Oil markets face greatest uncertainty ever

Has there ever been a time of greater uncertainty in global oil markets? It seems doubtful.

Even the Persian Gulf crisis surrounding Iraq's blitzkrieg attack and takeover of Kuwait, followed by the US-led coalition to oust Iraq from Kuwait, pales in comparison. One has the sense that truly no one has a good handle on where the unfolding drama that started with last week's terrorist attacks will lead.

President George W. Bush's stirring, no-nonsense speech last night left the unavoidable conviction that Operation Infinite Justice will not end with Osama bin Laden and Afghanistan. Already military and intelligence officials are talking up the prospect of a strike against Iraq. Baghdad's gloating over the terror attacks don't do anything to deter that possibility.

Some may dismiss Bush's speech as mere bluster and saber-rattling. That seems highly unlikely, however, given the mood of the US public today-and given the strategic necessity in a war against terrorism of recognizing that empty saber-rattling would be an invitation to still more terror attacks.

Already, the media have peppered Washington officials with queries as to what other targets there might be in the antiterrorism campaign. And while no one is talking beyond Afghanistan or the stray hint at Iraq, there is the inescapable conclusion that other major oil exporters might be targeted. Even the moderate Middle East governments that are friends and allies of the US must worry-as Pakistan does today-that an attack on Bin Laden and an Islamic country will inflame extremist groups in their own countries, possibly destabilizing their governments. There remains a strong possibility that nations seen as friendly to the US might themselves be the targets of terrorist attacks. Recall that Bin Laden's chief complaint against the US, beyond its support of Israel, is that the US has a military presence in Saudi Arabia-which millions of Muslims see as sacred land. The twisted logic of terrorists can contain even the self-contradictory notion of attacking land sacred to them and its citizens to rid it of infidels.

Such scenarios complicate oil supply availability in other ways. The prospect of military or terrorist attacks on such nations is likely to scare off insurers-an industry already facing the biggest financial setback in its history with the collapse of the World Trade Center towers and related loss of thousands of lives-from insuring tankers, drilling-production facilities, and the like. Without such protection or even with such protection but at an astronomically higher cost, there is no telling how much production or tankering might dry up. There may certainly be enough spare productive capacity in OPEC-namely Saudi Arabia-to take up the slack if Iraq's supplies are again removed from the market, as is likely to occur, regardless of whether the attacks go beyond Afghanistan.

But what happens if Saudi tankers are targeted? If terrorists sow mines in the Gulf of Hormuz? If there's an assassination attempt on the Saudi royal family? If the public outcry in Iran causes the moderates to lose sway? Don't be dismissive of such seemingly wild scenarios. On Sept. 10, would any of us have found the simultaneous hijacking of four airliners used as flying bombs intended to destroy the World Trade Center, the Pentagon, and perhaps the White House anything but a far-fetched plot from a Tom Clancy wannabe?

Perhaps worst of all is that the campaign President Bush spoke of is one he described as a long one, often involving covert attacks by US special forces. When the war that's being waged has no way of being accurately gauged as to its scope or duration, that merely increases the uncertainty.

Demand picture

Yet even with such troubling prospects for world oil supplies, the near-term consensus is decidedly negative.

While oil prices spiked a couple of dollars in the wake of the terrorist attacks, they have fallen back, largely on OPEC's assurances about supply.

But the focus now is on the picture for oil demand. Beyond the immediate depressive effects of millions of barrels of jet fuel overhanging the market because of the shutdown of aviation in much of the world last week, there is also the longer-term prospect of slumping demand owing to the impending likely slide into global recession.

The reduction in jet fuel demand owing to reduced aviation is projected to reach as much as 400,000 b/d over the winter, estimates the London-based Centre for Global Energy Studies. CGES puts the overall decline in global oil demand year-on-year to about 400,000 b/d. At the same time, OPEC is likely to be slower than it has been in the past to cut output as demand falls, easing up on its price band target defense so as to not appear to be profiteering. Consequently, CGES pegs dated Brent possibly falling as low as $22/bbl in first half 2002.

But the events of the months to come could just as easily propel oil prices to double those levels. Uncertainty will rule the oil market, perhaps for a long time to come.

OGJ Hotline Market Pulse

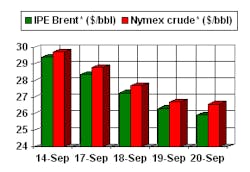

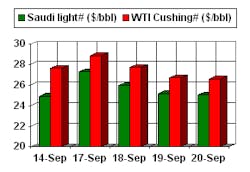

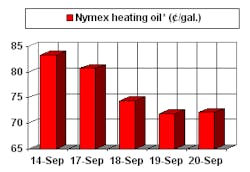

Latest Prices as of Sept. 21, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price