Oil markets take on bearish tone amid softening demand, rising non-OPEC output, sagging gasoline prices

Oil markets have suddenly taken on a distinctly bearish tone. As expected, the Organization of Petroleum Exporting Countries took no action at its meeting this week in Vienna. Taken by itself, that would leave the market pretty much in balance for now, as OPEC has repeatedly noted. But some analysts have claimed that the seasonal demand pick-up that begins near the end of the third quarter would set the stage for an oil price spike later in the year or early next year, if OPEC were to do nothing on supply-and especially if Iraqi oil supplies were still being withheld from the market.

What was unexpected was the collapse of the US-UK bid to get "smart sanctions" adopted by the United Nations. This modification to the sanctions regime targeting Iraq would, in theory, loosen constraints on Iraqi imports of goods and services that would benefit Iraqi citizens while tightening the screws on Saddam Hussein's ability to rebuild his arsenal and smuggle oil. It was even the initial, tentative consideration of such a proposal that spawned Baghdad's cutoff of its legal oil exports, covered by the UN Security Council oil-for-aid program in the first place. But the US and UK were blindsided by a threatened Russia veto of the plan, and the proposal was tabled. Russia wants a more-comprehensive sanctions regime that is acceptable to Iraq to be put in place as a prelude to an eventual lifting of all sanctions against Iraq (considering that Iraq's stance never changes-that all sanctions should be lifted immediately-this would be, no doubt, the best possible outcome for Baghdad geopolitically, even if it doesn't nothing to enhance Saddam's financial situation, which would be the case with a continued cutoff of legal Iraqi exports). What happened, instead, was the UN simply agreed to roll over the existing sanctions regime for another 5 months.

At the same time, gasoline prices in the US-the other primary driver in oil markets of late-continue to fall. That's certainly counterintuitive at a the peak of the summer driving season, but it can be explained by the frantic scrambling by US refiners to make or import enough gasoline to meet the seasonal surge in demand. The brimming stocks situation has sliced about a quarter from wholesale gasoline prices in the past couple of months, and that has helped take some of the heat off crude oil prices.

Now OPEC is starting to talk about considering an emergency meeting-ahead of its next regularly scheduled ministerial meeting, on Sept. 26, should the resumption of Iraqi oil exports undermine prices to the point where the OPEC basket marker price falls below the bottom of the group's official $22-28/bbl target price band.

That's pretty much in line with what the Canadian Energy Research Institute is projecting. The Calgary think tank contends that much of the strength in oil markets lately has emanated from concerns over US gasoline stocks earlier in the quarter and over Iraq's potential mischief. With these two elements largely neutralized, that suggests oil prices will continue to slide in the months ahead, and OPEC will be forced to consider production quota cuts again soon, perhaps early in 2002.

"The consensus view for the past several months has been that OPEC will have to increase quotas in the third or fourth quarter this year, to keep a lid on oil prices in the face of seasonal demand," CERI said. The analyst holds to its view that relatively weak world oil demand growth, stemming from the slowdown in the world economy, and solid non-OPEC supply growth will alleviate the need for an OPEC quota increase later this year.

"CERI continues to expect that OPEC in fact will have to cut its quotas early in 2002 to keep crude prices above its target floor (about $24/bbl for WTI)," the analyst said. "Even if quotas are cut, forward demand cover could jump to 56 days in first quarter 2002, compared to our estimate of an average 55 days over the last 3 quarters of 2001."

CERI also dismisses the notion that a shortfall of heating oil stocks in the winter will cause another spike in oil prices. That scenario evolved from the similar concerns over gasoline stocks, which have since evaporated. The analyst contends that the same self-fulfilling prophecy will come about with heating oil: "Ample crude stocks will keep a lid on product prices. Any fear of shortages will push heating oil prices up relative to crude and increase refining margins, which in turn will encourage higher crude runs, build heating oil stocks, and alleviate the fear of shortage."

If supply and demand are roughly in balance, then, it follows that oil prices probably will stay relatively flat until further signs of that weakened demand materialize. Ensuing softness in oil prices will encourage OPEC to trim output again. Remember, though, that the oil-for-aid program comes up for renewal in December-exactly the same time of year that Iraq pulled its oil off the market in 2000. And the rest of OPEC (mainly Saudi Arabia) stepped in to take up the slack, keeping oil prices from going through the roof at a period of peak demand.

The betting here is that Iraq will stir up trouble again as the program renewal deadline approaches. The US and UK certainly will revive their smart-sanctions proposal, and warming relations between presidents Bush and Putin suggest that it may make more headway the next time around. And North Sea output always falls in the summer and comes roaring back in the fall; the same thing happens on Alaska's North Slope. So a very possible scenario is one of OPEC cutting output in September (if not sooner) amid a weakening demand outlook and rising non-OPEC supply, then restoring those cuts in December. And despite the rollercoaster ride, the average price of oil over the year probably will remain pretty much where it is now.

How long the Saudis want to keep this up (and in the final analysis, that's what this all about, anyway) depends to a large extent how much market share it loses to non-OPEC nations. Its fellow members are not really that much of concern, given the swing-supply leverage the oil giant has and the limited capacity growth potential for other OPEC members. But the Caspian, Russia, Angola, Sudan, et al., are contributing to what shapes up as the biggest year-to-year non-OPEC supply jump in years. More on that subject next week.

OGJ Hotline Market Pulse

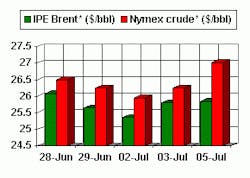

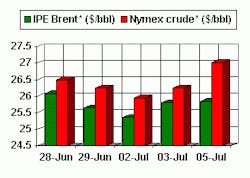

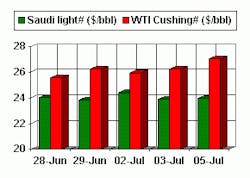

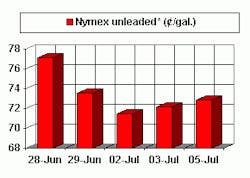

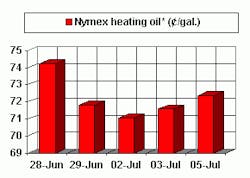

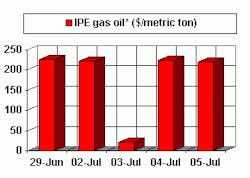

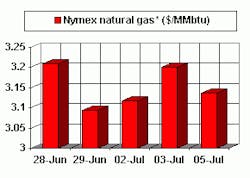

Latest Prices as of July 6, 2001

null

NOTE: DATES FOR IPE BRENT AND GAS OIL ACTUALLY REFLECT THE LATEST 5 DAYS OF TRADING (June 29-July 5), NOT ACTUALLY BROKEN BY THE JULY 4 HOLIDAY AS THE DATE AXIS INDICATES.

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.