Oil demand slump a sobering counterpoint to threat of supply disruption

Oil demand remains a chief concern, and that concern is growing beyond the near term.

Oil prices took an uptick this week with word that the Organization of Petroleum Exporting Countries soon may swallow hard and trim output. The group is reacting to three weeks of oil prices remaining below the floor of its targeted price band (for the OPEC basket of crudes) of $22-28/bbl.

In the past, the prescription for action when prices fell below this range-namely an automatic trigger to cut output by 500,000 b/d-was a timespan of only 10 days. OPEC has been quick to act on those occasions, showing the kind of cohesion necessary for such market micromanagement. The group would take perhaps 3 weeks-and sometimes longer, when specific circumstances seemed to warrant-to boost output when oil prices remained above the ceiling of that price band.

This time, though, represents a period truly unprecedented in the annals of geopolitics: The US is leading a global war on terrorism and its suspected sponsoring nations that could spread to envelop certain key OPEC oil exporters; yet concurrent with the implicit threat of huge oil supply disruptions that could accompany that scenario is a deepening oil demand slump as the global economy continues to reel. In short, we have a market simultaneously poised on the brink of collapse and tightness. The last even remotely analogous situation was the onset of hostilities during the Persian Gulf crisis of 1990-91, when the high oil prices that prevailed during Desert Shield evaporated at the start of Desert Storm.

Just as the parameters of scope and duration of the current conflict are much more difficult to define than that earlier crisis, so too is the related future oil market outlook almost opaque by comparison with then.

In his press conference last night, President George W. Bush was fairly unequivocal about sticking with his "You're either with us or against us" theme on combatting terrorism, even to the point of suggesting amnesty for the alleged terrorist hosts and sponsors of the past if they renounce terrorism today. This comment came in response to the prospect of embracing help from Syria in the antiterrorism campaign.

At the same time, Bush took time to again denounce Saddam Hussein, and the subtext of his comments seemed to be that if Baghdad does not reallow UN weapons inspectors to monitor whether Iraq is developing weapons of mass destruction (particularly chemical and biological), it may be next in the US crosshairs. Meantime, Saddam's contribution to this situation only serves to paint a bigger bulls' eye on his country.

If, as the prospect grows, the US and its allies in the Enduring Freedom campaign attack Iraq, it will certainly mean the loss of more than 2 million b/d of Iraqi crude from world supply. And thus the OPEC cut would be quickly rolled back, and then some. Saudi Arabia alone could easily make up the difference.

But would this widening of hostilities involving Islamic nations serve to inflame local populations to the point that the key moderate nations that export oil might see their regimes threatened?

Here's another scenario: Yasser Arafat took the extraordinary step this week of using Palestinian Authority police to quell rioting Palestinians, with the startling sight of Palestinian police firing upon and killing their brethren. That may ultimately prove to be a turning point in the Middle East peace process, sowing the seeds for peace as a nascent step in the Palestinian recognition of Israel's right to exist. Or it could prove Arafat's undoing, with the even more radical pro-Palestinian groups becoming emboldened to step up terrorism against Israel-prompting swift retaliation-and even the US. Arafat could even be assassinated by one of these groups. Then what?

It's a bit difficult to assess the possibility of a broader Islamic uprising against the West and its perceived proxies in the Middle East. But regardless of their more circumspect comments made publicly regarding the current campaign against Osama bin Laden and the Taliban, the more moderate Islamic states in the Middle East would like to see both eliminated from the face of the earth. And few among them would grieve to see Saddam's generation-long reign of terror end with his demise.

Bear in mind that the moderate states of the Persian Gulf have maintained their hold on power largely through the largesse that oil revenues have bought them. Just a few weeks ago, OPEC avoided cutting production even though it collectively believed that such cuts were necessary to support oil prices. But the collapse in demand has the group rethinking that posture, even overtly. Perhaps the logic that will prevail here is that a temporarily higher oil price is the price the West should pay in order to keep the extremist Islamic conflagration from spreading at a time that it must fight what may prove to be the most insidious and intractable foe of all.

Demand concerns

But the price the West must pay may, in turn, redound to OPEC's chagrin as demand continues to erode.

The Energy Information Administration this week sees 2001 global oil demand growth as reaching only 500,000 b/d, less than half of the volume projected only a month ago.

Given the massive falloff in jet fuel demand after the Sept. 11 terrorist attacks, coupled with the slumping global economy, that should not come as a surprise.

But there are other signs of concern for the longer-term demand outlook. FACTS Inc., the Honolulu-based think tank headed by Fereidun Fesharaki, worries about the implications of a worsening oil demand slump, particularly in the Asia-Pacific region.

FACTS pegs incremental oil demand growth in the region this year at only 350,000 b/d, with some key importing nations registering their worst performance in terms of oil demand growth in 2 decades-excluding 1998.

The reminder of that terrible slump year is sobering enough. While the think tank projects oil demand recovering in 2002, it sees Asia-Pacific oil demand growth rates at only 2.2-2.7%/year through 2015. While that sounds fairly healthy in the broader view of things, the impending long-term match-up with supply prospects does not.

"While global oil demand growth has slowed, both OPEC and non-OPEC producers continue to add capacity," FACTS said in a new energy advisory. "Approximately 1.5-2 million b/d in new capacity is expected to be added each year through 2005. Maintaining prices in the mid-$20s in this demand and supply environment will be next to impossible."

But if a war on terrorism-and with it perhaps more terrorist retaliation-lingers across the Middle East for years to come, the prospect of a market perpetually poised simultaneously on the brink of collapse or tightness, as counterintuitive as it sounds, may become a way of life for us all.

OGJ Hotline Market Pulse

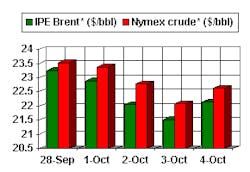

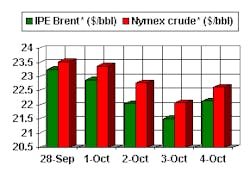

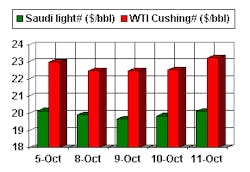

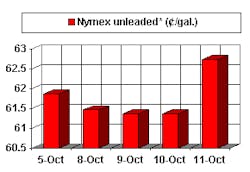

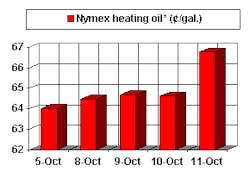

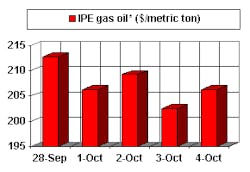

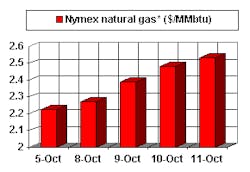

Latest Prices as of Oct. 12, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price