OGJ Newsletter

GENERAL INTEREST — Quick Takes

Corps of Engineers approves ConocoPhillips project

The US Army Corps of Engineers issued a permit to ConocoPhillips Alaska Inc. for the CD-5 Alpine Satellite Development Project within the National Petroleum Reserve-Alaska.

The Dec. 19 action culminates a nearly year-long review that included an analysis of engineering alternatives and supplemental technical information from state and federal agencies.

Section 404 of the Clean Water Act requires ConocoPhillips to use the least environmentally damaging practicable alternative.

The CD-5 permit authorizes construction of a drilling pad, a 6-mile access road, 4 bridge crossings, 2 valve pads with access roads, and new pipeline support structures.

The permit also includes 22 special conditions intended to minimize the impact to the environment within the Arctic Coastal Plain. ConocoPhillips also agreed to pay mitigation fees to the Conservation Fund to compensate for unavoidable losses to aquatic resources, the Corps said.

The Corps evaluated practicable alternatives that included underground and above-ground pipelines. Additional information from ConocoPhillips, along with opinions from government agencies, documented that an aboveground pipeline posed less of a risk of damage to the aquatic ecosystem in this particular case.

Col. Reinhard Koenig, commander of the Corps's Alaska District, said the ConocoPhillips proposal "will provide year-round quick and effective pipeline monitoring, leak detection, and spill response."

A spokeswoman in ConocoPhillips's Anchorage office said that in coming months, ConocoPhillips plans to evaluate and incorporate the permit's terms into the project plan.

Deputy US Interior Sec. David J. Hayes also noted issuance of a final permit will allow construction of pipelines and a bridge over the Niqliq River.

"The Department of the Interior will continue to work with industry to develop the abundant resources in the NPR-A—protecting critical habitat for millions of migratory birds and calving areas for the Teshekpuk Lake caribou and safeguarding Native Alaskans' subsistence needs, while guiding sensible, productive energy exploration and development," Hayes said.

DOI appropriations bill in House omits some plans

Appropriations legislation introduced in the US House on Dec. 14 would set budgets for the US Department of the Interior and eight other federal departments for the rest of fiscal 2012, which began on Oct. 1. But the measure also would drop the Obama administration's proposal to increase oil and gas fees at the US Bureau of Land Management by $38 million.

BLM would receive $1 million, $5 million less than the previous year. The US Bureau of Ocean Energy Management would receive $60 million to review offshore exploration plans and issue drilling permits. The US Bureau of Safety and Environmental Enforcement would get $76 million, including $15 million for oil spill research. It also would be authorized to collect $62 million in inspection fees, with dedicated funding for approving permits and hiring inspectors and engineers.

The measure also contains provisions directing DOI to expedite permit approvals for new offshore energy production, and prohibiting implementation or enforcement of Interior Sec. Ken Salazar's order for BLM to review its holdings and designate "wild lands" for possible future designation as wilderness.

US Sen. Lisa Murkowski (R-Alas.), the Energy and Natural Resources Committee's ranking minority member, separately said DOI's appropriations bill before the House contains language that would move authority over offshore Arctic air emissions from the US Environmental Protection Agency to DOI. Doing so would make the situation there comparable to the Gulf of Mexico without compromising environmental protections, she maintained.

She said she decided to propose transferring the authority after watching Shell Offshore Co. wait more than 5 years to receive valid operating permits from EPA after investing nearly $4 billion to prepare to explore its leases in the Beaufort and Chukchi seas. DOI, by contrast, processes such permits in a matter of months, Murkowski said. She believes that all areas of the US Outer Continental Shelf should be regulated equally, she added.

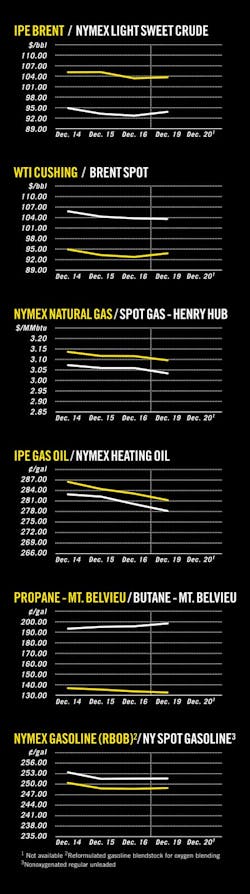

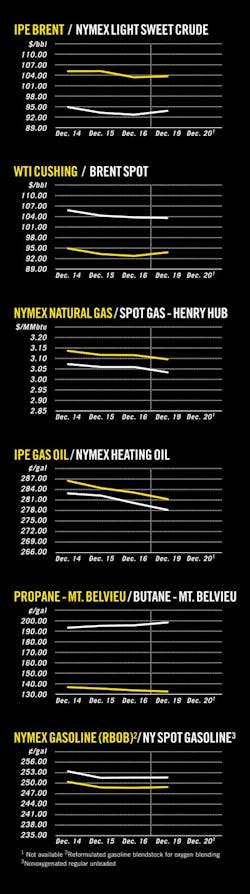

Analyst sees oil averaging $105/bbl in 2012

Deutsche Bank AG analysts believe oil prices generally will be in an overall recovery position going out to 2015, Adam Sieminski, chief energy economist of Deutsche Bank global markets commodities research, said during a Dec. 15 Deloitte LLP oil and gas conference in Houston.

Sieminski forecast West Texas Intermediate crude oil will average $105/bbl on the New York Mercantile Exchange during 2012.

"In 2011, the stock market was driving oil prices," Sieminski said. "Just recently, we're starting to see a separation…oil is doing better than the overall market, and I suspect that will be the case going into 2012."

He noted commodity prices will remain vulnerable while European policy makers work to resolve European sovereign debt issues.

"We do expect Europe will be in a recession in 2012," Sieminski said of Deutsche Bank analysts.

Global oil demand tends to be driven primarily by economic activity, he said, noting a slowing in China's economic activity. Yet, Chinese oil demand still continues to grow, and the question is how fast it will grow, Sieminski said.

"We believe China will add about 960,000 b/d of new refinery capacity over the course of 2012 and utilize it," Sieminski said in a Dec. 9 research note.

"We expect a pick-up in crude demand for direct feedstock as well as crude demand for operational stockpiling purposes," he added. "China has an operational crude oil stockpile rule of thumb of about 20-25 days of cover. This means that on a full year average, China will likely have to add about 50,000 b/d of additional crude to their operational stockpiles."

Exploration & Development — Quick Takes

Lower Cleveland play grows along Oklahoma line

Operators have reported 28 horizontal completions in southern Ellis County, Okla., in the past 18 months in a low permeability play for oil and gas in the lower member of the Pennsylvanian Cleveland formation.

The 28 completions, some reported as Marmaton in regulatory filings, have averaged an initial 514 b/d of oil and 1.3 MMcfd of gas.

Exploration and production companies have drilled more than 1,070 horizontal wells in the Cleveland reservoir in the Texas Panhandle and western Oklahoma since 1995, but most of the wells have been drilled and completed in the Upper Cleveland reservoir. Participants in the Lower Cleveland play include EOG Resources Inc., Chesapeake Energy Corp., Mewbourne Oil Co., Primary Natural Resources III LLC, and Plano Petroleum LLC.

The Lower Cleveland sand at an average depth of 9,400 ft is 50-120 ft thick. It produces at higher average oil rates than the Upper Cleveland, and there is no depletion risk from prior production, said Plano Petroleum, a private Plano, Tex., independent.

Geologic limits of the Lower Cleveland sand have yet to be defined by drilling, but mapping from deeper subsurface control indicates the best quality Lower Cleveland sand appears to be centered in southern Ellis and northern Roger Mills counties, Okla. Strong results have been reported with openhole, packer-type completions and cemented completions.

Plano Petroleum started a five-well horizontal program in mid-2011 and has completed two Lower Cleveland horizontal wells and one horizontal well in the shallower Tonkawa reservoir. The company has spudded two more Cleveland wells.

The company's first Lower Cleveland well, Nelwyn 1H-7 in 7-17n-24w, Ellis County, had an initial flow rate of 570 b/d and 1.7 MMcfd and recovered 31,315 bbl of oil, 10,727 bbl of natural gas liquids, and 69 MMcf of dry gas in its first 90 days on production.

The Sharon 1H-18, in 18-17n-24w, Ellis County, is flowing back following a 14-stage hydraulic fracturing procedure to stimulate production in the Lower Cleveland. Its initial flow rate was 578 b/d and 1.1 MMcfd. Adeline 1H-4, a horizontal Tonkawa producer in 4-17n-22w, Ellis County, flowed at an initial rate of 199 b/d and 312 Mcfd.

Plano Petroleum sees large, low-risk development potential on its acreage in the Cleveland, Tonkawa, Cottage Grove, and Cherokee oil reservoirs.

Plano has more than 13,250 gross acres, 8,000 net acres, in the stacked pay area and owns production from horizontal wells in the Tonkawa, Cottage Grove, Upper and Lower Cleveland, and Cherokee reservoirs. Plano is the operator of 19 sq miles with each section having one to four separate oil reservoirs prospective for horizontal drilling. The company's acreage block is 87% held by production.

Southeast Cana well tests gas, oil

The Continental Resources Inc. Lyle 1-30H step-out and confirmation well in the Cana Woodford horizontal drilling play of Oklahoma flowed at rates of 7.1 MMcfd of natural gas and 325 b/d of oil during a 1-day test.

The Grady County well is 4 miles southeast of the Continental 1-11H well, which tested 5.4 MMcfd of gas and 160 b/d of oil in August and extended the Cana Woodford horizontal oil play 25 miles southeast (OGJ Online, Aug. 5, 2011).

Since late May, the 1-11H well has produced 825 MMcf of rich natural gas and 19,300 bbl of oil.

Continental is drilling an additional step-out 4 miles southeast of the Lyle 1-30H well.

Kwanza basin blocks due exploration

Total reported plans for seismic surveys and exploratory drilling on three blocks in the deepwater Kwanza basin off Angola for which it has signed production sharing agreements with state-owned Sonangol.

The company and partners will target presalt hydrocarbon deposits geologically similar to the Santos and Campos basins off Brazil, which have yielded large oil and gas discoveries.

During an initial exploratory period of 5 years, the combine will acquire 14,000 sq km of 3D seismic data and drill five wells on contiguous Blocks 25, 39, and 40. The northern extent of the area covered by the blocks is about 330 km south of Block 17, where Total produces from the Girassol-Rosa, Dalia, and Pazflor hubs and is developing the CLOV hub (OGJ Online, Aug. 11, 2011).

Total will operate 7,604 sq km Block 40, where water depths are 1,500-3,400 m, with a 50% interest. Partners are Sonangol P&P 30% and Statoil 20%.

It also will operate Block 25, covering 4,842 sq km in 700-2,200 m of water. Partners are Sonangol P&P 30%, Statoil 20%, and BP 15%.

On 7,831 sq km Block 39, in 1,330-3,400 m of water, Statoil is operator with a 55% interest. Total holds 15%, and Sonangol P&P holds 30%.

Drilling & Production — Quick Takes

Chevron: Yet to receive lawsuit from Brazil

Chevron Corp. said Dec. 15 it had yet to receive formal notice of a civil lawsuit that a Brazilian federal district prosecutor said he intends to file against Chevron and drilling contractor Transocean Ltd. seeking $10.7 billion in damages and also seeking an injunction to stop Chevron's activities in Brazil.

The lawsuit concerns a November oil seep from an appraisal well at Frade oil field in 3,800 ft of water 370 km northeast of Rio de Janeiro. Upon receiving approval from the Brazilian National Agency of Petroleum on Nov. 13, Chevron Brazil immediately began plugging and abandonment activities.

Chevron said the oil flow was stopped within 4 days, and the company continues to contain any residual oil (OGJ Online, Nov. 16, 2011).

Brazil's regulatory agencies and regulators have not issued any instructions to Chevron about suspension of operations, the company noted.

"From the outset, Chevron responded responsibly to the incident at its Frade field and has dealt transparently with all Brazilian authorities," the company said Dec. 15.

Chevron said it continues to address the surface sheen, which is now estimated at less than 1 bbl. At one point, the sheen was estimated at 400-600 bbl. There have been no coastal or wildlife impacts.

Ali Moshiri, Chevron's president for Africa and Latin America exploration and production, said Chevron remains committed to its long-term strategy in Brazil. He talked briefly with reporters at the Dec. 15 Deloitte LLP Oil & Gas conference in Houston after making a speech.

Chevron has 51.74% interest in Frade field, which has been in production since 2009.

CNOOC shuts down platforms because of leak

CNOOC Ltd. said Zhuhai Hengqin gas processing terminal reported a leak in a subsea gas pipeline, prompting the shut down of relevant platforms in Panyu 30-1 gas field and Hui Zhou 21-1 oil field in the eastern South China Sea off Guangdong Province.

Zhuhai terminal, on the Hengqin island of Zhuhai city, is the gas processing terminal for the joint development gas project of PY30-1 and HZ21-1 fields. No injuries or environmental damage was reported, CNOOC said.

Currently, the terminal is under accelerated depressurization process. A pipeline leakage emergency plan was initiated CNOOC and Chinese authorities are investigating the cause of the incident.

CNOOC is monitoring the situation and setting up an alert zone around the area where the incident took place. Operations at Zhuhai terminal are to be resumed as soon as possible once the pipeline is repaired, CNOOC said.

PROCESSING — Quick Takes

Newfield projects Uinta crude oil sales to Tesoro

Newfield Exploration Co. has signed an agreement to supply 18,000 b/d of crude oil from its Uinta basin fields to Tesoro Corp.'s 60,000 b/d Salt Lake City, Utah, refinery.

Newfield said the agreement spans a 7-year period starting in 2013 and secures additional supply capacity for the company's planned oil growth in the basin. The oil price differential associated with this agreement is not materially different than Newfield's current supply contracts in the basin.

Newfield has been active in the basin since 2004. Multiple oil-productive geologic targets exist across the acreage, and an active drilling campaign is under way to develop the more than 6,000 potential locations.

Newfield plans to test multiple horizontal intervals in 2012 in two new central basin oil developments, the Uteland Butte and Wasatch formations, on which it disclosed initial tests in mid-2011 (OGJ Online, July 20, 2011). The company has been increasing its rig count and expects to run at least eight rigs in the basin next year, up from an historic five-rig program.

Newfield sells its crude oil from the Uinta basin to multiple Salt Lake City-area refiners and continues to work with each to secure additional refining capacity to meet future growth plans from the region.

More Oklahoma cryo capacity under construction

Superior Pipeline Co. LLC, Tulsa, is installing a 30-MMcfd cryogenic plant in Kay County, Okla. Superior is a wholly owned subsidiary of Unit Corp., Tulsa.

Superior has signed a long-term agreement with Range Resources Corp. as the initial producer for the plant. Start-up is to occur during second-quarter 2012.

Construction of the plant is "consistent with Superior's strategic plan" to build greenfield gathering and processing in the Mississippian trend, said Superior Pipeline Pres. Bob Parks. "We are constructing this plant with the flexibility to accommodate future expansions as we contract to receive additional gas volumes in northern Oklahoma," Parks said.

He said, "This plant, along with our existing assets accessing the Mississippian trend, will bring our overall processing capacity" in the region to more than 100 MMcfd.

Feasibility study for Iraqi refinery

South Refineries Co., a part of the Republic of Iraq's Ministry of Oil, has awarded Shaw Group Inc. a contract to provide a feasibility study for the rehabilitation of its 140,000-b/d refinery in Basra. Shaw's announcement did not disclose a contract value.

The study will assess the current condition of the refinery and estimate the engineering, equipment supply, and construction services required to improve its operation.

The US Trade and Development Agency agreed to provide a grant to the South Refineries Co. to finance the work. The Shaw announcement said this is the first grant the agency has provided directly to an Iraqi grantee.

This will be Shaw's fourth refining project in Iraq, said James Glass, president of Shaw's Energy & Chemicals Group.

In Iraq, Shaw is conducting feasibility studies and frontend engineering and design for two grassroots 150,000-b/d refineries near the cities of Maissan and Kirkuk for the Ministry of Oil. The FEED work includes all process units, off site facilities and utilities for both refineries.

Through a fluidized catalytic cracking alliance, Shaw, with its partner, Axens, are providing a process-design package for a 30,000 b/d residual fluidized catalytic cracking (RFCC) unit at Midland Refineries Co.'s refinery in Daura.

TRANSPORTATION — Quick Takes

Cheniere developing more gulf liquefaction

Cheniere Energy Inc., which already is working to install natural gas liquefaction adjacent its Cameron Parrish, La., terminal, has announced its subsidiary Corpus Christi Liquefaction LLC is developing LNG export capabilities at one of Cheniere's existing sites previously permitted for regasification.

The LNG export plant is to be in San Patricio County, Tex., and primarily supplied by reserves from the Eagle Ford shale, about 60 miles northwest of Corpus Christi. The proposed project is being designed for up to three trains capable of producing up to 13.5 million tonnes/year (tpy) total.

Currently, Cheniere is developing a two-train LNG export capacity at its Cameron Parrish Sabine Pass LNG terminal through subsidiary Cheniere Energy Partners LP. The company anticipates the project will include four liquefaction trains capable of producing in aggregate up to 18 million tpy of LNG (OGJ Online, Nov. 16, 2011 http://www.ogj.com/articles/2011/11/contract-let-for-sabine-pass-lng-liquefaction-trains.html ).

Cheniere recently announced it concluded three long-term LNG sale and purchase agreements for three of the four trains under development and is currently in discussions with parties interested in entering into SPAs for the remaining capacity (OGJ Online, Dec. 12, 2011 http://www.ogj.com/articles/2011/12/gail-india-signs-20-year-sabine-pass-lng-deal-with-cheniere.html ).

In connection with the Corpus Christi project, Cheniere initiated the US Federal Energy Regulatory Commission's National Environmental Policy Act pre-filing review for the proposed gas liquefaction plant through Corpus Christi Liquefaction.

The project, said the company's announcement, would be supported by the large reserves under development in the Eagle Ford, which covers nearly 12,000 sq miles in South Texas and ranks among the largest shale discoveries in the US.

Geologic studies commissioned by Cheniere estimate recoverable oil and gas resources in Eagle Ford at more than 180 tcf equivalent, or 30 billion boe. About 200 rigs currently are drilling in the shale play.

"With our newly proposed project, we will be able to provide up to an additional 13.5 million tpy of liquefaction capacity in the Gulf of Mexico," said Charif Souki, Cheniere chairman and chief executive officer.

The Corpus Christi site consists of about 664 acres, including 212 acres owned, 52 acres under a lease option, and 400 acres of permanent easement. The site is on the La Quinta Channel on the northeast side of Corpus Christi Bay.

The project will be constructed in phases, with each LNG train beginning operations about 6-9 months after the previous train.

Crestwood to build Marcellus gathering system

Crestwood Midstream Partners LP signed a memorandum of understanding with Mountaineer Keystone LLC (MK) to build a 42-mile, 16-in. OD Tygart Valley Pipeline natural gas gathering system, serving MK's Marcellus shale development program in Northeast West Virginia.

MK, based in Pittsburgh, plans to commence its horizontal drilling program in Barbour, Preston, and Taylor Counties, WVa., in mid-2012.

Crestwood expects to complete TVP by fourth-quarter 2012, interconnecting with Columbia Gas Transmission's WB Pipeline in Randolph County, W Va. Crestwood estimates the TVP project will cost $70 million.

TVP initially will transport 200 MMcfd, expandable to 300 MMcfd with compression. MK expects to reserve firm capacity of 115 MMcfd as anchor shipper under a long-term, fixed-fee gathering agreement.

Crestwood is offering remaining firm capacity to area producers who have delayed or slowed drilling and development plans due to a lack of pipeline infrastructure in the area.

TVP will give MK and others access to gas markets in the Washington, DC, and Baltimore areas. MK is a First Reserve portfolio company. First Reserve also manages the fund that owns Crestwood Holdings LLC, the majority owner of Crestwood's general partner.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com