Tanker attack underscores 'true' market tightness

The apparent terrorist attack on the French-flag Limburg supertanker off Yemen on Oct. 7 has ratcheted up oil market jitters again.

This comes just as the much-discussed "war premium" that has been built into crude oil prices continues to come under critical scrutiny. Inherent in the view that a war premiumwhich various analysts have pegged at ranges of anywhere from $2-4/bbl to $6-9/bblexists is the corollary view that the likely quick end to a US-led military strike on Iraq would spawn a collapse in oil prices. The precedent for this view is the 1991 Desert Storm campaign to oust Iraqi forces from Kuwait, whose onset spawned history's biggest 1-day drop in oil prices. In other words: Remove uncertainty over market repercussions from a war against Iraq, and oil prices are again in the low-to-mid $20s/bbl, or even lower.

If, as some believe, the war premium is in fact overstated and that a $30/bbl oil price is underpinned by more-secular market fundamentals, then the markets do indeed have something to be jittery about.

Academic exercise

Merrill Lynch analysts offer a somewhat academic exercise to demonstrate that the war premium is overhyped and in fact masks the effect of underlying supply tightness.

The analysts looked not only at the buildup and campaign to oust Iraq from Kuwait in 1990-91 but also at the more obscure Yemeni civil war of 1994. Oil markets' concern in 1994 was that the Yemeni conflict might spawn a massive influx of refugees into Saudi Arabia, perhaps stabilizing the kingdom and the rest of the Arabian Peninsula. The oil markets moved from contango into backwardation as concerns mounted over security supply: Traders began paying increasingly more for the next delivered barrel of crude vs. a deferred-month delivery.

"The shift to backwardation took on added significance," said Merrill Lynch, given that petroleum stocks were higher than normal.

The same situation held true after Iraq invaded Kuwait in 1990again with oil stocks higher than normal.

Different circumstances

But the circumstances are different for this go-round, say Merrill Lynch analysts.

"For all the hype and hoopla about a potential conflict with Iraq, the fact is that oil prices have generally stayed in contango despite the fact that oil inventories have been trending to below-normal levels," they said. "This juxtaposition is one of the primary reasons we maintain a view that current crude price levels are largely a function of the storage situation as opposed to a 'war premium' that some market-watchers assert as being $6-9/bbl."

In the latest week's data, petroleum stocks were just 16 million bbl above their all-time lows in March 1996, the analysts noted. Unlike the recent stock draws triggered by a big pulldown in crude caused by weather-related Gulf of Mexico shut-ins, about 80% of the latest stock draw was represented by refined product stocks.

This trend into deficit tracks back to early June, contends Merrill Lynch. With PADD II crude stocks near record lows, the widening spread between West Texas Intermediate and Brent crudes normally would attract more imports into the US Midcontinent.

But that isn't happening, and the analyst bases this disconnect between the storage situation and price spread on what they call refiners' "purposeful decision to limit discretionary imports, which in turn stems from the view that crude prices will decline materially

And, says Merrill Lynch, this stance is reinforced by continued weakness in refining margins and the continuing harping on oil price strength being a function of war concerns.

The upshot is that, by deferring crude purchases, PADD II refiners "may be setting up a potentially leveraged upside reaction for WTI prices relative to other oil down the road, when buyers come to realize crude prices aren't crashing down to the teens."

A real war premium

So there is an underlying secular tightness to the market, and while the outcome of an attack on Iraq may be a widely held given, there is no certainty.

Add to this the prospect of terrorist groups now targeting oil transportation and perhaps other industry facilities in the Middle East, which may prove to be the "real" and long-termwar premium, not unlike the extra few dollars built into the price of crude during the 8-year Iran-Iraq war.

The Organization of Petroleum Exporting Countries may be meeting again, sooner than the group had planned.

OGJ Hotline Market Pulse

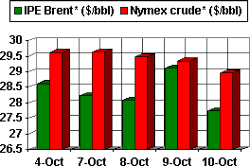

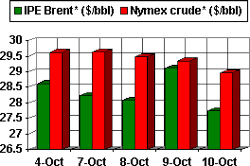

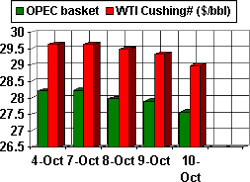

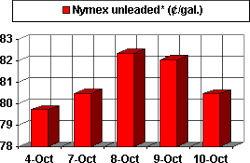

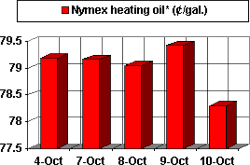

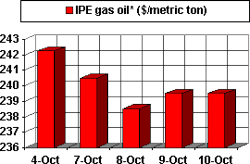

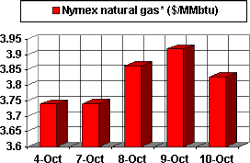

Latest Prices as of Oct. 11, 2002

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price. @New contract