Sam Fletcher

OGJ Senior Writer

HOUSTON, Nov. 18 -- For the fourth consecutive trading session, the crude price fell Nov. 17 in the New York futures market, down 2.3% after Chinese Premier Wen Jiabao said his government is formulating plans to curb inflation. Natural gas, however, jumped 5.6% on forecasts of cooler weather.

“Jiabao stole the show yesterday on what could have been a strong day for crude,” said analysts in the Houston office of Raymond James & Associates Inc. Speculation that China will raise interest rates, effectively slowing the economic growth of the world's largest energy consumer, “more than offset a second straight very-bullish Department of Energy petroleum inventory report showing large and unexpected draws in crude,” they said. “The broader market ended the day roughly flat as the outlook that Ireland would receive financial aid improved. This was offset by concerns that technology spending was slowing domestically. Energy stocks outperformed the broader markets.”

Walter de Wet at Standard New York Securities Inc., the Standard Bank Group, noted, “The front month West Texas Intermediate and North Sea Brent spread continues to widen as December WTI approaches expiry tomorrow, partly attributable to Cushing, Okla., crude inventory build. Product cracks improved slightly, as crude got sold off more than products. The time spread has started to show signs of weakness.”

The weekly inventory report by the DOE’s Energy Information Administration appeared “very bullish indeed.” However, De Wet said, “US domestic demand is still weak, which will be a drag for the supply and demand fundamentals.”

US inventories

The Energy Information Administration said commercial US inventories of crude fell 7.3 million bbl to 357.6 million bbl in the week ended Nov. 12. The Wall Street consensus was for no change. Gasoline stocks dropped 2.7 million bbl to 207.7 million bbl, outstripping market expectations for an 800,000 bbl decline. Both finished gasoline inventories and blending components inventories decreased. Distillate fuel inventories were down 1.1 million bbl to 158.8 million bbl, less than the anticipated 2 million bbl decline (OGJ Online, Nov. 17, 2010).

The EIA “showed a large 9 million bbl stock draw that follows the large 12 million bbl draw of the previous week,” said Olivier Jakob at Petromatrix, Zug, Switzerland. “Overall US stocks are still above the levels of previous years. In visible stocks, the US is up about 90 million bbl vs. the levels of 2007 or 2008.”

Most of the latest stock draw was in crude and primarily on the Gulf Coast. However, the Gulf Coast is also where crude stocks have been considerably higher than in previous years. “It is also a region that manages crude oil stocks at the end of the year for tax purposes,” Jakob noted. “On the other hand, stocks in Cushing…could continue to build if we see as in previous years a transfer of stocks from the US Gulf to Cushing for the end of the year.” He said crude imports into the Midwest remain relatively low, however.

Meanwhile, the latest mortgage applications, consumer price index, and housing starts data “all turned out to be weaker than expected,” and the dollar weakened in response. “Although these data are bad for oil demand, they give the market more assurance that the Federal Reserve Bank will be much more likely to fully implement its [second round of quantitative easing (QE2)] program. In our view, the Fed’s monetary policy remains the main upside risk for oil prices,” De Wet said.

“Looking ahead, a significant volume of “risk-on” trade is not likely to take place from now until the US Thanksgiving holiday [Nov. 25]. We expect the market shake-up to continue till then in response to any economic and policy developments,” he said.

In other news, Ireland’s Finance Minister Brian Lenihan said Nov. 18 the Irish government is in talks the European Union and the International Monetary Fund that may lead to a financial plan to shore up the country’s banking sector.

Repetitive trading patterns

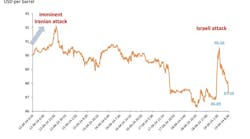

Jakob reported, “The trading patterns in 2010 have been very repetitive with five speculative rallies [in crude prices] followed by sharp reversal corrections. Each time it is supposed to be different, but each time it is not. We find that the speculative activity of 2010 is much sounder than the financial flows that were driving the rally of 2008. One, it does show the limit that the large speculators have in driving the price above certain limits imposed by the fundamentals; two, it does show that the enhanced Commodity Futures Trading Commission report is helpful in identifying the trends and limits of certain speculative activity; and three, the speculative activity has helped the process of price discovery while prices at the end of 2010 are unchanged from their start of the year levels (December WTI started 2010 at $83.23/bbl).”

As far as price discovery, Jakob said, “Our main take from the repetitive rallies of 2010 is that on the approach of $90/bbl both in the recent rally and earlier this year, the Chinese government has shown some real unease with oil prices close to those levels. This is an important input that we will need to keep in mind in the next rally towards $90/bbl. It also confirms our view that with many other commodities above the 2008 peaks it will be very difficult for the current world economy to sustain oil prices above $90/bbl.

Energy prices

The December contract for benchmark US light, sweet crudes fell $1.90 to $80.44/bbl Nov. 17 on the New York Mercantile Exchange. The January contract dropped $1.80 to $81.04/bbl. On the US spot market, WTI at Cushing, was down $1.90 to $80.44/bbl. Heating oil for December delivery lost 5.71¢ to $2.25/gal on NYMEX. Reformulated blend stock for oxygenate blending for the same month, however, inched up 0.22¢ to close at $2.16/gal.

The December natural gas contract shot up 21.2¢ to $4.03/MMbtu on NYMEX. On the US spot market, gas at Henry Hub, La., escalated 10¢ to $3.77/MMbtu.

In London, the new front-month January IPE contract for Brent was down $1.45 to $83.28/bbl. Gas oil for December fell $10.50 to $713.50/tonne.

The average price for the Organization of Petroleum Exporting Countries' basket of 12 reference crudes declined 45¢ to $81.90/bbl.

Contact Sam Fletcher at [email protected].