EIA: Continuing but lower global oil inventory builds expected in second half

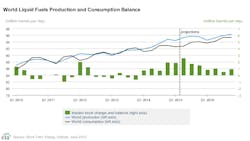

Global petroleum liquids production continues to exceed consumption, resulting in inventory builds, the US Energy Information Administration said in its most recent Short-Term Energy Outlook, released this month. However, averaged global oil inventory builds are projected to fall from 2.2 million b/d through this year’s first half to 1.6 million b/d during this year’s second half, reflecting rising demand and slowing production growth outside of the Organization of Petroleum Exporting Countries, particularly in the US.

EIA expects global consumption to increase 1.3 million b/d in both 2015 and 2016. Forecasted global consumption growth was revised modestly upward from last month’s STEO, as lower oil prices stimulated global demand growth more than previously expected. Projected real gross domestic product weighted for oil consumption, which increased an estimated 2.8% in 2014, is projected to rise 2.4% in 2015 and 3% in 2016.

In this month’s outlook, OPEC crude-oil production is forecast to rise 600,000 b/d in 2015 and fall 200,000 b/d in 2016. Iraq is expected to be the largest contributor to OPEC production growth in 2015.

At the June 5 OPEC meeting, the group did not change its production quota of 30 million b/d. EIA forecasts OPEC crude oil production will continue to exceed that target over the forecast period, contributing to the expected global inventory builds.

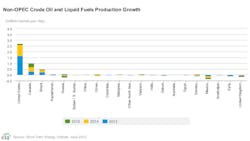

Non-OPEC petroleum and other liquids supply is forecast to increase 1.3 million b/d in 2015 and 200,000 b/d in 2016. Forecast non-OPEC production growth was revised upward from last month’s STEO by an average of 500,000 b/d in 2015, to account for historical revisions to first quarter US production and increases to forecast Canadian production.

“After remaining relatively flat in 2015, production in Eurasia is projected to decline almost 0.2 million b/d in 2016. The projected decline reflects reduced investment in Russia’s oil sector stemming from low oil prices and international sanctions,” EIA said.

Prices

North Sea Brent crude oil prices averaged $64/bbl in May, a $5/bbl increase from April and the highest monthly average of 2015, attributable to continued signals of higher global oil demand growth, expectations for declining US tight oil production in the coming months, and the growing risk of unplanned supply outages in the Middle East and North Africa.

EIA forecasts Brent crude oil prices will average $61/bbl in 2015 and $67/bbl in 2016. The 2016 price forecast is $3/bbl lower than in last month’s STEO. West Texas Intermediate prices, meanwhile, in both 2015 and 2016 are expected to average $5/bbl less than the Brent price.

US crude oil, liquid fuels

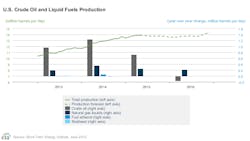

Total US consumption of liquid fuels in 2015 is projected to rise 2%, or 370,000 b/d from 2014. EIA projects liquid fuels consumption growth will slow to 70,000 b/d (0.4%) in 2016. The 2015 and 2016 consumption forecasts are about 40,000 b/d higher than in last month’s STEO.

US crude oil production will average 9.4 million b/d this year, up from 8.7 million b/d last year, and then decline to 9.3 million b/d in 2016.

Despite the 60% decline in the total US oil-directed rig count since October 2014, US crude oil production averaged almost 9.6 million b/d in May 2015, almost 400,000 b/d higher than the average production during the fourth quarter of 2014.

“Production has increased as producers work through the backlog of uncompleted wells (completing more wells than they are drilling) and achieve potentially better completions with higher initial production rates,” EIA said.

EIA expects US crude oil production will begin to decline in June, with continuing declines through early 2016, largely attributable to unattractive economic returns in some areas of both emerging and mature onshore oil production regions, as well as seasonal factors such as anticipated hurricane-related production disruptions in the Gulf of Mexico.