Saudis remain best bet for oil price stability

There once was a time when Saudi Arabia labored mightily to avoid the role of swing supplier for the world oil market.

It was in the process of fulfilling that role that the kingdom saw its own market share shrivel to a level that it could not survive economically. The Saudis' response to that development was the innovation of a netback pricing scheme that brought customers scrambling back. Anyone who was involved with the oil industry in 1986 knows the consequent result: a devastating price collapse and industry retrenchment that still has some lingering legacy traces.

The last time it chafed under the burden of swing supplier was when the kingdom got crosswise with Venezuela over the latter's then-cavalier attitude toward its own quota a few years ago. A showdown was mediated by Mexico, which resulted in an accord that laid the foundation for several years of surprising cohesion on production quotas by the Organization of Petroleum Exporting Countries, plus a few non-OPEC countries. A similar showdown loomed with Russia at the start of this year until Moscow backed down (albeit mainly as face-saving gesture for the Saudis).

And yet Saudi Arabia seems to be comfortable in sustaining the role of swing supplier today. It is the Saudis who effectively have used both the quota system and quota-breaking the past 3 years to modulate oil supplies in support of an oil price near $25/bbl for the OPEC basket of crudes.

Since January 2000, Saudi oil production has fluctuated in a band of 7.25-8.75 million b/d. During the same period, NYMEX next-month crude prices have remained within $20-37/bbl-the majority of the time at $25-30/bbl. That latter range translates quite nicely to the OPEC basket target price of $22-28/bbl.

In a number of cases, this careful management of oil markets came in response to Iraq's erratic behavior on production—the most recent example of which occurred this year, when Baghdad slashed exports over a spat with the United Nations over the country's illegal lifting surcharges and then later reversed itself.

Calibrating supply

Correctly calibrating oil supply to match expected demand in the market today is anything but an exact science.

But for the oil traders who determine the day-to-day direction of oil prices, the perceived direction of either factor tomorrow is more important than the actual physical fundamentals of the market today. This is why an oil market that is fundamentally tight in terms of forward stock cover and rising demand can see oil prices plunge by 20% just because the threat of imminent war is lessened (or in today's case, probably just postponed).

As sabers rattled and oil prices hovered near $30/bbl (New York next-month futures), Saudi Arabia led the quotabreaking in OPEC with an increment of 1 million b/d—even though Iraq was already ramping up production again itself. But in addition to the doubling of Iraqi exports in recent weeks, non-OPEC production is on track to expand by 1.3 million b/d n 2003—mainly via output increases in the former Soviet Union and Canada—according to estimates by analysts with CIBC World Markets Inc., Toronto.

CIBC also projects global oil supply will exceed demand—and forward stock cover will rebound as refiners rebuild stocks—by 600,000 b/d in 2003. CIBC sees the consequent price effect as moderate, because of refiners' need to rebuild inventories (not to mention the lure of NYMEX oil prices stabilizing in the low $20s/bbl).

Questions for 2003

As OPEC prepares for another ministerial meeting this month, such market projections naturally raise questions.

Will the Saudis continue to act as swing supplier?

Will OPEC cohesion last into another year?

Will non-OPEC exporters fall into line again rather than risk a production war with Saudi Arabia?

To which the only reply can be a look at the past 3 years and consequently a recitation of the old saw: "If it ain't broke, don't fix it."

But will the suppositions inherent in these three questions still hold even in the wake of a US-led military strike on Iraq?

If one believes that 1) US resolve to effect regime change in Baghdad holds firm, and 2) security will be stepped up to prevent a long-term outage of Saudi oil supply, then the answer remains the same: Yes.

OGJ Hotline Market Pulse

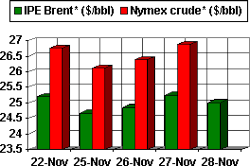

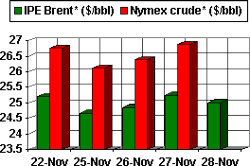

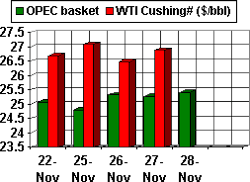

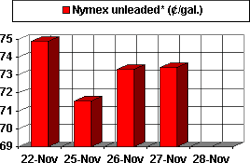

Latest Prices as of Dec. 2, 2002

Nov. 27-28 for the Thanksgiving holiday)

null

null

Nymex unleaded

null

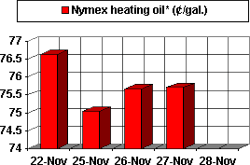

Nymex heating oil

null

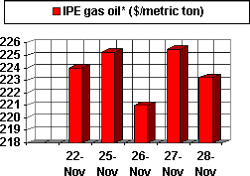

IPE gas oil

null

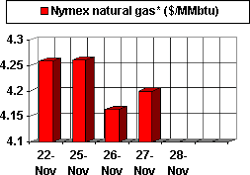

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price. @New contract