Just how bearish should the US natural gas market be in light of rising domestic gas production?

The effects of a decline in US gas demand owing to high prices, fuel-switching, and a slowing economy have already been well-documented in this space.

But there is much greater uncertainty over the role of rising US natural gas production. Increased gas output has certainly been a factor, as record natural gas drilling activity has spawned a jump in wellhead production that has been estimated as high as 3-4% for the full year.

Lehman Bros, for one, suggests that the sharp rise in US gas production is beginning to have a significant impact on supply, perhaps partly offsetting the positive impact of recovering gas demand stemming from the price slump.

Lehman Bros. reckons that US production has risen by 1.7% during the past 6 months and that this rise will continue into the first half of next year. The analyst also estimates that Canadian production is up about 8% from a year ago. Coupled with the continuing storage overhang and weak demand, Lehman Bros. contends the market could be headed toward a prolonged period of weak natural gas prices.

Drilling slowdown

However, there are also signs that gas-related drilling activity may have peaked for now. Even though the blistering heat wave in the US Midwest and Northeast buoyed spot gas prices above the critical $3/Mcf threshold, there are indications that a longer-term improvement is on the horizon, according to UBS Warburg.

Warburg notes that the New York Mercantile Exchange's 12-month futures strip last week traded at $3.45/MMbtu, about flat on the week, and the September-March strip ranges from $3.05/MMbtu to $3.73/MMbtu.

It cites recent shrinkage in the US gas rig count, coming in response to the decline in prices. Last week, the US gas rig count fell by three units to 1,047, compared with the recent high on July 13 of 1,068. This development "could suggest that the market has peaked near-term.

Even if drilling activity levels had continued to climb, eventually they would have hit a wall regardless of the price of gas. Infrastructure, equipment, and personnel constraints likely would have capped the industry's ability to keep ramping up production past the short term.

Long-term strength

Indeed, another analyst sees a short-term misreading of the production outlook as pointing to an aspect of the ags industry that underpins a forecast of long-term price strength.

Raymond James & Associates assessed second quarter company-reported gas production results and thinks that provides a better understanding of what the natural gas industry is capable of achieving in terms of supply increases. For the moment, it seems as if the North American natural gas industry is capable of supplying 2.24 bcfd more gas than a year ago.

"Over the long term, if the industry is unable to increase yearly supply more than 2 bcfd, it is likely that a certain amount of gas demand will need to be removed from the market [to balance the market, i.e., 2000], thereby setting the stage for higher long-term gas prices," RJA said. "Given this, our original belief in long-term gas priecs of $35.0-$5.50/MMbtu remains very much intact."

RJA notes that, a year ago, the historical data indicated that about 600 gas rigs were necessary to maintain production: "In 2000, the gas rig count averaged 720, and the 3-month lagging gas rig count averaged 664, and production still declined, suggesting a minimum of 700 gas rigs are likely necessary to maintain production.

"Given the continued acceleration in rig activity in 2001, it's likely that the combination of increased rig inefficiency and degradation in drillable prospects will require 800-900 gas rigs just to maintain production."

Looking at the principal gas-producing regions of the US in 2000, the data show that only Texas, which logged a huge 51% increase in drilling activity, showed any kind of increase in gas production. A drop in Oklahoma gas production in 2000 was largely offset by an increase in Wyoming coalbed methane output.

While the deepwater Gulf of Mexico is a promising new area for increasing US gas production-accounting for 20% of total gulf output vs. just 5% 5 years ago-the increase in deepwater gas production last year was more than offset by a decline in gas production on the Gulf of Mexico shelf. Even while the gulf gas rig count reached a record high last year, gulf shelf production nevertheless dropped by 6.4%. Even though deepwater gulf gas output jumped by 18% last year, the overall gas production for the entire Gulf of Mexico fell by 2.6%.

Reckoning that US producers should be able to boost gas output by 1.5 bcfd this year, against the backdrop of a gas rig count of 1,000, state data indicate a continuing in rig efficiency and the inventory of drillable prospects, which necessitates a gas rig count of 800-900 to maintain gas production at current levels, RJA speculated. Taken together with the inability to boost gas volumes from the Gulf of Mexico shelf, contends RJA, it appears that these gas-supply trends are growing only more pronounced, making it "increasingly likely that, in the long term, demand rationalization at gas prices above $3.50/MMbtu will be required to balance the market."

OGJ Hotline Market Pulse

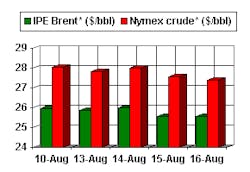

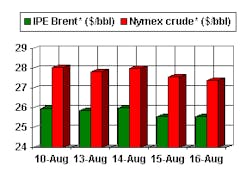

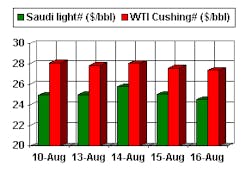

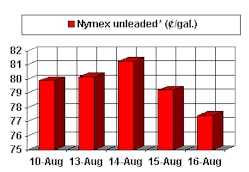

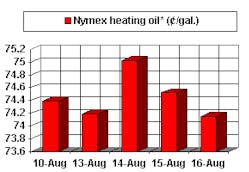

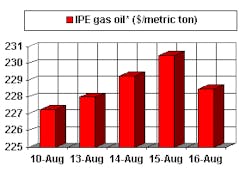

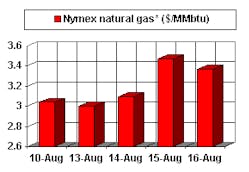

Latest Prices as of August 17, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.