Near-term gas outlook bleak; longer-term improved but volatile

While the near-term outlook for US natural gas prices may be bleak-absent any sustained weather-related rescue-the underlying supply-demand fundamentals of the market suggest upward pressure on gas prices in the longer term.

The combination of depressed industrial demand for gas and a strong supply response spawned by last year's price spike have whelped a monster year-to-year storage surplus. At yearend 2001 this surplus was projected at 1 tcf by the end of the heating season on Apr. 1. That overhang would augur ill for the summer cooling season and, consequently, for gas prices for the rest of 2002-provided US wellhead deliverability were to hold up.

But there are signs that the 2001 gas supply response will prove short-lived, possibly evaporating even before economic recovery rejuvenates demand.

So the wild price rollercoaster of 2000-01 could repeat in 2002-03-and perhaps for years to come.

Supply response evanescent

US gas production through the first 3 quarters of 2001 logged a 00% increase over the same period a year ago.

That situation is the flip side of lagging production in preceding years when gas prices were low. The resulting supply side slide coupled with rising demand created the tight markets in late 2000 and early 2001 that kept gas prices buoyed at 10-year highs.

The supply jump clearly reflected producers taking advantage of higher prices to drill more wells and reap the benefits of a spike in cash flow. But how sustained has that effort been?

Houston-based consultants and investment bankers Simmons & Co., in a late fourth quarter 2001 analysis, claimed that the 2000-01 production bump was not a "quality" supply increase.

Looking at a sample group of US producers representing over half of US gas deliverability, Simmons noted that their third quarter 2001 US production was flat compared with the prior year and down 1.7% compared with the prior quarter.

What makes this observation noteworthy is the fact that this suppy response followed a record level of gas-directed drilling activity.

"...We believe as many as 200 of the last 350 rigs added since second quarter 2000 have been dedicated to acceleration projects, i.e, shallower, quick-hit wells designed to capture the opportunity presented by high commodity prices," Simmons said at the end of November.

These opportunistic efforts, especially in key areas such as East Texas, often were 10,000-15,000 ft prospects that targeted reserves as little as 2-3 bcf/well with initial production potential of less than 5 MMcfd and first-year decline rates in excess of 50%, according to Simmons.

And, conversely, the unexpected decline in gas prices produced an equally abrupt falloff in drilling activity.

"The recent downtick in gas-directed drilling with relatively firm gas prices is confirming evidence that wells were being drilled assuming $4.00+/Mcf."

With those price expectations already beginning to fade by the third quarter, the gas-dominated US active rig count was well into a slump. Simmons projected the rig count would trough at 650 in first quarter 2002.

The resulting upward blip in output spawned by the price-opportunity shallow wells has briefly masked the longer-term trend of declining wellhead deliverability in the US. According to the US Energy Information Administration, more than 30% of US gas production in recent years has flowed from wells that are no more than 2 years old. So comparatively more wells are being drilled to replace the production from older wells.

It follows then that a return to historic drilling levels portends a return to a declining trend in US gas production in 2002.

Demand side rebound

On the demand side, however, signs point to a recovery in demand in 2002.

How much of a recovery depends on the extent of economic recovery and weather-related demand surges in the winter and summer.

The heating season has been pretty much a bust so far. EIA in early November 2001 estimated heating demand for gas this winter to be about 7% below last winter's levels, with most of the difference concentrated in fourth quarter 2001.

Assuming normal temperature ranges in the summer leads to expectations of a surge in the cooling load in summer 2002 compared with the cool weather last summer.

Another factor is the pricing of crude oil relative to natural gas. An oil price collapse will make it tougher for the gas sector to recover from the flurry of fuel-switching that high gas prices triggered in 2001.

There are already early indications of a recovery in industrial demand for gas. According to Cambridge, Mass.-based consultants Energy Security Analysis Inc., gas prices hovering near $3/MMbtu for several months were sufficient stimulus for chemical and fertilizer companies to reopen shutin capacity. But full recovery has been delayed by the recession.

If the recession is short-lived, ESAI expects industrial demand to return to pre-2000 levels by yearend 2002-or about 16.5 bcfd.

Meanwhile, ESAI estimates that new gas-fired power capacity will represent an incremental pull on demand of 1.7 bcfd in 2002 and 4.6 bcfd in 2003-or year-to-year increases of 9.5% and 25.7%, respectively. Perhaps as much as 25% of that power capacity increment slated for 2003 could be delayed, however.

So what will meet this resurgent gas demand?

There remain some pipeline capacity constraints as far as US imports of Canadian gas are concerned, as well as infrastructure constraints within the US itself. And prospects for greatly expanded imports of LNG or deliveries of arctic gas from Alaska are still long-term opportunities.

Until those latter opportunities materialize-and gas persisting at $2/Mcf for long makes that problematic-rising US gas demand will be met by a short-term supply response spawned by price-sensitive, opportunistic drilling in the Lower 48.

As a result, US gas markets will see shorter, more volatile price cycles for the greater part of the decade.

OGJ Hotline Market Pulse

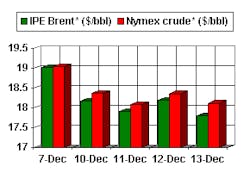

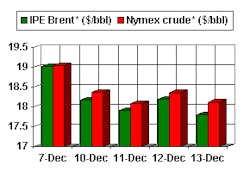

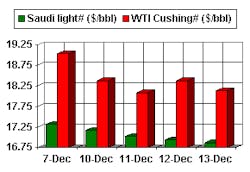

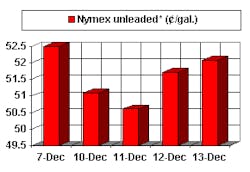

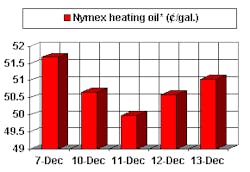

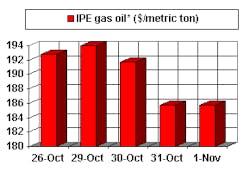

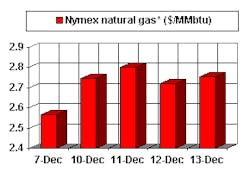

Latest Prices as of Dec. 14, 2001

null

null

null

null

IPE Gas Oil

null

Nymex Natural Gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.