The front-month natural gas futures contract dropped 1.8% Jan. 9 on the New York market with forecasts of warm weather for the East Coast. Oil prices were down modestly with European problems still tainting the market outlook for demand.

“The oil market was weaker yesterday as general market sentiment was soured by the intransigent Euro-zone debt crisis,” said James Zhang at Standard New York Securities Inc., the Standard Bank Group. “Oil products, however, continued to make gains amid problems in the refining industry. Brent structure weakened sharply, but remained in backwardation, while West Texas Intermediate structure was broadly unchanged.

Olivier Jakob at Petromatrix in Zug, Switzerland, said, “The flat price of crude oil has been trading a small range the last 4 days, torn between the risk of supply disruption and the risk of demand destruction.”

He said, “Ever since the strange alleged Iranian plot to assassinate the Saudi ambassador to Washington, Iran and the West have been engaged in a continued escalation that has no clear exit solution apart from war. The announcement yesterday of Iran that it has now moved its enrichment facility deep in the mountains of Qom will be a further step in that escalation process. The US aircraft carrier USS Vinson has now joined the USS Stennis in the 5th Fleet area (the area that covers the Arabian Sea and the Persian Gulf). The USS Lincoln is currently in Thailand on its way to the 5th Fleet, and it will now be very important to see whether the USS Stennis sails back to the US as per the original schedule or stays a bit longer in the 5th Fleet. Two US aircraft carriers in the 5th Fleet is already a crowd; having three will make Iran very, very nervous. Meanwhile the UK is sending for its first mission its brand new stealth Destroyer HMS Daring to the Persian Gulf (the HMS Daring supposedly has the world’s most sophisticated naval radar system, able to track at the same time all sorts of flying objects).”

Jakob observed, “One of the risks with Saudi Arabia trying to replace Iran supplies while the West imposes an embargo is that the conflict starts to degenerate into a greater conflict between Iran and Saudi Arabia. We should not forget that the initial start of the Iraqi attack on Kuwait had something to do with Kuwait over-producing and taking the market shares of Iraq.” Iran might take the same attitude toward Saudi Arabia, especially after the “proxy” conflict between the two governments last March in Bahrain.

At KBC Energy Economics, a division of KBC Advanced Technologies PLC, analysts noted US legislation enacted Dec. 31, 2011, makes it more difficult for lifters of Iranian oil to pay for their purchases. Also, the European Union subsequently reached a preliminary agreement among its members for an embargo of Iranian crude embargo. “All this threatens a backlash from the Islamic republic whose leaders have become increasingly shrill in their rhetoric in recent weeks. Iran has already said it will hold a new round of war games in the gulf from Jan. 21,” they said.

However, KBC analysts said, “The EU has yet to announce a date for the embargo to go into effect, and agreeing on the details will not be plain sailing. Italy has asked for an exemption, and others such as Greece are understood to be urging a slow phasing in of the embargo, rather than a guillotine. Any such import ban would add to that imposed on Syria due to Damascus’ response to unrest in that country.”

Zhang said, “The EU is reported to bring forward its decision over Iranian oil imports to Jan. 23. An embargo on Iranian oil appears to be certain, which is likely to tighten the European crude market and push prices higher.”

Meanwhile, US Sec. of the Treasury Timothy Geithner is scheduled to visit China and Japan to discuss the latest US sanctions on Iran. KBC analysts said, “Iran says that, in the face of an EU embargo and US sanctions, it is ready to ship its oil to China and other Asian countries as well as Africa. Such importers will drive a hard bargain. China has already cut its imports from Iran and has been busily buying up cargoes from elsewhere to replace these.”

Strait of Hormuz

Iran has threatened to retaliate by blocking the Hormuz Strait, but few knowledgeable analysts take that as a given. “Iran’s few allies are among its main crude buyers, [and] Iran depends on oil for three quarters of its revenue,” KBC analysts said. “During its long 1980-88 war with Iraq, exports from the gulf producers kept flowing, and despite the so-called tanker war, Iran at no stage tried to block the Strait of Hormuz for the simple reason that it needed oil revenue to pay for the war effort. Nevertheless, the noose appears to be tightening and countries are generally at their most unpredictable when under threat, so it is impossible to rule out retaliation of some sort by Iran. Forecasting prices under such scenarios is notoriously difficult and usually will get the consultant involved quoted in the press as having predicted that oil prices will actually rise to $200/bbl (or whatever other round numbers seem plausible at the time). We therefore give the following views with caution. A possible response by Iran would be to proactively announce a cessation of oil exports to Europe. If this happened, a price spike similar to that in early 2011 is likely, as refiners seek to secure alternative supplies. Because the volumes involved are smaller, however, and Iran’s crude is poorer in quality than Libya’s light, sweet grades, we would not expect prices to rise much above $120/bbl on Brent.”

Jakob said, “While we focus a lot on the [potential] closure of the Strait of Hormuz, we need to keep in mind that it is still relatively easy to have some local bombings of pipelines in Iraq, especially since the political situation in that country is currently a bit tense and terrorist bombings still an almost daily act (three car bombs yesterday in Baghdad). If internal fighting slows the flow of crude from Iraq, then Saudi Arabia is stuck on its spare capacity potential, and Iran regains an edge without using its option on the Strait of Hormuz. And in the meantime we still have to keep an eye on Nigeria for a possible escalation in street protests against the price of gasoline and growing unrest between the north and the south regions.”

In other news, Jakob said, “Chinese imports of crude oil in December were 250,000 b/d higher than a year ago and make for an average [increase] of 286,000 b/d for the whole of 2011 vs. 2010. The oil prices of 2011 were not the result of a Chinese pull but of a supply disruption in Libya, and for the prices of 2012 it is again the geopolitics that will be the main input, not China. The growth of Chinese crude oil import demand was in 2011 at the slowest level of the last 6 years.”

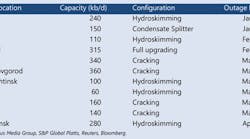

With little sign of improvement in business conditions for Petroplus Holdings AG, the shutdown and throughput reduction of its European refineries could last a prolonged period, possibly leading to a permanent shutdown of some refineries or a sell-off. “Consequently, European refining margins received a temporary boost from Petroplus’s woes, with both cracking margins and hydroskimming margins rallying over the past few weeks. However, we are not expecting the strength to last as product demand is still lackluster. More importantly, there remains plenty of spare capacity in the European refining system, and we expect other refineries to pick up the supply gap left by Petroplus. The strength in product cracks should be sold into,” Zhang advised.

Warm winter so far this year in many parts of the North Hemisphere has reduced heating demand for middle-distillates. “December was warmer than normal by 13%, losing 290,000 b/d of heating oil demand for the month. This warmer-than-expected winter has arrested the sharp decline in distillate inventories we saw during autumn, another factor which usually weighs on refining margins,” Zhang said.

Energy prices

The February contract for benchmark US sweet, light crudes dropped another 25¢—the same loss as in the previous session—to $101.31/bbl Jan. 9 on the New York Mercantile Exchange. The March contract continued its decline, giving up 26¢ to $101.52/bbl. On the US spot market, WTI at Cushing, Okla., was down 25¢ to $101.31 in tandem with the front-month futures contract.

Heating oil for February delivery inched up 0.28¢ but closed essentially unchanged at a rounded $3.07/gal on NYMEX. Reformulated stock for oxygenate blending for the same month increased 0.74¢ to $2.76/gal.

The February natural gas contract gave back most of its gain from the previous session, down 5.1¢ to $3.01/MMbtu on NYMEX. On the US spot market, gas at Henry Hub, La., regained 3.5¢ to $2.90/MMbtu.

In London, the February IPE contract for North Sea Brent lost 61¢ to $112.45/bbl. Gas oil for January decreased $1.75 to $959/tonne.

The average price for the Organization of Petroleum Exporting Countries’ basket of 12 benchmark crudes was up 28¢ to $112.51/bbl.

Contact Sam Fletcher at [email protected].