2010, before dropping to 19 in June 2010 following the Deepwater Horizon explosion and blowout. The count recovered to 57 by December 2014, and currently sits at 33.

EIA attributes the drop in part to technological advancements that accelerated gulf deepwater development, resulting in fewer rigs operating in shallow waters. Natural gas prospects also have become less profitable, as the largely shale-driven increase in onshore gas supply contributed to decreases in US gas prices.

Steady global offshore activity

The share of active rigs operating offshore the Asia-Pacific, the Middle East, and Latin America regions grew significantly from 2000 to 2006. That share remained steady over the past decade.

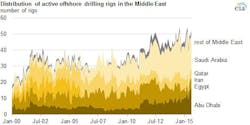

EIA attributes Asia-Pacific growth to expansion of offshore drilling in India and China. Qatar and Iran during the early 2000s accounted for much of the growth in active offshore rigs in the Middle East, with Saudi Arabia representing a large portion of regional growth since 2006.

Mexico accounted for the growth in active offshore rigs in Latin America in the early 2000s, as Petroleos Mexicanos (Pemex) increased its offshore activity to arrest declining production from aging fields. Since 2006, Brazil has been responsible for much of Latin America's growth.

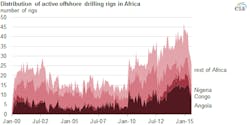

Most of the more recent growth in active offshore rigs outside the US has occurred in Africa, EIA said. Angola and Nigeria account for much of the growth in the region after 2010. Angola has more than 10 offshore oil projects expected to come online within the next 5 years. Nigeria's offshore activities have been focusing on the deepwater and ultradeepwater, with at least three deepwater projects in development and projected to come online within the next half-decade.

Moody’s Investor Service, however, last week said it expects pain for the global offshore drilling industry through 2017 (OGJ Online, Sept. 15, 2015).

“Drillers will increasingly contend with diminished backlogs, rig values, fleet sizes, and margins if oil prices do not bounce back to the $70-80/bbl range, which we believe could support an increase in shallow-water as well as deepwater and ultradeepwater drilling,” it said.

Contact Matt Zborowski at [email protected].