Oil-for-aid rollover just delaying inevitable over Iraqi oil supply disruption

The United Nations Security Council's approval to extend the Iraqi oil-for-aid program for another 6 months would, at first glance, seem to deflate the oil market expectations outlined in this space last week.

Instead, it really is just delaying the inevitable day of reckoning when Iraqi oil supply prospects collide with the geopolitical and military objectives of the US-led coalition in the war on terrorism. Discovery of any "smoking gun" involving Iraqi complicity in terrorist acts or continued work on prohibited weapons manufacture would accelerate that day of reckoning sharply.

US-Russian deal?

The latest rollover of the oil-for-aid sales program was engineered jointly by the US and Russia via a compromise that has been hailed as further evidence of growing cooperation between Washington and Moscow since Sept. 11.

The compromise has its roots in a longstanding dispute between Russia and the US over the UN sanctions against Iraq. The latest flare-up in that dispute occurred this past spring when the program was again up for a 6-month renewal. The US and UK had sought to reform the sanctions program at that time to allow greater flow of civilian goods into Iraq but at the same time clamp down on Iraqi imports of goods with potential militiary applications and resume UN inspections of Iraqi arms programs. Russia's threatened veto at the time caused that plan to be shelved.

Under the compromise, Russia agreed to approve by May 30 a new list of goods requiring UN review before Iraq can import them. The US, meanwhile, has agreed to Russia's oft-repeated call for a comprehensive settlement of sanctions issues that would set the stage for ultimately lifting the military embargo on Iraq. What is specifically requested here is a need to clarify just what steps Iraq must take in order to have the sanctions lifted.

At least one self-styled oil market expert-whose background is anesthesiology and a propensity for picking oil company stocks-has jumped to the conclusion that this compromise represents the beginnings of a "new world order" in oil markets, in which Russia is positioning itself and the other former Soviet republics as a reliable alternative to OPEC oil supplies. This stock-picker goes so far as to suggest that part of the compromise includes the US softening its position on Iraq. By implication, this would also suggest that Russia's recent defiance of OPEC is part of the "deal," i.e., a tradeoff on the US easing its stance on Iraqi sanctions in exchange for a low oil price regime that could jump-start the US economy.

If that latter view were true, it would accelerate the revival of Iraq's oil sector much faster than anyone had expected and represent a long-term depressant on oil prices.

That's a massive if.

First, it is unthinkable that-the potential for political suicide aside-President George W. Bush would abdicate a personal moral responsibility to allow Iraqi sanctions to be lifted without a return of UN weapons inspectors to Iraq. The Bush administration has repeatedly cited Iraq as a chief sponsor of terrorism in the world, and it is no secret that Iraq remains in the US crosshairs in the war on terrorism-especially with the mounting evidence of Iraq's ties to Osama bin Laden's terrorist network and intelligence reports suggesting that Baghdad has continued work on weapons of mass destruction despite the sanctions. To suddenly reverse himself on Iraq merely for the sake securing low oil prices for the US would represent a geopolitical obtuseness and pandering appeasement of a scope to make Neville Chamberlain at Munich seem positively Churchillian. It just doesn't wash.

It isn't cynical to suggest that the compromise does represent a mutual accord by the US and Russia to postpone the possibility of an Iraqi oil supply disruption until second half 2002, when by many accounts the world economy is expected to begin its recovery. It is an unfathomable leap from there to suggest the Bush administration would overlook the continuing threat Saddam Hussein poses to the world, and the US in particular, for the sake of joining with Russia to undermine OPEC.

The same cooler heads that prevailed when the Wolfowitz camp in the Bush administration wanted to take the antiterrorism campaign to Baghdad while simultaneously waging war in Afghanistan have have likely fashioned this delay game as well.

The real question for now is how long both Russia and Saudi Arabia want to play their own delay game in working up production cuts to keep oil prices out of the cellar. The betting here is that the Russians likely will blink sooner rather than later and together with the Saudis implement some face-saving compromise that will still leave markets a bit oversupplied but not falling off a cliff because of the winter demand pickup.

The real question for a little later is what happens after Osama bin Laden and other key figures of the Al-Qaeda terrorist network have been brought to justice (which, in this corner, means killed). Perhaps after the first of the year, if that richly deserved end has come about, the Bush administration will deem it necessary to unveil the information it likely is harboring for now regarding Iraq and terrorism. When the elements of a Phase 2 in the war on terrorism begin to gel and that puts Iraq in the US sights again, the status of an oil-for-aid program will be moot.

Even if that takes much longer, by the time the sanctions program comes under review again, the US will not-cannot-change its stance on Iraqi sanctions and weapons inspections. Together with the likelihood that the US antiterrorist campaign will focus, at least rhetorically if not in action, increasingly on Baghdad, there still remains a better than 50-50 chance that Iraq's (legal) oil supplies will come off the market before second half 2002.

Rest assured that the Bush administration will provide the "clarification" Russia seeks on what it would take to get Iraqi sanctions lifted. And Iraq won't like what is clarified one bit. Furthermore, Russia recognizes the need for a weapons inspection regime too.

If there remains some question over a US-Russia deal that would allow an eventual lifting of sanctions on Iraq without a weapons inspection regime, consider this quote, courtesy of the Associated Press, from Russia's UN ambassador, Sergey Levrov:

"The only way to radically solve the Iraqi problem is to ensure that international disarmament monitoring resumes in Iraq in conjunction with the suspension and lifting of sanctions, and the only way to achieve this is to eliminate ambiguities which exist in the [1999 UN] resolution [to ease sanctions in return for Baghad's cooperation with weapons inspectors."

That statement could allow the Russians some rhetorical wiggle room later as what timing is implied by the phrase "in conjunction."

But there is no wiggle room in President Bush's own rhetoric on the issue. Only this week, he demanded that Iraq must allow UN weapons inspectors to return or "face the consequences."

With our country at war in a conflict likely to spread, how could we believe otherwise?

OGJ Hotline Market Pulse

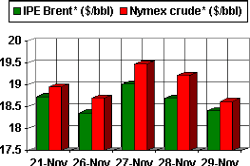

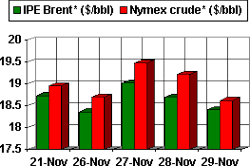

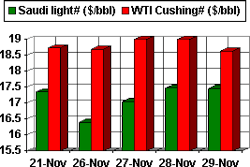

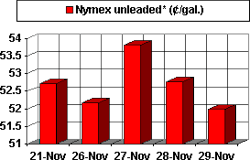

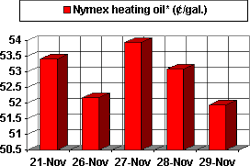

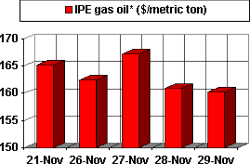

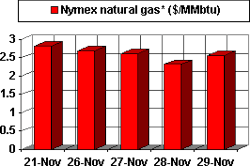

Latest Prices as of Nov. 30, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null