P. 2 ~ Continued - Third-quarter earnings climb with higher oil prices, refining margins

Displaying 1/2

View Article as Single page

The increase in throughput margin was primarily due to higher margins for diesel and jet fuel plus substantial discounts for light, sweet oil in the Midcontinent and better discounts for heavy, sour feedstocks, Valero said. The increase in throughput volumes was due to added capacity from the Aug. 1 acquisition of the Pembroke refinery in the UK from Chevron plus operating the Aruba refinery, which was not in operation during third-quarter 2010.

Meanwhile, Sunoco Inc. reported a $1 billion net loss despite $12.158 billion in revenues during this year's third quarter. During the quarter, Sunoco recorded a $1.959 billion noncash provision ($1.175 billion, aftertax) to write down assets at its Philadelphia and Marcus Hook refineries to their estimated fair values in connection with Sunoco's decision to exit the refining business (OGJ Online, Dec. 2, 2011).

"Market conditions continue to pose challenges for our refining and supply segment and, while the refineries' operational performance improved during the third quarter with crude utilization averaging 90%, the segment reported another loss. We remain focused on running our assets safely and reliably at economic utilization rates," said Lynn L. Elsenhans, Sunoco's chairman and chief executive officer.

Canadian companies

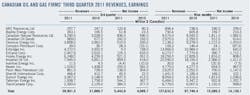

Most of the companies in the sample of producers and pipeline operators with headquarters in Canada posted improved earnings compared with their third-quarter 2010 results.

These 17 companies combined during the recent quarter for a 25% increase in revenues and a 16% climb in net income from a year earlier. For the first 9 months of 2011, the group's collective revenues were up 10% and earnings were up 7% from the corresponding 2010 period.

Four companies in the group posted a decline from their third-quarter 2010 earnings, and one company, Ivanhoe Energy Inc., posted a loss in the recent quarter.

Imperial Oil Ltd. recorded one of the biggest gains in third-quarter earnings, posting net income of $859 million (Can.), up from $418 million (Can.) in the 2010 quarter.

Imperial Oil attributed the increase primarily to stronger refining margins of $270 million, higher oil commodity prices of $190 million, increased Cold Lake bitumen production of $90 million, and higher Syncrude volumes of $45 million.

These factors were partially offset by foreign exchange effects of the stronger Canadian dollar of $65 million, higher royalty costs of $60 million, and lower conventional oil volumes of $35 million due to third-party pipeline reliability issues, the company reported.

These same factors affected Imperial Oil's results in the first 9 months, when earnings jumped 68% to $2.366 billion (Can.) on a 24% increase in revenues to $22.59 billion (Can.).

Pipeline operator Enbridge Inc. reported $5 million (Can.) in earnings for the third quarter, down from $158 million (Can.) in the 2010 third quarter due to hedging. Revenues over the periods increased by 22% to $4.272 billion.

These third-quarter results reflected unrealized noncash mark-to-market accounting impacts, primarily related to the comprehensive long-term economic hedging program Enbridge has put in place to mitigate exposures to foreign exchange risks, including exposures inherent within the new Competitive Toll Settlement (CTS) that took effect July 1, the company said. On June 24, Canada's National Energy Board approved the 10-year CTS agreement reached between Enbridge and shippers on its mainline system.

Displaying 1/2

View Article as Single page

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com