Gathering gloom over OPEC's 'Russian roulette' ignores likelihood of a new supply disruption

The gloom gathers over oil markets with the continuing standoff between Russia and OPEC.

Oil prices this week had made back more than half of the $4/bbl they had lost the previous week, when OPEC surprised markets by linking a proposed 1.5 million b/d cut by the group to a 500,000 b/d cut by non-OPEC oil exporters. In particular, Saudi Arabia singled out Russia as the chief culprit in snagging OPEC market share. The price slide started when Russia showed its disdain for the call for non-OPEC cuts by offering a paltry 30,000 b/d cut.

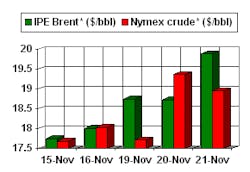

The ensuing war of words between OPEC and Russia led to hints earlier this week out of Moscow that Russia would, in fact, agree to more substantive cuts. Speculation had it that Russia would cut output by at least 100,000 b/d. That prospect caused oil prices to rally back, with Brent topping $20/bbl today after Norway announced cuts of its own of 100,000-200,000 b/d. But the rally was short-lived when Russia disclosed its cut would be only 50,000 b/d. This will no doubt be seen as a slap in the face to OPEC, which had called for Russia to slash its output by at least 300,000 b/d.

The London futures market reacted by pulling Brent for next-month delivery down past $19/bbl, and expectations are that both New York and London futures markets may close Monday south of $18/bbl.

The market is pulling down oil prices because it perceives a market share war in the making. Russia has been the surprising backbone of a recent surge in non-OPEC oil output, a trend viewed with alarm by the Saudis in particular, who have been struggling mightily these past 2 years to sustain OPEC cohesion in defense of a targeted price band of $22-28/bbl for a basket of OPEC crudes (but unofficially to hew to $25/bbl for that basket, putting WTI at about $28/bbl.

What next?

So what happens next? Have the Russians called OPEC's bluff, if indeed it is a bluff? Will the Saudis unleash the kingdom's spare productive capacity of more than 2 million b/d to flood markets and spawn a price collapse? How far will oil prices fall? $15/bbl? $10/bbl?

As outlined in this space last week, some analysts have speculated that a market share war between OPEC and non-OPEC will cause oil prices to collapse to an average of $14/bbl (WTI) next year. That tracks the view of OPEC, which has warned that oil prices will collapse to $10/bbl if a 2 million b/d cut in production isn't forthcoming.

But the current physical fundamentals of the market don't support that view, according to the Centre for Global Energy Studies. The London-based think tanks contends that, even with no further cuts in output, Brent prices are expected to stabilize around $17/bbl in first half 2002. It notes that oil stocks are not high enough to drive oil prices back down to $10/bbl, and stocks are expected to fall, if only modestly, over the winter.

CGES thinks that Russian producers can live comfortably with a Brent price of $17/bbl and that OPEC economies are more susceptible to the strain of low of oil prices than are those of the big non-OPEC oil exporters. It cites the comments of one Russian major oil company CEO who would like to see oil prices stabilize at about $16-22/bbl (Brent).

The consulting group points to two areas where OPEC is out of touch in predicting a price collapse. First, oil stocks are much lower than they were in 1998, so the level of inventories would not exert as much downward pressure as they did 3 years ago. Second, a price collapse could occur only in the absence of any demand growth while production levels remain constant.

Regarding the second point, CGES contends that "such a scenario defies economic logic. It is almost inconceivable that the 45% drop in annual average crude oil prices implied in this scenario would trigger no increase in oil demand."

A more likely scenario, says CGES, is one that envisions a slight rise in demand in the first quarter, expanding more in the second half of next year for a full-year average increase of almost 1 million b/d in 2002 vs. 2001.

And that's not such a bad prospect, the think tank asserts: "With a weakening outlook for the global economy, a period of lower oil prices might be just what is needed to pull us out of the impending recession."

Another scenario

Both CGES and other analysts have pointed out that Saudi Arabia might be the one to blink in this standoff, as its budget requires oil prices at $20/bbl (WTI). It follows that Saudi Arabia would then be the one to lead OPEC in another round of cuts-perhaps with the assistance of Mexico and Oman, plus token cuts from Norway and Russia-to keep oil prices above that important psychological level. And that would come probably only after several weeks of $16-19/bbl oil.

There are interesting geopolitical undercurrents in this situation. Some fret over the viability of the Saudi government if its budget could not be sustained, especially considering the restiveness of Islamic populations these days. Increasingly, intelligence reports point the role of Saudi money in financing the terrorist network of Osama bin Laden and the Taliban and to the obstructionism of the Saudi government toward US military initiatives and intelligence-gathering. Commentators and congressmen are grumbling ever more loudly over the perception that the Saudis have played both sides of the fence for far too long. Certainly, this perception is going to be tied to the sight of Riyadh trying to prop up oil prices at a time when the world economy is reeling.

As this outcry grows, Russia positions itself even more firmly as a secure source of oil supply while Vladimir Putin charms the folks of Crawford, Tex., with his new best friend, George W. Bush.

Is it conceivable that the Saudis could allow their most important customer (not to mention defender against the likes of Saddam Hussein) to slip away? Would not the best defense against such a prospect-and the best defense of market share-be to swallow hard and offer a "gift" to the US and the rest of the OECD in the form of rock-bottom oil prices?

Here's another scenario that renders these others moot, and the odds are better than 50-50 that it will happen: Iraq takes all of its 2 million b/d of oil exports under the oil-for-aid program off the market, and Saudi Arabia and the rest of OPEC saves face by not having to implement cuts.

Iraq's removal of its oil exports is almost assured. In a few weeks, the current round of supply deals under the oil-for-aid program will expire, and Baghdad and the United Nations will review conditions for the next rollover of the program. As always, this will be a contentious affair, and Saddam Hussein will almost certainly provide some new pretext for snagging further concessions. This little minuet has taken Iraqi oil off the market for a few weeks in each of the preceding two heating seasons, and there is no reason to believe that it will not happen again this time. It is worth remembering that Saddam sees none of the UN money, but earns billions of dollars from smuggling oil. Each time he takes the oil-for-aid supplies off the market, the value of and demand for his smuggled oil rises. But it also spurs OECD countries to ramp up stock-building, which boosts overall oil demand.

Only there's a huge wrinkle this time. Intelligence information released publicly points increasingly to Baghdad's role in supporting international terrorism and efforts to develop weapons of mass destruction. Reports have also surfaced tying Iraqi agents to the Sept. 11 terrorist hijackers. It is probably just a question of time before the "smoking gun" is produced-probably about the time the rout in Afghanistan has been completed and Osama bin Laden's death is announced. There is a strong push for taking the antiterrorism campaign to Iraq and a growing sentiment to "finish the job" begun by the US and its allies in 1991 with the defeat of the Iraqi army.

The absence of Iraqi oil from the market for a sustained period-however long it takes to "finish the job"-probably will keep oil prices high enough for OPEC and the Russians to produce at will, which in turn will help dampen oil prices enough to sustain demand as the global economy recovers.

Of course, that doesn't take into consideration the kind of horrific scenarios about further terrorist attacks, US-led reprisals, and insurrections in Islamic countries that have become inescapable since Sept. 11.

The nearsighted oil markets seem to have forgotten that in this new OPEC game of "Russian roulette."

OGJ Hotline Market Pulse

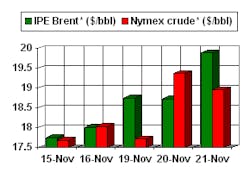

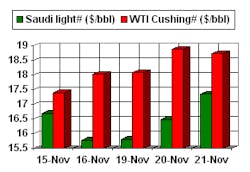

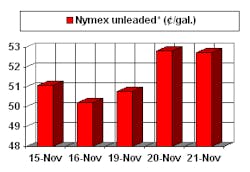

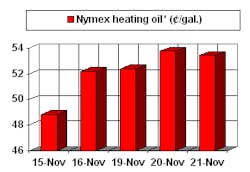

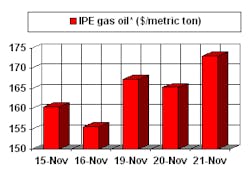

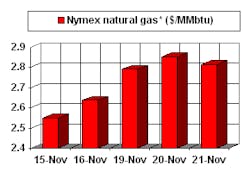

Latest Prices as of Nov. 23, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price