Natural gas appears likely to supplant coal as the world’s second biggest energy source—after crude oil—by 2025, ExxonMobil Corp. said as it released its 2013 Energy Outlook. Demand for gas will grow by about 65% through 2040, with 20% of worldwide production occurring in North America, supported by growing supplies from shale and other unconventional sources, it said.

“Today, the world consumes some 25 times the energy it used 200 years ago,” William M. Colton, ExxonMobil’s vice-president of corporate strategic planning, said as he presented the forecast at the Center for Strategic and International Studies on Dec. 11.

“It took over 100 years from the first oil well’s discovery until oil became the world’s No. 1 energy source,” he continued. “Natural gas is poised to surge as modern renewables also grow.”

The report also predicted that North America will change to a net energy exporter from an importer by 2025. It said that more than half of the growth in unconventional gas supplies will take place in North America, providing a foundation for strong US economic growth with solid contributions from the energy, chemical, steel, and manufacturing industries.

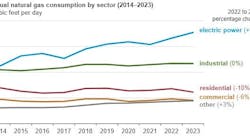

Electricity demand will account for more than half the global energy demand increase over the next few decades, with gas, nuclear, and renewable energy meeting more power generation demand as coal and oil meet less, according to ExxonMobil’s 2013 outlook.

Transportation demand

It said a more than 40% increase in global energy demand related to transportation from 2010 to 2040 will come almost entirely from commercial sectors—heavy-duty, aviation, marine, and rail—as expanding economies and international trade stimulate more movement of goods.

Colton said the 2013 forecast projects more gas penetration into transportation than its predecessors because lower prices make it more economically attractive. It sees the biggest growth here in fleets, and in using liquefied natural gas for long-haul trucking, he indicated.

“There will be significant opportunities, and we expect the market to drive this growth,” he said. “We expect compressed natural gas to be marginal because it’s more difficult.”

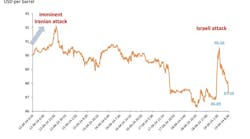

Gas-to-liquids looks somewhat better because the technology exists, but Colton said that its capital costs are high. “You have to be confident that the gap between oil and gas prices will be persistent through a plant’s lifetime,” he explained.

The forecast said that by 2040, only about 55% of the world’s energy liquids will be supplied from conventional crude oil production. The rest will come from deepwater wells, tight oil formations, and natural gas liquids, as well as oil sands and biofuels.

Slow, steady growth

“It’s still very much the early days for tight oil,” Colton said, adding that production from the Bakken shale has grown slowly but steadily. Other domestic tight oil formations show similar growth trends, he said.

Other unconventional technologies also are relatively new, he continued. “Deepwater production was barely on our radar screen 10 years ago, and is expected to more than double,” Colton said.

ExxonMobil’s 2013 energy outlook also sees efficiency continuing to play a key part in solving energy challenges. Hybrid vehicles, high-efficiency gas-fired power plants, and other technologies and practices will help industrialized nations within the Organization for Economic Cooperation and Development keep energy use essentially flat as their economic output grows 80% by 2040, it said.

Energy efficiency improvements aren’t new, Colton observed. “They’re actually accelerating in some industries, and they’re occurring across the board,” he said. “People see benefits and adopt more efficient practices.”

ExxonMobil’s challenge remains producing the world’s fuels with the lowest possible footprint, noted Kenneth P. Cohen, the company’s vice-president for public and governmental affairs, who also participated. “Going forward, it’s all about technology,” he said. “Human creativity and innovation always will be the biggest drivers of energy progress.”

Contact Nick Snow at [email protected].