Price stability key to oil, gas markets today

Price stability is the watchword in oil and gas markets these days. But the two markets are coming at it from different directions.

Oil markets are anticipating higher prices as supply tightens again, while gas markets (at least in the US) are anticipating some price moderation as cold weather relents and demand is squeezed.

OPEC and oil prices

OPEC will enter its latest ministerial meeting next week in Vienna with a consensus on cutting oil production in order to shore up sagging oil prices.

Since a peak of about $36/bbl in autumn 2000, oil prices have dropped by as much as $10/bbl before rebounding in recent weeks. Just as oil prices were bid up to probably unsustainable levels on the expectation that Iraq might cut off oil supplies, the big shrug of self-fulfilling prophecy that greeted Baghdad's fulfillment of the threatened cutoff meant a price drop. (Other factors were evidence of stockbuilding as earlier OPEC increases finally hit the market and a decline in demand.) Correspondingly, the widespread expectation that OPEC will cut production next week in Vienna has caused oil prices this week to rebound to almost $30/bbl.

The question of import, of course, is: how much of a cut? Reports from various OPEC capitals indicate suggested cuts could range anywhere from 1 million b/d to 2 million b/d. It's impossible to foretell how much of a cut will produce the desired soft landing for oil prices, but a wise guess would focus on what's politically acceptable. Right now, with energy markets in general jittery, signs of an economic slowdown spreading, and political ire rising in the US, OPEC probably will heed the price doves led by Saudi Arabia and cut output by less than 2 million b/d. However, the market may very well not respond to a cut of only 1 million b/d, especially if the next API and IEA reports indicate continued stockbuilding.

So let's throw a dart at the board and shoot for 1.5 million b/d. That would probably keep WTI close enough to $25/bbl to keep Riyadh happy but sufficiently far south of $30/bbl to keep Washington happy.

Power to sustain gas prices

The respite from cold weather and the collapse in much industrial demand has seen natural gas prices retreat a bit from the near-$10/Mcf level of recent weeks.

But while cold weather has sustained US natural gas prices at unprecedented levels in recent weeks, the outlook for continued high gas prices in the coming decade owes more to burgeoning demand for gas from the electric power sector.

That's the view of Ed Krapels, director of Energy Security Analysis Inc.'s natural gas and power practice, who contends that demand from the electric generation sector is the main culprit for extreme price volatility in the natural gas market.

"Gas prices will average $6 in years when hot summers follow cold winters, and $3 in years when cool summers follow mild winters," Krapels said. "This is the central and irreducible consequence of the choice made over the last 5 years to make natural gas the primary fuel for generating new electricity supplies."

As far as 2001 is concerned, it already shapes up as a year with a very cold winter, leading ESAI to project an average gas price of $5.33/MMbtu-a projection it deems too low if summer proves to be very hot (OGJ, Jan. 8, 2001, Newsletter, p. 5).

"This is a significant development, considering that natural gas prices have averaged approximately $2.00/MMbtu over the past 10 years," Krapels said.

Gas price factors

ESAI cites four key factors that will affect gas prices in 2001

- The weather. If the first quarter is as cold as November-December was and a really hot summer throughout the US follows, that's a recipe for an average Henry Hub price of $6-7/MMbtu for the full year, ESAI contends. If this winter turns mild, followed by a temperate summer throughout the US, the price is likely to average $3-4/MMbtu for the full year.

- The supply response. "No one is investing serious capital in gas reserouce development that requires $5[/MMbtu] for 10 years, nor should they," Krapels said. "Hence, the supply response that we can expect in 2001 and 2002 is based on sustainable $3-4 gas."

- The inventory level and consequent prices. Incremental supply will be swallowed by higher demand in the first quarter, keeping prices buoyed at $8-9/MMbtu early in the period and drifting down to $6/MMbtu in March, ESAI contends: "During the second quarter, the incremental supply will be sucked into a nearly depleted stockpile."

- The demand response from consumers dependent on natural gas for space heating. The analyst contends that residential consumers will conserve aggressively and that demand from power producers will continue to grow as more gas-fired electricity capacity will come on line in 2001.

Inventory squeeze

The squeeze on US natural gas storage will ensure that gas prices remain bolstered in 2002-and probably beyond, says Lehman Bros.' Thomas Driscoll.

"We expect to exit winter with storage at about 200-400 bcf vs. a normal level of around 1,000 bcf," he said. "Industry is unlikely to be able to refill storage for next winter; thus, low inventory levels will likely continue to exert upward pressure on gas prices for a prolonged period of time."

Accordingly, Lehman Bros. last week hiked its 2001 natural gas price forecast to $6.25/MMmbtu from an earlier forecast of $5.00/MMbtu and its 2002 natural gas price projection to $4.50/MMbtu from $4.15/MMbtu.

The storage shortfall-with expected season-end levels put as low as a fifth of levels seen for last year and for the 5-year average-equals about 6-7% of production over the 7-month refill season, Driscoll notes.

Don't look for US natural gas production to come to the market's rescue anytime soon, Lehman Bros. contends.

"We estimate that US natural gas production has fallen nearly 7% over the past 3 years," Driscoll said. "We think that US natural gas production is back to 1990 levels.

"Although [third quarter 2000] probably represented the production trough, we believe that production will rise more slowly this year than is expected by many investors. We are forecasting a production increase of 1-2% in 2001."

Crimping demand

The key to balancing US gas markets, says Driscoll, may be "demand destruction."

"Clearly, current high prices are causing decreases in consumption by many industrial and perhaps commercial customers," he said. "In the fourth quarter, we estimate that heating demand increased by 564 bcf compared with [fourth quarter] 1999 levels; this demand increase was met not by supply growth but by a 301 bcf increase in storage withdrawals plus a 263 bcf decreased in nonheating consumption."

With fourth quarter natural gas spot prices averaging about $6.25/MMbtu, Lehman Bros. thinks that nonheating demand for gas fell in the period by 2.9 bcfd.

"Thus we expect that a first quarter average price of $8-10/MMbtu would cause an even larger demand response," Driscoll said.

OGJ Hotline Market Pulse

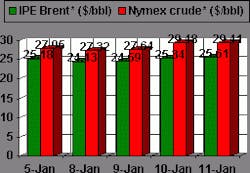

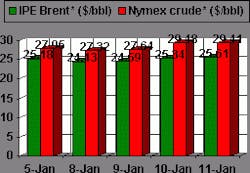

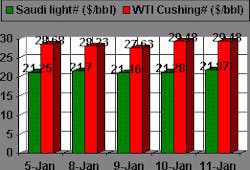

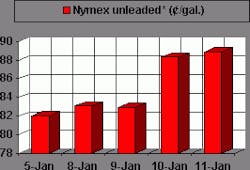

Latest Prices as of January 12, 2001

null

null

Nymex unleaded

null

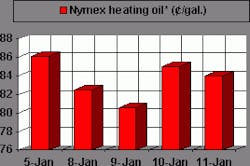

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null