'Bear trap' looming for misguided oil markets?

The events of the first half of November suggest that oil markets and geopolitical realities are on divergent paths.

And the result may be that oil markets are backing into a "bear trap."

In response to Iraqi President Saddam Hussein's acceptance of the United Nations Security Council resolution mandating the return of UN weapons inspectors to Iraq, oil prices immediately fell to a 5 month low in New York and an 8 month low in London.

By mid-November oil prices had fallen nearly 20% in 6 weeks. The decline is apparently a response to rising OPEC production and to diminishing fears of a military campaign against Iraqwith the latter buttressed by Baghdad's apparent cave-in.

But is the ostensible acquiescence by Baghdad the endpoint of the game? Or merely the beginning? That all depends on one's view as to whether it will stave off war indefinitely or just for the short termand therein lies the dilemma for oil markets. Any military action against Iraq is likely to spike oil prices briefly. But the longer-term outlook for oil prices following an attack on Iraq is uncertain.

Discount vs. premium

Marshall Adkins, analyst with Raymond James & Associates Inc., St. Petersburg, Fla., contends that oil markets continue to have it backwards on Iraq. Noting that Iraq slashed oil exports by 1 million b/d in March, he suggested that markets should have been incorporating a discount in oil prices because a warin all likelihood short-livedwould soon restore those volumes to the market.

But when Iraq reversed itself and boosted exports again by almost 1 million b/d in October, that should have reinstated a war premium in oil prices, Adkins said: "Now that Iraq is producing all out, the only possible impact of a war with Iraq on oil would be to reduce oil supply and drive up oil pricing."

Meantime, OPEC has continued to ramp up production in disregard for its collective quota. As a result, global oil supply is now 3 million b/d more than in the spring. And yet the current state of inventories and projected demand for oil in the second half would suggest that the extra volumes will be needed. Adkins maintains that current US stock levels would suggest an oil price $4-5/bbl higher than they are at present; instead, markets are pricing in a substantial inventory build over the next 6 months.

'Bear trap' ahead?

Merrill Lynch analysts offer a similar view, saying that the sell-off towards $25/bbl (New York Mercantile Exchange next-month futures contract) has the makings of a "bear trap."

They noted that the production cuts early this year by Iraq and the rest of OPEC have slashed oil stocks in the Organization for Economic Cooperation and Development countries to a level 45 million bbl below normal at the end of September from a level 93 million bbl above normal at the end of March. Typically, September sees a stockbuild of 9 million bbl and instead underwent a drop of 39 million bbl. And this situation holds at the outset of a season when demand always rises sharply.

Merrill Lynch contends the oil supply security factor seems to have "fallen off the oil market's radar screen" under the misapprehension that the Bush administration is easing its hawkish stance vs. Iraq.

Cat-and-mouse vs. mandates

In the weeks to come, there no doubt will be many opportunities for Saddam to play the cat-and-mouse game over inspections that he perfected in the 1990s. Compliance with the UN resolution calls for key milestones for Iraq to meet in December prior to an initial report by inspectors no later than Feb. 21. There can be little doubt that deception and obstructionism will continue; what choice does Saddam really have, given the "mandate" of terror and defiance of the world order with which he rules?

There can be no doubt about US resolve on zero tolerance towards Saddam. President George W. Bush also has mandates. The first came Nov. 5 at the ballot box. The second came Nov. 8, with the 15-0 UN Security Council vote favoring almost everything the US asked for.

Whether through war, coup, or assassination, upheaval in Iraq in the next 3 months is all but certain. And that means a supply disruption amid an already tight market.

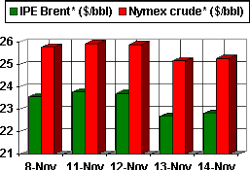

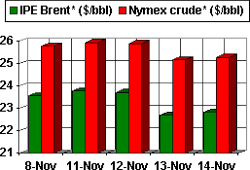

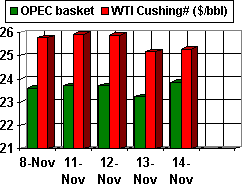

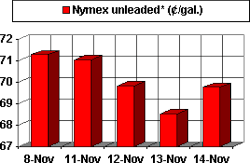

OGJ Hotline Market Pulse

Latest Prices as of Nov. 15, 2002

null

null

Nymex unleaded

null

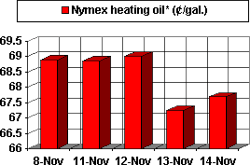

Nymex heating oil

null

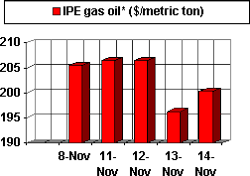

IPE gas oil

null

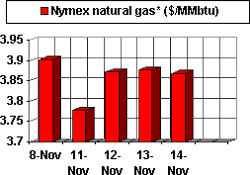

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price. @New contract