Softening oil supply-demand balance proving OPEC right

Proliferating signs of a softening supply-demand balance are taking a bit of the wind of the oil market's sails.

Leading the pack of downward market indicators this week was a clear sign from OPEC that another production cut would not be forthcoming at the upcoming Mar. 16 ministerial meeting.

OPEC Pres. Chakib Khelil dashed hopes among market bulls Wednesday when he declared that there would be no need for the group to cut output again. In Houston last week, Khelil said, "The cuts we have made so far have allowed the market to stabilize. It will be very difficult to justify another decrease in March."

What has Khelil and other moderates in OPEC concerned are the growing signs of slumping oil demand and especially the flagging US economy-both coming ahead of the seasonally slack second quarter.

Khelil expressed concern about the knock-on effects on global oil demand of a slumping US economy. Not only would US oil demand slide in the wake of a deepening economic recession, but a weakening US economy also could slow the economic recovery of Southeast Asia and the Pacific Rim. Of special concern are the giant economies of India and China.

Chinese demand slump

There is already evidence that China's demand for oil is weakening, an alarm raised this week by Boston-based consulting group Energy Security Analysis Inc.

ESAI contends that Chinese crude oil imports will remain flat or lower in 2001: "This prediction marks a significant departure from 2000, when imports almost doubled."

In 2000, China imported 1.38 million b/d of crude oil, accounting for more than 650,000 b/d of the year's overall increase in global oil demand and representing a significant factor in rising oil prices last year.

"Many people expected China's crude oil imports to continue to grow in 2001. ESAI's analysis, based on our comprehensive database, shows that this isn't the case," said Paul Flemming, ESAI Asian oil analyst.

This forecast has implications for worldwide crude oil demand, Flemming said: "China was importing a lot of oil last year, and that definitely had an impact on prices. "Flat or lower demand from China in 2001 impacts our view on the overall crude oil balance."

Last year's increases in crude imports were manifested in high refinery throughput rates in 2000, up 14% from 1999, and large inventory builds in crude oil and products, ESAI said. The consultant forecasts nominal throughput increases this year of about 2% and a directional draw on inventories. These factors will combine to keep crude imports stable near 2000 levels.

China's crude oil exports could increase, as there is incentive for China to take advantage of high sweet-sour differentials by selling sweet crude and purchasing lower priced sour crude for domestic processing, ESAI noted. Any increase in exports will be offset by incremental imports.

Global demand slowing

The International Energy Agency this week trimmed its estimate of global oil demand growth in 2001 by 140,000 b/d to 1.5 million b/d. That follows a comparable reduction of its estimate of 2001 oil demand growth by 280,000 b/d, made last month.

The agency noted that oil demand numbers since October have fallen short of expectations and that even January demand had slipped despite a surge in substitution of oil for natural gas owing to the latter's price spikes.

"High crude prices and mild weather in Europe and Asia explain only part of the disparity," IEA said. "The global economy is slowing, curbing demand."

Similarly, the Energy Information Administration recently reported its own data for estimated US oil demand, also showing a slump. EIA reported that US crude oil stocks last week rose 3.4 million bbl from the prior week, indicating that the pressure to draw down stocks has eased.

Oil supply rising

Meanwhile, signs abound that global oil supply is steadily making gains.

World oil production rose by about 500,000 b/d in January, to an average 77.9 million b/d, according to IEA. The agency cited a rise in Iraqi oil exports as the driver in world oil supply gains.

Baghdad last month boosted exports under the UN-brokered oil-for-aid sales program to 1.8 million b/d, only about 400,000-500,000 b/d less than the peak seen last fall. The UN this week said that Iraqi oil exports appear to be returning to normal levels, with several foreign tankers loading or slated to load this week. That led to speculation that Iraq has sharply cut or eliminated its illegal surcharge. It was the surcharge that caused the latest tiff between Baghdad and the UN, leading Iraq to halt exports altogether at the start of December.

It would appear that OPEC has been more on the money than its critics in assessing the state of global supply. The warnings that oil supply is adequate, necessitating the latest round of production cuts that kicked in at the start of this month, are being borne out. Both the EIA data and the lastest report on US stocks from the American Petroleum Institute suggest that crude stocks grew even as refining utilization rates remained high.

With NYMEX crude futures tumbling by more than $3/bbl in the past week in response to the fading tightness of supply-demand fundamentals, price hawks in OPEC are likely to press for further production cuts Mar. 16 in order to bolster oil prices again. But it is clear that Saudi Arabia is steering this ship, and its own concerns about the US economy will be buttressed by the upcoming meeting between Khelil and new US Energy Sec. Spencer Abraham.

It's starting to look as if that ship is safely navigating the oil price ship amid the supply and demand shoals into the "soft landing" price harbor. And with the hindsight that the widely criticized Feb. 1 production cut is beginning to look entirely necessary, then OPEC's prescience on the market will not be so easily assailed in the future.

OGJ Hotline Market Pulse

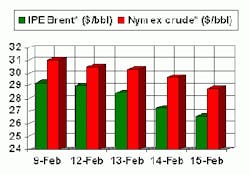

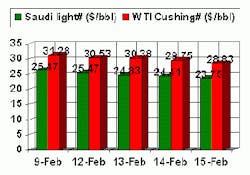

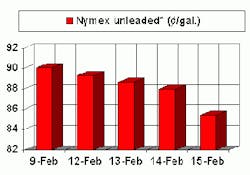

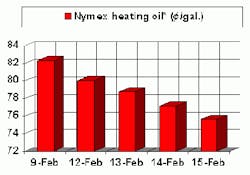

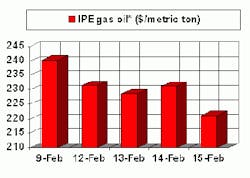

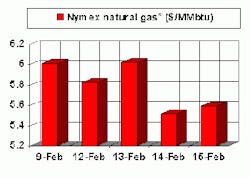

Latest Prices as of February 16, 2001

null

null

Nymex unleaded (¢/gal.)

null

Nymex heating oil (¢/gal.)

null

IPE gas oil ($/metric ton)

null

null