OGJ Newsletter

GENERAL INTEREST — Quick Takes

Feds delay Ohio forest lease sale to study fracing

The US Department of Agriculture Forest Service has postponed a sale of mineral leases scheduled for the sprawling Wayne National Forest in eastern Ohio for at least 6 months to study surface affects related to hydraulic fracturing.

The sale, formerly set for Dec. 7 at the Bureau of Land Management office in Springfield, Va., was to have made available for bids 3,300 acres on five parcels in Athens, Gallia, and Perry counties, southeastern Ohio.

Studies have indicated that the emerging unconventional Utica shale play could generate as many as 200,000 jobs within 3 years compared with the 13,000 existing jobs that the petroleum industry supports in Ohio, the Ohio Oil & Gas Association has reported.

Wayne National Forest covers 241,000 acres in three large elements, one near Nelsonville and two along the Ohio River in southern and eastern Ohio. Nearly 1,300 oil and gas wells are in operation on forest land, mostly in Washington and Monroe counties in the eastern unit.

Stone Energy to buy stake in gulf assets from BP

Stone Energy Corp., Lafayette, La., agreed to acquire BP PLC's 75% operated working interest in the deepwater Pompano field and other assets for a total of $204 million. In addition, Stone plans to acquire a 51% operated working interest in the adjacent Mississippi Canyon Block 29, a 50% nonoperated working interest in Mica field that ties back to the Pompano platform, and interests in deepwater exploration leases near Pompano field.

Pompano platform is a four-leg, 12-pile fixed structure in 1,300 ft of water with 23 producing wells and production capacity of 60,000 b/d of oil and 135 MMcfd of gas.

The acquisition is subject to preferential rights, due diligence and other customary closing conditions, and is expected to close by early 2012.

Kinder Morgan to buy CO2-helium assets

A unit of Kinder Morgan Energy Partners LP (KMEP) will buy carbon dioxide and helium holdings on the St. Johns dome in Arizona and New Mexico from Enhanced Oil Resources Inc. (EROI), Houston, for $30 million.

The purchase includes all of EORI's rights, title, and interest in the St. Johns dome and certain related assets in Apache County, Ariz., and Catron County, NM.

On closing, targeted for Dec. 1, KMEP agreed to amend the CO2 gas sale and purchase agreement with EORI, originally announced Apr. 20, 2010, modifying the dates of pipeline connection and the date of first deliveries and eliminating the termination fee. The companies anticipated a pipeline link to Permian basin oil fields.

EORI said St. Johns "offered tremendous long-term potential for the right company, (but) the capital financing risks including our cost of capital and continuing associated carrying costs were considered to be too onerous on a company of our size."

Proceeds from the sale will accelerate EORI's infill oil development on 27,000 acres in New Mexico and help finance its planned San Andres CO2 flood at 5,000-acre Milnesand field and potentially at the adjacent 20,000-acre Chaveroo field.

EORI and predecessor Ridgeway Arizona Oil Corp. had been appraising the St. Johns CO2-helium producing properties since the early 1990s (OGJ, May 28, 2007, p. 41).

Sinopec to gain stake in Galp's Brazilian acreage

China's Sinopec Group, aiming to increase its presence in Brazil, agreed to acquire a 30% stake in the Brazilian unit of Galp Energia SGPS SA for $5.18 billion.

Galp subsidiaries Petrogal Brasil and Galp Brazil Services will issue new shares equivalent to 30% of the enlarged shareholder base, which Sinopec will purchase for $4.8 billion. The state firm will pay an additional $390 million to cover debt.

Galp's primary assets in Brazil include four deepwater blocks: BM-S-11, BM-S-24, BM-S-8 and BM-S-21 in the Santos basin, Sinopec said.

Analyst Juliet Kerr of IHS Global Insight said the partnership with Sinopec will help Galp Energia finance its share of development costs related to the Tupi, Cernambi, and Iara presalt projects in Brazil in which it participates. But Kerr noted that the agreement will mark a "significant" boost to Sinopec's standing in Brazil's oil and gas industry, especially following its earlier purchase of stakes in the sector from Repsol YPF SA.

The agreement marks the latest in a series of purchases by Chinese firms in Brazil's offshore oil fields.

Sinopec paid $7.1 billion for a stake in Repsol's Brazilian assets. Sinochem's acquired a $3.1 billion stake in Peregrino oil field from Statoil.

Exploration & Development — Quick Takes

Colombia Putumayo subsalt exploratory well cased

Pacific Rubiales Energy Corp., Toronto, has set casing to test the Yaraqui-1X exploratory well on a subsalt prospect on the Topoyaco block in the Putumayo basin foothills in Colombia.

Drilling and logging provide encouraging indications of the potential of the subthrust play, a new exploration horizon for the company, Pacific Rubiales said.

The well drilled through Tertiary and Cretaceous and penetrated 61 ft of Precretaceous basement before reaching a total depth of 10,651 ft measured depth. The well was drilled directionally with a southeast-northwest orientation in a subthrust monocline structure,referred to as structure D, that covers 4,500 acres.

Petrophysical evaluation of the logs indicates that the well encountered 142 ft of potential hydrocarbon-bearing sandstones distributed among the base of the Rumiyaco formation and in the Villeta and Caballos formations, all of which have proven to be commercial reservoirs elsewhere in the basin.

In the Rumiyaco formation, the Arena Neme sandstone unit was encountered at 9,714 ft MD, 8,801 ft TVD with 20 ft of net oil sandstones with 10% porosity. In the Villeta formation, the pay units were found at 9,748 ft MD, 8,828 ft TVD, with a total of 120 ft of potential oil pay, 10 ft in the M2 sandstones encountered at 10,110 ft MD, 9,126 ft TVD, 40 ft in the U sandstones that start at 10,202 ft MD, 9,201 ft TVD, and 70 ft in the "T" sandstones, found at 10,354 ft MD, 9,327 ft TVD.

The U sands have porosities of 10% while the "T" sands have porosities in the order of 11%. In the Caballos formation, found at 10,510 ft MD, 9,458 ft TVD, a total of 2 ft of potential hydrocarbon sandstones was found with porosities of 11%.

Turkey, Shell to sign exploration agreement

Turkey's Energy Minister Taner Yildiz, eyeing recent developments in neighboring Iraq and Cyprus, said his country will sign a contract with Royal Dutch Shell PLC for offshore oil and gas exploration. The minister did not say where the exploration would be conducted.

Turkey's move follows an announcement that Iraq's government approved an agreement with Shell and Mitsubishi Corp., forming a joint venture to gather gas from three major oil fields.

The JV, Basrah Gas Co., is comprised of Iraq's South Gas Co. (51%), Shell (44%), and Mitsubishi (5%), and will gather raw gas that is currently being flared.

Shell said it will provide project management and technical expertise aimed at facilitating the learning and development of Iraqi staff to progressively assume key positions in the management of the company.

The JV will collect and process gas from the Rumaila, Zubair and West Qurna 1, and Majnoon fields in the southern part of the country. Shell said the primary market for the gas will be Iraq, but any surplus can potentially be exported.

Some 700 MMscfd of gas is currently burned off in southern Iraq. At current prices, the gas is worth about $1.8 billion/year.

Turkey's move also comes after Cyprus' government, which is not recognized by Ankara, struck a deal with Noble Energy for gas exploration off the southern coast of the divided island.

In September, Turkey sent a ship of its own, the Piri Reis, to the region after signing an accord for gas exploration with the breakaway Turkish Republic of Northern Cyprus, which only Ankara recognizes.

Turkey says the Greek-speaking Cyprus government has no right to conduct offshore energy exploration while United Nations-backed talks on reunifying the island continue.

Noble Energy recently said it has identified 12 more prospects with more than 20 tcf of gross unrisked resource potential in the eastern Mediterranean that target sands equivalent to those it discovered at Tamar off Israel (OGJ Online, Nov. 15, 2011).

Anadarko, Noble tout Niobrara resource potential

Two key operators have provided positive assessments of horizontal drilling results in the emerging Niobrara play in giant Wattenberg field in the Denver-Julesburg basin.

Anadarko Petroleum Corp. said its well results in the Niobrara and Codell formations indicate excellent economics and a net resource of 0.5-1.5 billion boe, and Noble Energy Inc. said its Niobrara activities have revealed an estimated net risked resource of 1.3 billion boe, up more than 60% from 2010.

Anadarko, producing from only 11 horizontal wells within field boundaries, said the company has 1,200-2,700 future drilling locations with estimated ultimate recoveries of 300,000-600,000 boe/well, 70% liquids. It put costs at $4-5 million/well. Initial well rates have averaged 800 boe/d.

Initial rate at Anadarko's best horizontal well to date, the Dolph 27-1HZ, was 1,100 b/d of oil and more than 2.4 MMcfd of gas. The well paid out in less than 4 months, and EUR exceeds 600,000 boe. The play should become self-funding in short order because payouts are expected to average 10 months, Anadarko said.

At more than 70,000 boe/d, Anadarko is the largest net producer in the basin. It holds more than 350,000 net acres in Wattenberg and operates more than 5,200 wells with an average 96% working interest and 88% net revenue interest. Anadarko will run extensive tests to define the optimum spacing and lateral lengths for the Niobrara and Codell. It plans to be running seven rigs drilling Wattenberg horizontal wells by yearend 2012 and drill 160 horizontal wells compared with 40 in 2011.

Anadarko said it is exploring other liquids-rich horizontal opportunities on its 550,000 net acres in the greater DJ basin outside Wattenberg and 360,000 net acres in the Powder River basin. Both prospective for the horizontal Niobrara and "other horizons that we will evaluate over time."

Noble Energy said it holds more than 840,000 net acres in the DJ basin and expects to double its 2011 net production of 67,000 boe/d, 54% liquids, by 2016.

Niobrara horizontal drilling, Noble Energy said, has derisked the legacy portions of Wattenberg and has expanded the economic limits of the field by 67%. The company's 58 horizontal wells in the Niobrara are yielding 14,000 boe/d of net production, up more than 20% since Sept. 30.

"Strong returns continue to improve with recent production performance exceeding previous results. The company's most recent 18 wells are expected to achieve an average EUR of 355,000 boe, which is a 22% improvement over an average EUR of 290,000 boe from 23 early wells," Noble Energy said.

Within 2 years, Noble Energy plans to double its horizontal Niobrara rig count and well completions.

Cairn finds more gas, some liquids off Sri Lanka

Cairn India Ltd. said its second exploratory well off Sri Lanka is an apparent gas discovery in three zones with some liquid hydrocarbon potential.

Cairn Lanka (Pvt.) Ltd., a subsidiary of Cairn India Ltd., has notified appropriate government authorities in Sri Lanka of a gas discovery in the CLPL-Barracuda-1G/1 well in the SL 2007-01-001 block in the Mannar basin.

The well went to 4,741 m in 1,509 m of water and intersected 24m of hydrocarbon-bearing sandstone in three zones between 4,067 m and 4,206 m. The reservoirs are mainly gas bearing with some liquids potential.

Cairn will evaluate the well results and work with the authorities to determine the discovery's commercial potential.

CLPL-Barracuda-1G/1 is 38 km west of the CLPL-Dorado-91H/1z discovery well and 68 km from the Sri Lanka coast. An update on the well results will be provided after the end of the program, which is expected to be complete by early next year.

Cairn's first well, 175 km north-northwest of Colombo, cut 25 m of gas pay with liquids potential in a sandstone at 3,043.8-3,068.7 m (OGJ Online, Oct. 3, 2011).

Drilling & Production — Quick Takes

Perdido well sets subsea producer water-depth record

A completed subsea well in the Gulf of Mexico's Tobago field set a producing well water depth record of 9,627 ft, according to Shell Oil Co. Tobago is one of the three Lower Tertiary fields producing to the Perdido drilling and production spar, moored in about 8,000 ft of water on Alaminos Canyon Block 857. Tobago field lies about 8 miles from Mexican waters.

Shell said the previous water depth record of 9,356 ft was held by a Silvertip well also producing to the Perdido spar.

Great White is the third field producing to the Perdido spar, which has a capacity to handle 100,000 bo/d and 200 MMscfd.

Perdido accesses the Great White, Tobago, and Silvertip oil and gas fields with subsea completed wells directly below the facility and from wells up to 7 miles away.

Production to Perdido started on Mar. 31, 2010.

GKP sees 40,000 b/d in Iraq by end-2012

Gulf Keystone Petroleum Ltd. (GKP) plans to build and upgrade facilities that will make it possible to produce and export 20,000 b/d of oil by mid-2012 and 40,000 b/d by the end of the year from Shaikan, which it calls one of the three major oil fields in Iraqi Kurdistan.

GKP has conducted nine well tests in all target formations in the Triassic and Jurassic that tested a combined 18,900 b/d of oil at the Shaikan-2 appraisal well 9 km southeast of the discovery well.

In anticipation of equally positive results from the Shaikan-4 appraisal well, the company plans to design and build an additional testing and production facility for Shaikan-2 with a minimum capacity of 20,000 b/d of oil. Upgrading of the existing Shaikan-1 and Shaikan-3 early well test facilities will lead to initial production of 20,000 b/d to export specifications by mid-2012, and the Shaikan-2 facility will increase this to 40,000 b/d by yearend 2012.

The rig is moving to drill the Shaikan-6 appraisal well, 9 km east of Shaikan-2, to 3,800 m. Shaikan has independently audited volumes of 8-13.4 billion bbl of oil in place.

Noble group starts Aseng output in Douala basin

A group led by Noble Energy Inc. has started up Aseng oil and gas-condensate field in the Douala basin east of Equatorial Guinea's Bioko Island 13% under budget and 7 months ahead of the original schedule (OGJ Online, July 22, 2009).

Four subsea wells at Aseng on Block I are making 50,000 b/d into a floating production, storage and offloading vessel. The first lifting from the Aseng FPSO is expected in December.

Production at the Alen project on Block O remains on schedule for start-up in late 2013 at 37,000 b/d.

Meanwhile, the company and its partners have made an oil discovery on Block O at the Carla prospect, which is estimated to contain 35-100 million boe gross resources, 80% liquids.

The Carla well, which went to 11,500 ft in 1,900 ft of water, encountered 26 net ft of oil pay in high-quality Upper Oligocene sands under Alen field. Noble is Carla operator with 51% working interest.

A second exploratory well testing the Bwabe prospect on the sprawling Tilapia block off Cameroon reached total depth and did not find commercial hydrocarbons. Noble has identified the Bouma prospect off Cameroon with a 95-400 million boe gross unrisked resource and 35% probability of geologic success.

Recent appraisal work at Diega, a 2008 discovery on Block O, has confirmed a gross resource range of 45-110 million boe, 60% liquids. Noble anticipates developing Carla and Diega through Aseng or Alen facilities.

In development the area's liquids resources, Noble noted that the three blocks cover a combined 1.5 million underexplored acres and that the discovered fields have 4 tcf of gross gas resources remaining to be monetized.

PROCESSING — Quick Takes

FTC allows ConocoPhillips, Holly to modify order

The US Federal Trade Commission approved ConocoPhillips's request to reopen and modify a final order settling the agency's competition concerns arising from Conoco Inc.'s 2002 merger with Phillips Petroleum Co. FTC also approved a change to ConocoPhillips's agreement with refiner-marketer Holly Corp.

FTC's 2002 order required ConocoPhillips to sell to Holly a Phillips refinery at Woods Cross, Utah, with a 10-year license to use "Phillips," "Phillips 66," and related brands for 10 years at retail outlets in Utah, Idaho, Wyoming, and Montana. ConocoPhillips sold the 25,000-b/d refinery to Holly in compliance with the order, and the current agreements between the two companies include the required exclusive rights, FTC said.

The application indicated that ConocoPhillips and Holly have negotiated an extended agreement that continues the license agreement for 7 years in the four states on a nonexclusive basis, FTC said. The companies have entered into an amended agreement as part of these negotiations that would convert Holly's FTC-ordered license in Wyoming and Montana from an exclusive to a nonexclusive license for the current license term's remaining 2 years. It said ConocoPhillips asked FTC to reopen and modify the order to match the new agreement's terms by removing the Montana and Wyoming exclusivity provision. Holly supported the application, which FTC has approved.

TRANSPORTATION — Quick Takes

Cushing MarketLink oil line moving forward

TransCanada Corp. still plans to build its Cushing MarketLink crude oil pipeline between Cushing, Okla., and the Texas Gulf Coast, despite plans to reverse the Seaway pipeline to deliver crude along a similar route. Enbridge (US) Inc. and Enterprise Products Partners LP, meanwhile, are evaluating plans for the 800,000 b/d newbuild Wrangler pipeline in the wake of the reversal decision.

Enbridge bought ConocoPhillips's share of Seaway earlier this week, joining with EPP in its ownership and jointly announcing that its flow would be reversed to deliver crude from Cushing to the Gulf Coast (OGJ Online, Nov. 16, 2011). Initial capacity of the reversed pipeline will be 150,000 b/d, but will reach 400,000 b/d by early 2013, according to EPP.

EPP also said the companies plan to expand Seaway beyond the 400,000 b/d mark, and will start an open season in January 2012 to gauge shipper interest in the additional capacity, believing the 400,000 b/d will be fully subscribed.

EPP stopped short, however, of saying it had cancelled the 800,000 b/d Wrangler pipeline outright, saying only that its "plans for bringing crude down form Cushing had obviously changed."

TransCanada held an open season for its 150,000 b/d Cushing MarketLink pipeline earlier this year, and told OGJ that the Seaway reversal would not affect its plans to build the pipeline. TransCanada expects the pipeline to be in service by mid-2013.

The Canadian Association of Petroleum Producers estimated US demand for Western Canadian crude in 2015 as at least 380,000 b/d based on contractual commitments to TransCanada's Keystone XL pipeline. The Seaway reversal and construction of Cushing MarketLink will not only help meet some of this demand while Keystone XL awaits approval from the US Department of State, but will also make other volumes currently bottlenecked in the Midcontinent more readily available on the Gulf Coast.

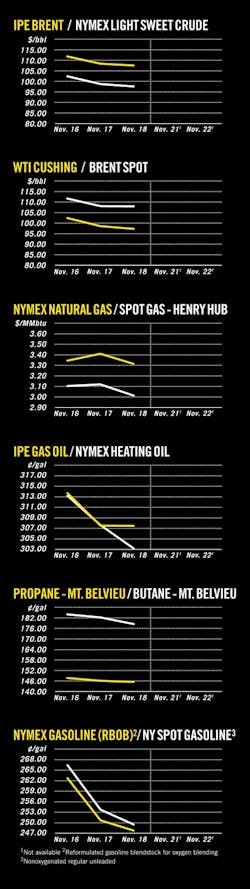

Increased pipeline capacity into Cushing, and limited ability to move the arriving crude out, has resulted in more oil flowing into the Midcontinent than the refinery system there can handle, holding prices for West Texas Intermediate crude at persistent discounts to Brent and other comparable global crudes.

Cooper basin Western Flank oil line back in service

Santos Ltd. has returned its Tantanna to Gidgealpa crude oil pipeline in Australia's Cooper basin to service at 5,500 b/d of throughput, reported Beach Energy Ltd., Adelaide.

The Beach-operated, 6,000 b/d PEL 92 crude oil pipeline from Callawonga field to Tantanna has remained fully operational while the Tantanna-Gidgealpa pipeline was out of service, Beach noted.

In addition to the Tantanna pipeline, Beach is considering trucking early in 2012 to maximize oil production from its Western Flank operations. This will be underpinned by completion of the Parsons-3, 4, 5, Butlers-2, 3, 4, Germein-1, and Elliston-1 wells in coming months and the new Butlers facility, expected to come on line in December.

The growth of oil production from the Western Flank of the Cooper Basin is a key focus for Beach. To this end, Beach is in the process of planning the construction of a 50-km, 8,000 b/d oil pipeline from Growler field, operated by Senex Energy Ltd. and in which Beach has 40% interest, to Lycium that will tie into a new 15,000 b/d trunk line from Lycium to Moomba.

Contract let for Sabine Pass LNG liquefaction trains

Cheniere Energy Partners LP selected Bechtel to provide engineering, procurement, and construction services for two liquefaction trains at the Sabine Pass LNG terminal in Cameron Parish, La. The project builds on Bechtel's previous work at Sabine Pass where the company designed, built, and expanded the LNG receiving facility.

Bechtel will design, construct, and commission the two liquefaction trains using ConocoPhillips's Optimized Cascade technology. The trains will be built next to the existing facilities at the Sabine Pass terminal, which include five tanks with storage capacity of 16.9 bcf, two docks that can handle vessels up to 265,000 cu m and vaporizers with regasification capacity of 4 bcfd. Bechtel expects to begin construction in 2012.

Cheniere signed its first LNG sale and purchase agreement for production from the Sabine Pass facility in October with BG Group (OGJ Online, Oct. 26, 2011).

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com