Sam Fletcher

OGJ Senior Writer

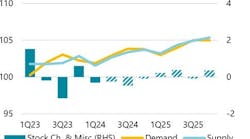

HOUSTON, Oct. 14 -- Crude prices rallied Oct. 13 for the fourth consecutive session on the New York market, climbing to a 7-week intraday high above $74/bbl with the help of a weak US dollar and stronger-that-expected trade data out of China, the world’s second biggest oil consumer behind the US.

“Chinese crude oil imports in September were off from the July peaks and from August but are still 530,000 b/d higher than a year ago,” said Olivier Jakob at Petromatrix, Zug, Switzerland. “The dollar index was again heavily pressured overnight and that in turn brought West Texas Intermediate to trade above $75/bbl [after the close of regular trading in New York], but the oil markets are still looking for a fundamental story to tell.”

The main directional influence on crude prices remains the dollar index, Jakob said. “The world economy is, however, not in the same shape as in 2006 and 2007,” he said. “The economy back then was not able to digest $100-plus oil so we need to stay cautious before thinking that it can digest $80/bbl oil now.”

In Houston, analysts at Raymond James & Associates Inc. reported, “Today, crude is off to another solid start due to strong demand commentary out of OPEC and the continual depreciation of the dollar (now at its lowest level against the euro since August 2008).” The Organization of Petroleum Exporting Countries slightly increased its forecast for 2010 global oil demand for the second consecutive month. OPEC is now forecasting global oil demand of 84.9 million b/d next year, up 1% from 2009 (OGJ Online, Oct. 13, 2009).

Meanwhile, Raymond James analysts said, “The oil service [quarterly earnings] season unofficially kicks off with a very strong report out of Lufkin.” Driven by its oil field division, Lufkin Industries Inc. of Lufkin, Tex., reported earnings twice as high as Wall Street analysts’ previous estimates, thanks to the recent uptick in North American oil-related drilling, they said.

As for natural gas, Raymond James reported “an almost 50¢/Mcf fall since the start of the week.” Analysts said, “We remain anxious on spot pricing…. With the broader markets (and energy space) set to rip this morning following positive earnings reports and solid export data out of China, we would urge energy investors to stay disciplined…stay oily.”

In New Orleans, analysts at Pritchard Capital Partners LLC noted several reasons given for the weakness in gas prices, including:

• Indications the US Natural Gas Fund may shift a portion of its investments from the New York futures market to over-the-counter swaps.

• Rumors that gas producers are still producing flat out, despite claims of shut-in output.

• Concerns among technical traders because gas has failed to hold above $5/Mcf. “This implies when natural gas does hold above the $5/Mcf level, the rally could regain momentum,” said Pritchard Capital Partners.

Energy prices

The November contract for benchmark US light, sweet crudes traded as high as $74.55/bbl Nov. 13 before closing at $74.15/bbl, up 88¢ for the day on the New York Mercantile Exchange. The December contract gained 97¢ to $74.71/bbl. On the US spot market, WTI at Cushing, Okla., was up 88¢ to $74.15/bbl. Heating oil for November delivery increased 2.9¢ to $1.92/gal on NYMEX. Reformulated blend stock for oxygenate blending (RBOB) for the same month advanced 3.28¢ to $1.83/gal.

However, the November natural gas contract fell 29.2¢ to $4.59/MMbtu on NYMEX. On the US spot market, gas at Henry Hub, La., increased 1¢ to $4.01/MMbtu.

In London, the November IPE contract for North Sea Brent crude gained $1.04 to $72.40/bbl. The new front-month November gas oil contract was up $4 to $597/tonne.

The average price of OPEC’s basket of 12 reference crudes increased 88¢ to $70.94/bbl.

Contact Sam Fletcher at [email protected].