OGJ Newsletter

GENERAL INTEREST — Quick Takes

Chamber petitions EPA to correct GHG estimate

The US Chamber of Commerce petitioned the US Environmental Protection Agency to correct assumptions EPA used to develop greenhouse gas requirements for gas producers since 2010. EPA used a well completion emissions factor of 9,175 Mcf/completion, which the Chamber calls an overestimate.

In a Dec. 19, 2011, filing, the Chamber said EPA's estimate was based on unverified information from a limited number of wells regarding gas captured by green completions and gas emitted from nongreen completions obtained through Natural Gas STAR Program.

"No one had addressed this issue in this way," Ross Eisenberg, the Chamber's environment and energy counsel, told OGJ. "The Information Quality Act requires information developed for regulations to be reasonably correct. We wanted to ask EPA to correct information in this case that was flat-out wrong."

The Chamber cited an IHS CERA report, "Mismeasuring Methane: Estimating Greenhouse Gas Emissions from Upstream Natural Gas Development," and the petition said methodology used by EPA's Climate Change division was flawed.

The petition also said that URS Corp. conducted a survey of seven producers' shale gas well completions and emissions, which provided data on 1,200 wells.

The survey found actual GHG emissions from the wells' completions were more than 1,200% lower than EPA's estimate, that green completions were used on 92% of the wells, and that gas from 55% of the nongreen completion wells was flared instead of vented.

The Chamber's petition sought a correction from EPA within 90 days, or a notice, explanation, and estimated completion date if more time is required.

BLM extends Rough Draw project comment period

The US Bureau of Land Management extended the comment period on Patriot Energy Resources LLC's proposed Rough Draw coalbed methane project 13 miles north of Gillette, Wyo.

BLM's office in Buffalo, Wyo., announced the comment period was extended to Jan. 17. Initially, the comment period was to have ended on Jan. 3 (OGJ Online, Dec. 7, 2011).

BLM's Buffalo, Wyo., office has added a new exhibit, "Analysis of Impacts of Methane Farming on Federal Coal in the Powder River Basin, Wyoming," on its web site along with Patriot's application and supporting documentation.

Patriot is a Gillette-based subsidiary of Luca Technologies, an applied research company based in Golden, Colo. BLM documents show Luca spent $40 million developing a method to farm methane through a biogenic gas generation process.

Luca has acquired operating rights to 589 wells in central Campbell County, Wyo. The coalbed gas development area in Wyoming involves federal, nonfederal, and partial federal mineral ownership.

NETL seeks proposals to manage project impacts

The National Energy Technology Laboratory has issued a request for proposals to study ways to improve environmental performance for unconventional natural gas projects. Proposals will be accepted until Mar. 6.

The proposal is part of an onshore unconventional resources program by NETL's contractor, the Research Partnership to Secure Energy for America.

RPSEA has a specific goal of unlocking substantial domestic shale gas resources while addressing public concerns about potential environmental impacts.

"There is a need to demonstrate that the controls, safeguards, and environmental impact mitigation procedures put in place during drilling and production are commensurate with the associated risks," it said in its program opportunity statement.

Proposals will be accepted in four focus areas: minimizing surface disruption, improving groundwater protection, maximizing hydraulic fracturing efficiency by minimizing total fluid requirements, and improving fluid management approaches.

The request follows one on Dec. 13, 2011, aimed at small oil and gas producers, for which proposals will be accepted until Feb. 27, NETL said.

Williams to buy gathering system in Marcellus shale

Williams Partners LP, Tulsa, reported it will acquire the Laser Northeast Gathering System and other midstream businesses from Delphi Midstream Partners LLC, a unit of American Securities LLC, and management, for about $750 million.

The Laser gathering system currently consists 33 miles of 16-in. natural gas pipeline and associated gathering in Susquehanna County, Pa., as well as 10 miles of gathering pipeline in southern New York.

The acquisition is supported, said the announcement, by existing long-term gathering agreements that "provide acreage dedications and volume commitments." As production in the Marcellus increases, the company expects the Laser system to reach a capacity of 1.3 bcfd.

Williams Partners will fund the purchase with a combination of $300 million cash and about 7.5 million common units of Williams Partners, the announcement said. The acquisition is subject to customary regulatory filings and approvals.

WGP to buy Anadarko midstream assets

Western Gas Partners LP, Houston, reported it will buy the Red Desert complex and related assets, primarily in the greater Green River basin of southwestern Wyoming, from Anadarko Petroleum Corp. for $483 million.

Under the agreement, WGP will buy Anadarko's 100% ownership interest in Mountain Gas Resources LLC, which owns the Red Desert complex, a 22% interest in Rendezvous Gas Services LLC, and related facilities.

Red Desert, which represents more than 90% of MGR's cash flow, includes the 125 MMcfd Patrick Draw processing plant, the 48 MMcfd Red Desert processing plant, 1,295 miles of gathering lines, and related facilities.

Rendezvous owns a 338-mile mainline gathering system serving Jonah and Pinedale Anticline fields in southwestern Wyoming that deliver gas to WGP's Granger complex and other locations. WGP's announcement said Red Desert and Rendezvous are together expected to generate more than 98% of MGR's operating cash flows.

WGP expects the transaction to close in January, with an effective date of Jan. 1.

Exploration & Development — Quick Takes

LLOG producing from Who Dat oil

LLOG Exploration Co. LLC started production from Who Dat oil and natural gas field on Mississippi Canyon Blocks 503, 504, and 547 in the Gulf of Mexico. LLOG expects to ramp up production to 20,000 b/d and 22 MMcfd from three existing wells.

The field development plan calls for drilling nine additional wells for fully loading the 60,000 bo/d and 150 MMcfd capacity of the floating semisubmersible production unit that is moored in 3,100 ft of water on MC Block 547.

Who Dat, discovered in December 2007, will produce from 10 stacked Pliocene and Upper Miocene reservoirs at 10,000-17,000 ft. On test the zones that are mainly oil tested 17-26° gravity oil with 400-1,300 GORs. Reservoir pressures ranged from 6,000 to 12,500 psi.

LLOG also plans to start production from Mandy in 2,465 ft of water on MC Block 199 and Goose in 1,625 ft of water on MC Block 751 in the first and second quarters of 2012, respectively.

The company expects Mandy to produce at an initial rate of 15,000 bo/d and 12 MMcfd of gas to W&T Offshore's Matterhorn tension leg platform. LLOG estimates that Mandy will recover 10-30 million boe.

Goose is a Spinnaker Petroleum late-1990s discovery that LLOG plans to complete as a subsea tie-back to its Valley Forge field manifold on MC Block 707.

The well encountered gas-condensate in three sands and tested 8,000 b/d of liquids and 28 MMcfd of gas.

Round extended for 15 blocks in Egypt

Egyptian General Petroleum Corp. has extended by 2 months a bidding round launched in September for 12 onshore and 3 offshore blocks in Egypt. The round now will close on Mar. 29.

EGPC is offering production sharing agreements for seven blocks in the Western Desert, three blocks in the Eastern Desert, two blocks in Sinai, and three blocks in the Gulf of Suez.

Breitling enters Bakken oil formation

Irving, Tex., independent Breitling Oil & Gas Corp. acquired a nonoperated acreage position in Sand Creek field within the Bakken formation in McKenzie County, ND.

Plans call for Breitling to participate in six Bakken and Three Forks wells during 24-36 months on acreage acquired through a joint venture. The operator will be Denbury Resources Inc.

Chris Faulkner, Breitling chief executive officer, said he believes the Bakken and Three Forks "will be a major focus of Breitling's future exploration and production activities."

Alliance, Repsol form joint venture for exploration

Alliance Oil Co. Ltd and Repsol Exploracion SA agreed to form a joint venture for exploration and production in Russia, combining Alliance's Russian exploration and production expertise with Repsol's technological and financing capabilities.

Under the agreement, Alliance will transfer its upstream subsidiaries Saneco and Tatnefteodatcha, which comprise exploration and production licenses at 14 fields with proved and probable oil reserves of 171.5 million bbl and production of 20,500 b/d of oil.

Alliance's asset contribution is valued at $570 million, and Repsol will carry out a capital increase in the joint venture as well as paying cash to Alliance to obtain 49% interest participation. The companies said their joint venture will have preferential rights regarding new upstream business opportunities identified by either Alliance or Repsol in Russia.

Drilling & Production — Quick Takes

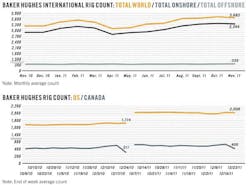

Aramco to increase drilling rigs by 12% in 2012

Saudi Aramco plans to increase its drilling rig count by 12% next year to 145 to increase production of oil and natural gas from offshore Manifa field, according to an energy analyst.

Most of the expansion is for gas development, said Sadad al-Husseini, a former executive vice-president for exploration and development at Aramco who now runs Husseini Energy.

Al-Husseini said Aramco will drill for gas onshore in northern Saudi Arabia and near Shaybah oil field in the Empty Quarter desert, and offshore in Hasbah field in the Persian Gulf.

He said the Saudi firm expects to have 50 rigs drilling for oil, 50 for gas, 15 exploration rigs, and 30 workover rigs to maintain existing wells during 2012.

The oil drilling is mainly to replace capacity declines that result from ongoing production and will not add new capacity, except for the Manifa drilling, he said.

Aramco increased the number of drilling rigs this year to 130, a higher figure than those supplied by rig contractors, according to al-Husseini.

In March, Baker Hughes Inc. Chief Executive Officer Chad Deaton said Saudi Arabia would increase the number of its drilling rigs by yearend to 118 from 92. Al-Husseini said Aramco is increasing the number of rigs in Manifa field to 20 from 8.

Pacific Drilling receives deepwater drillship

Pacific Drilling SA has taken delivery of the Pacific Santa Ana dual-gradient ultradeepwater drillship, for which Chevron holds a 5-year contract for work in the Gulf of Mexico.

Samsung Heavy Industries of South Korea built the vessel, which has dual load path capability as well as dual-gradient drilling upgrades. The ship can drill to 40,000 ft in as much as 12,000 ft of water.

It's Pacific Drilling's fourth ultradeepwater drillship. The company has two other comparable ships on order with Samsung, both to be delivered in 2013.

Anadarko sanctions Lucius truss spar development

A group led by Anadarko Petroleum Corp. has sanctioned development of the Lucius deepwater discovery in the Gulf of Mexico using a truss spar with a capacity of 80,000 b/d of oil and 450 MMcfd of gas starting in 2014.

The field's reserves of more than 300 million bbl of oil equivalent lie in "relatively shallow and highly productive reservoirs that can be developed in a capital-efficient manner" with off-the-shelf technology, Anadarko said. Lucius would be among the company's most economic projects.

The Lucius unit includes parts of Keathley Canyon Blocks 874, 875, 918, and 919. Anadarko, which operates the unit with a 35% working interest, drilled the discovery well in 2009 in 7,100 ft of water.

Anadarko said Lucius "will establish important infrastructure in an emerging area of the Gulf of Mexico where we have identified additional prospects and opportunities. We expect to have an active drilling program in the unit beginning in 2012, and we look forward to working with our partners to achieve first production in 2014."

Anadarko pioneered truss spar technology in 1997, and Lucius, under construction at Technip's facility in Pori, Finland, will be the largest of company-operated spars.

Following the previously announced unitization agreement, Lucius interest owners entered into an agreement with the Hadrian South coventurers under which natural gas produced from Hadrian South field will be processed through the Lucius facility in return for a production-handling fee and reimbursement for any required facility upgrades (OGJ Online, July 18, 2011).

Other participants in the Lucius unit include Plains Exploration & Production Co. 23.3%, ExxonMobil Corp. 15%, Apache Deepwater LLC 11.7%, Petrobras 9.6%, and Eni 5.4%.

PROCESSING — Quick Takes

Quicksilver, KKR form Horn River midstream venture

Units of Quicksilver Resources Inc., Fort Worth, and Kohlberg Kravis Roberts & Co. LP have formed a midstream partnership to build and operate natural gas midstream services in British Columbia and the Northwest Territories of Canada.

The companies will jointly build and operate natural gas gathering, transportation, and processing infrastructure to maximize the value of the production stream from Quicksilver's development in the Horn River basin. And Quicksilver has dedicated current and future production from its Horn River acreage to the partnership.

The agreement covers midstream activity over about 30 million potential acres in the Horn River, Liard, and Cordova basins, which would include third-party transportation and processing infrastructure and agreements.

Quicksilver contributed its existing 20-mile, 20-in. gathering and compression and 10-year contracts for gas deliveries. KKR paid $125 million to Quicksilver in exchange for a 50% interest in the partnership.

The new partnership anticipates building a treating plant that will lower Quicksilver's cost to move its produced natural gas to market by roughly 80¢/Mcf compared with its current alternative. Quicksilver will operate the partnership.

The partnership announcement said this is the second step in "ensuring the lowest cost solution relative to current options" to move Quicksilver's gas to market. The first step, it said, was TransCanada PipeLine's extension of its Alberta system to Quicksilver's lands. The planned treating unit that KKR will fund will be at the terminus of this pipeline.

The announcement also stated that the wells in the Horn River basin of British Columbia are "among the most prolific of shale plays in North America."

Recoverable reserves from Quicksilver's acreage alone, said the company, could exceed 10 tcf of natural gas, citing a recent Canadian National Energy Board study that Horn River basin reserves could exceed 75 tcf.

Total to own all of Fina Antwerp Olefins

Total, through its 100% affiliate PetroFina SA, has agreed to acquire the 35% interest held by ExxonMobil Petroleum & Chemical BVBA in Fina Antwerp Olefins.

The Fina Antwerp Olefins monomer plant in Antwerp, Belgium, processes naphtha, butane, and propane from Total's nearby 360,000 b/d refinery. It can produce 1.415 million tonnes/year (tpy) of ethylene, 710,000 tpy of propylene, 90,000 tpy of benzene, 90,000 tpy of cyclohexane, and 50,000 tpy of toluene.

Total polymer plants at Antwerp and Feluy process products of Fina Antwerp Olefins.

After completion of the transaction, which is subject to approval of European competition authorities, Total will be sole owner of Fina Antwerp Olefins.

Delaware City refinery due hydrocracker

PBF Holding Co. LLC and affiliate Delaware City Refining Co. LLC have reported conditional plans to build a mild hydrocracker and hydrogen plant at their 190,000 b/d Delaware City, Del., refinery.

Delaware City Refining and another PBF affiliate bought the then-idle refinery and its operating terminal from Valero Energy Corp. in June 2010 and promptly announced plans to restart the refinery after performing maintenance (OGJ Online, June 2, 2010). Valero had shut the refinery in 2009 but kept the terminal open.

The new hydrocracker would cut sulfur content in about 65,000 b/d of distillate to less than 15 ppm from 2,000 ppm and allow processing of a heavier crude slate. It would handle streams from the Delaware City refinery and the 170,000 b/d refinery at Paulsboro, NJ, that PBF bought from Valero in December 2010 (OGJ Online, Sept. 27, 2010).

In a statement, PBF said the $1 billion construction project is contingent on "the issuance of timely and appropriate federal and state environmental and other permits that will not increase the cost to build or operate the project, as well as acceptable labor agreements that will ensure that the project can be built in an efficient and cost-effective manner."

Major process units at the Delaware City refinery are a fluid coking unit, fluid catalytic cracking unit, hydrocracking unit with a hydrogen plant, continuous catalytic reformer, two alkylation units, and several hydrotreating units.

The Paulsboro refinery has a delayed coker, fluid cat cracker, hydrotreaters, reformer, alkylation unit, and 12,000 b/d of lube oil processing capacity.

TRANSPORTATION — Quick Takes

BLM decision amends Ruby Pipeline's right-of-way

The US Bureau of Land Management signed a decision amending the Ruby Pipeline Project's right-of-way on Dec. 7, BLM's Reno, Nev., field office announced on Dec. 13.

The changes include construction of 4 above-ground cathode sites to control pipeline corrosion and 15 small roads to main line valves, it said.

The system includes a 678-mile, 42-in. interstate natural gas pipeline crossing 368 miles of federal land from Opal, Wyo., across northern Utah and Nevada to a terminus near Malin, Ore., BLM said. BLM and the US Federal Energy Regulatory Commission issued permits for the project in 2010, and the pipeline went into service this year on July 28.

BLM said it and FERC would continue to monitor and evaluate restoration progress along the entire pipeline's ROW several years.

Questions about the cathodes and roads decision may be directed to BLM National Project Manager Mark Mackiewicz in the US Department of the Interior agency's field office in Price, Utah, it added.

Colonial Pipeline to add 100,000 b/d capacity

Colonial Pipeline Co. has approved a 100,000 b/d expansion of Colonial's main gasoline pipeline, originating in Houston and connecting Gulf Coast refineries with markets across Colonial's system. Colonial will add the capacity to its Line 01 during first-quarter 2013.

Line 01 begins in Houston and runs to Greensboro, NC, from where shipments to the Northeastern US are made.

The expansion will increase Colonial's overall gasoline delivery capacity by roughly 10%, and is the third capacity enhancement announced by Colonial in 2011. Previously announced were:

• A 100,000 b/d increase to the mainline serving the Northeast, put into operation earlier this year. This line begins in Greensboro and serves the Philadelphia, New Jersey, and New York markets.

• A 75,000 b/d capacity increase to the distillate mainline, with 20,000 b/d completed and 55,000 b/d due online by mid-2012. This line starts in Houston and ends in Greensboro.

Recent refinery closings in the Northeast have contributed to allocating space on Colonial mainlines, the company said, primarily between Houston and Greensboro. The announced and completed expansions are intended to help alleviate this condition.

Contract let for Kinneil degasification work

BP Exploration Operating Co. Ltd. has let a contract to a unit of Foster Wheeler AG's Global Engineering & Construction Group for work related to the debottlenecking of the Forties Pipeline System crude degasification facilities at BP Exploration's Kinneil Terminal in Scotland.

The Foster Wheeler unit will handle engineering, procurement, and construction management under the new contract. It has completed pre-front end design and FEED for the project, which will allow the terminal to handle high gas-to-oil-ratio unstabilized crude oil and natural gas liquids.

Expected to be completed in 2013, the debottlenecking involves plant modifications that include improvements to heater and process-control systems as well as new facilities, including crude coolers and a cooling-water system.

The Forties Pipeline System has nominal capacity exceeding 1 million b/d. It handles oil and gas liquids from more than 30 fields and the St. Fergus gas terminal.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com