India starts testing shale-gas plays

Santosh Kumar Das

Rajiv Gandhi Institute of Petroleum Technology

Raebareli, India

Although the first test of a shale-gas reservoir in India failed, plans for other tests continue.

The first shale well (RNSG No. 1) was drilled by Oil and Natural Gas Corp. Ltd. (ONGC) in cooperation with Schlumberger in Ichapur village near Durgapur, West Bengal (Fig. 1).

Fig. 1 also shows the location of RNSG No. 2, drilling of which is under study.

Other promising regions for shale-gas exploitation are Cambay in Gujarat state, Assam-Arakan in northeast India, and Raghavapuram shale on India's east coast.

One complication in India is that the government-issued leases for conventional petroleum exploration do not include unconventional sources such as shale gas. Gas from shales is not even mentioned in the petroleum ministry's plan for Indian energy through 2025.

According to the preliminary estimates, India's shale-gas resources may be larger than its conventional gas resources. Schlumberger estimates that India may have a 600-2,000 tcf shale-gas resource. The US Geological Survey also will be carrying out studies on India's shale-gas resources and will provide a report.

Supply of natural gas in India lags behind demand, and by 2015 gas demand may rise to 120 billion cu m/year from the 62 billion cu m/year in 2010.

First shale well

India's first shale-gas well, RNSG No. 1, was shut down on Sept. 20, 2010, due to problems with the casing, high water-cut production, and high surface pressure.

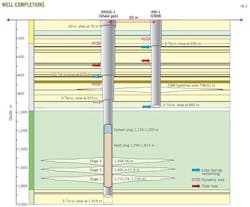

ONGC drilled the well to about 2,000 m and set a 51⁄2-in. casing shoe at 1,919 m (Fig. 2). The float collar was at 1,878.5 m.

The major complications while drilling included:

• Partial dynamic mud losses from about 243 m and total mud losses from 492-520 m while drilling the 171⁄2-in. section.

• Mud losses while running and cementing the 133⁄8-in. casing.

• Partial dynamic mud losses from about 693 m in the 121⁄2-in. section but no losses while running and cementing the 95⁄8-in. casing. The completion of this section included a casing packer set at 608 m and a two-stage cement job.

• Partial dynamic losses immediately on drilling resumption at 890-1,003 m in the 81⁄2-in. section. Two cement squeeze jobs stopped the losses, and the well did not encounter losses while the 51⁄2-in. casing was run and cemented. The cement top was at 800 m.

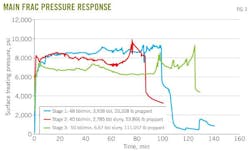

ONGC used a three-stage hydraulic fracturing job on the well.

The first stage was in the intervals 1,771-73 ft and 1,726-31 m, perforated with six shots/ft. Total slurry injected was 1,649 (4,463 lb proppant) and 3,938 bbl (20,208 lb proppant), respectively, with an average treating pressure of 8,403 psi.

The second stage was in the interval 1,658-56 m, perforated at 12 shots/ft. Total slurry injected was 2,726 bbl (53,866 lb proppant) with an average treating pressure of 7,888 psi.

The third stage was in the interval 1,656-54 m, perforated at 12 shots/ft. Total slurry injection was 6,167 bbl (111,057 lb proppant) with an average treating pressure of 6,799 psi.

Fig. 3 shows the frac pressure response.

One major problem was that the planned temperature log could not be run due to high surface pressure. In addition, very high surface pressure prevented the planned job to be fully completed. The high pressure also made it hard to shut down the job.

ONGC opened the well through a 40⁄64-in. choke but gradually reduced the choke to 16⁄64-in. because of sand indications at surface.

Flow back continued through a 16⁄64-in. choke. During flow back, the well flowed water along with a little gas. Thus, ONGC decided to produce the remaining water with artificial lift and testing of RNSG 1 No. 1 was suspended temporarily.

A temperature log recorded 7 days after the third frac indicated a considerable temperature drop (about 40° F. at the first perforation) across all the hydraulically fractured zones. A gradient plot suggested water inside the 95⁄8-in. by 51⁄2-in. annulus.

No gas was seen while bleeding off the annulus and casing pressure. During the bleed off, the pressure dropped to zero in a couple of minutes with a little muddy water recovered.

During flow back, gas surfaced within 3 hr of the first frac job. In the case of the offset coalbed methane well (Fig. 2), it required many days of dewatering before gas broke through after a frac job.

The shale-gas well had poor cement because of a micro annulus behind the 51⁄2-in. casing. Cement quality behind the 95⁄8-in. casing (shoe at 879 m) is not known because no cement bond log or variable density log was run.

The suspected reason for losing total returns at about 500 m is the intersection of a major fault zone with the wellbore.

At temporary abandonment of the well, both the casing and annulus pressure was 400 psi. The pressure started dropping gradually and coincided with the resumption of dewatering of the offset coalbed methane well.

Casing pressure bled off to zero on Mar. 23, 2010, and since then has increased and stabilized at 50 psi. Annulus pressure was not bled off and currently is about 150 psi.

Water influx from the offset coalbed methane well is an explanation for the buildup of the annulus and casing pressures.

Issues

One challenge in operating in India is security. In India, security personnel must guard every drill site to prevent the local population or others from stealing instruments and tools for resale.

Other problems in developing a field are the lack of skilled engineers (most prefer to go abroad), proper care and knowledge of the field, population density, and politics. One saying is that "Shale can bring riches and energy independence, but development creates a continuous series of tough decisions on how to balance public benefits against the costs to the same public."

Reliance Industries Ltd. and Gail India Ltd. are starting to exploit and acquire overseas assets in shale gas. This should help these companies also to explore for shale in India because of the technical and business knowledge gained overseas.

Companies operating in India initially have to import most oil field goods, which leads to higher cost.

Costs of oil field services also are higher because of the limited competition, and lack of clarity in regulations may limit the number of oil field service companies participating in India's shale-gas exploitation.

An estimate is that India's companies will need a 5-10 year learning curve to develop excellence in executing such technologies as horizontal drilling and fracturing as well as implementing a factory approach to shale-gas development that would bring down costs.

Although not all shale deposits in India are ideal for shale-gas exploitation, a substantial portion has potential for producing gas. Technological collaboration will help in the use of sophisticated models to select the most prospective places to drill.

Upcoming shale-gas programs

ONGC in cooperation with Schlumberger (which recently was given an integrated contract for drilling, assessing, and carrying out the relevant operations including hydraulic fracturing) will drill three wells in shale-gas prospects. Two wells will be in the Raniganj subbasin in West Bengal, and two wells will be in the North Karanpura subbasin in Jharkhand, Damodar basin.

The estimated expenditure for this project is about 1.68 billion rupees ($32 million), and completion of the project is expected within 520 days.

Another state-owned exploration and production company, Oil India (OIL), has initiated shale-gas studies in its oil fields in the northeastern state of Assam. A team is collecting and studying data available from the company's fields in consultation with Schlumberger.

The government of India is planning to launch its first auction of shale-gas acreages for exploration by mid-2012. India's upstream regulator, Directorate General of Hydrocarbons (DGH), is drafting an approach paper with international experts on shale-gas exploitation.

Early this year senior officials at DGH said they had identified six basins for resource assessment in the first phase. A task force has been working on a policy framework.

A robust shale-gas policy is likely by the beginning of next year but several issues may delay the policy. Issues include land use, environmental concerns, and simultaneous shale gas and conventional oil and gas exploitation.

The author

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com