OGJ Newsletter

GENERAL INTEREST — Quick Takes

GAO warns of financial risks from Macondo claims

Damage claims from the 2010 Macondo well incident and crude oil spill and the federal government's overall government spill response framework pose evolving, uncertain risks to the government and its Oil Spill Response Fund, the US Government Accountability Office said in an Oct. 24 report.

It warned that outlays from the fund could reach the $1 billion per incident limit despite BP PLC, the well's operator, paying more than $700 million of state and federal cleanup costs as of May 31. Federal and state cleanups are under way, and agencies continue to submit costs for reimbursement, GAO said.

"However, the full extent of these costs, particularly those related to environmental cleanup, may not be fully realized for some time," the report noted. More than $626 million had been paid from the fund as of May 31, it noted.

The report said GAO recommended in November 2010 that Congress consider setting a fund per incident cap based on net outlays (expenditures less reimbursement) instead of total expenditures. The congressional government watchdog service also recommended that Congress extend the per barrel tax collected for the fund. The tax is scheduled to expire in 2017, it said.

GAO also found that the US Coast Guard's processes for paying claims and reimbursements following the accident and spill were appropriate and properly documented. It said that it made four recommendations to establish and maintain appropriate cost reimbursement procedures for the fund. The USCG changed its operating practices to reflect lessons learned responding to Macondo-related claims and updated its reimbursement procedures, but has not yet updated procedures for processing significant claims, the report said.

Transocean seeks summary judgment against BP

Transocean Ltd. on Nov. 1 filed a motion for summary judgment requesting the US District Court in New Orleans compel BP PLC to hold Transocean harmless for damages associated with the 2010 Macondo well blowout and resulting massive oil spill off Louisiana in the Gulf of Mexico.

An explosion and fire on the Deepwater Horizon semisubmersible, owned by Transocean, killed 11 people, and the semi later sank. In the Deepwater Horizon drilling contract, BP agreed to release Transocean from fines, penalties, and damages associated with pollution from the well, Transocean said.

"BP cannot avoid its contractual promise by alleging that Transocean breached the drilling contract or that the Deepwater Horizon was unseaworthy," Transocean said. "BP cannot avoid its contractual promise by alleging that Transocean or its employees were grossly negligent."

Many lawsuits remain pending regarding the well blowout and the spill (OGJ Online, June 22, 2011).

Santos to sell Evans Shoal stake

Santos Ltd., Adelaide, has followed through with a decision to sell its 40% stake in the Evans Shoal natural gas field in permit NTP/48 in the Timor Sea.

Santos did not disclose the prospective buyer, saying only that it is a major international exploration and production company already operating in Australia.

Santos expects to receive as much as $350 million. It will take a cash consideration of $250 million plus a contingent future cash payment of up to $100 million pivoting on a final investment decision being reached to develop the field and the level of 2P reserves booked for the field at that point.

Santos is aiming to close the deal by yearend.

Santos' previous attempt to sell the stake to Magellan Petroleum for cash over several stages fell through earlier this year when Magellan struggled to come up with funds to complete the purchase.

Evans Shoal has a high carbon dioxide content and Magellan was hoping to capitalise on this by establishing a methanol development.

Other joint venture partners in Evans Shoal are Petronas 25%, Shell 25%, and Osaka Gas 10%.

Exploration & Development — Quick Takes

Chevron drilling its first Duvernay well in Alberta

Chevron Corp. started drilling its first well in Alberta's Duvernay formation during the third quarter, Chevron Chief Financial Officer Pat Yarrington told analysts during an earnings conference call on Oct. 28.

The Duvernay well spudded during the third quarter, Yarrington said. Earlier this year, Chevron said it accumulated 200,000 acres in the play at what it called a reasonable entry price (OGJ Online, Feb. 10, 2011).

The Alberta Energy Resources Conservation Board is evaluating the Devonian Duvernay among various shale formations targeted in a 2-year, $2 million resource assessment. The Alberta government has reduced royalty rates for shale gas wells.

In response to questions from analysts, Yarrington said Chevron has "continued to add significantly in unconventional properties" over the last 18 months.

In other shale-related news, Chevron Downstream & Chemical Vice-Pres. Mike Wirth said the chemical division is contemplating building an ethane cracker on the US Gulf Coast that would utilize feedstock from the development of shale gas.

"We'll keep you advised as this project progresses," Wirth said of an ongoing feasibility study on whether to build an ethane cracker. He did not provide any additional details.

Utica shale well tests 9.2 MMcfd

Rex Energy Corp., State College, Pa., said its initial horizontal Utica shale well stabilized at 9.2 MMcfd of dry natural gas and should begin flowing to sales in January 2012.

The Cheeseman-1H, north of Pittsburgh in Muddy Creek township of Butler County, Pa., had 12 frac stimulation stages in a 3,551-ft lateral.

Encouraged by the results, Rex Energy will drill and complete more Utica shale wells in Butler County in 2012.

Meanwhile, Rex Energy has closed on its 11,000-acre position known as the Warrior prospect in Carroll County, Ohio, which is prospective for the liquids portion of the Utica shale. The company continues to lease and targets 15,000 committed acres by the end of 2011.

Rex Energy recently secured 15 MMcfd of firm capacity at Dominion's Natrium processing facility set to be commissioned in December 2012. Until commissioning, Rex will have the ability to receive interruptible service for natural gas liquids uplift through processing at Dominion's Hastings extraction/fractionation plant.

North Slope shale oil, gas potential emerging

Spare capacity in the Trans-Alaska Pipeline System could provide an outlet for the development of oil in shale formations on Alaska's North Slope (OGJ Online, May 4, 2011).

Great Bear Petroleum LLC, Anchorage, holds 500,000 acres of leases on state lands, the maximum allowed by law, acquired in 2010 and has filed an exploration plan that outlines the drilling of as many as four exploratory wells.

Wider interest in the shales could become evident at a state lease sale planned for Dec. 7 with 15 million acres on offer on the central North Slope. Alaska Department of Natural Resources Commissioner Dan Sullivan has appointed a task force to "identify potential impacts and propose plausible solutions." The Division of Oil and Gas will lead the task force with Greg Hobbs as project manager.

Great Bear has its eye on the Triassic Shublik, Jurassic Kingak, and shallower Cretaceous shales south of giant Prudhoe Bay and Kuparuk River oil fields. Initial studies indicate that the shales sourced the oil in the North Slope's conventional fields.

If wells drilled this winter show promise, a pilot production project could be in operation as early as the 2012-13 winter. That would involve a small oil processing facility and the trucking of oil to Pump Station 1. Later commercial scale pad developments would also pipe natural gas to North Slope processing plants.

Ed Duncan, president and chief operating officer of Great Bear, is a 30-year North Slope veteran.

Duncan was part of a team that mapped, leased, and named the Kuvlum prospect in Camden Bay, led technical evaluation of the Arctic National Wildlife Refuge, planned and managed wellsite operations for Sohio Petroleum on the Kaktovik-1 well in ANWR, mapped and leased Point McIntyre field leases in 1985, and conducted regional source rock sampling and mapping across the Brooks Range outcrop belt. Later he was an exploration consultant to Unocal Corp.

Petrom connects Romania gas-condensate find

Romania's Petrom is commencing early production from a discovery well that it considers the country's top producer and the most important gas discovery in 6 years.

Petrom said the 4539 well in Totea deep field near Oltenia is making 15.2 MMcfd of gas and 423 b/d of condensate, or about 3% of the company's daily gas production. Two appraisal wells are planned.

Drilled to 3,600 m earlier this year on a 3D seismic prospect, the well has been placed on production through temporary facilities after 100 days. The company is still working at the field development plan and permanent facilities construction. Test production is to last 6-12 months.

Drilling & Production — Quick Takes

BSEE OKs BP's first drilling permit since Macondo

The US Bureau of Safety and Environmental Enforcement (BSEE) approved a drilling permit for BP PLC to drill for oil and gas in the deepwater Gulf of Mexico. The permit, which BP originally submitted in January, is BP's first drilling permit approved since the April 2010 Macondo deepwater well blowout and resulting explosion and fire that killed 11 crew members on Transocean Ltd.'s Deepwater Horizon semisubmersible. BP operated the Macondo well, which spilled nearly 5 million bbl of oil into the Gulf of Mexico.

The application is under a supplemental exploration plan that was approved last week following a site-specific environmental assessment by the Bureau of Ocean Energy Management (OGJ Online, Oct. 21, 2011).

"BP has met all of the enhanced safety requirements that we have implemented and applied consistently over the past year. In addition, BP has adhered to voluntary standards that go beyond the agency's regulatory requirements," BSEE Director Michael R. Bromwich said. "This permit was approved only after thorough well design, blowout preventer, and containment capability reviews."

BSEE said the proposed exploratory well is part of BP's Kaskida prospect in the gulf's Keathley Canyon area 246 miles south of Lafayette, La., in 6,034 ft of water.

In addition to meeting the bureau's rigorous standards, BSEE verified that BP has met the additional standards it volunteered to adhere to in July, including the use of blind shear rams and a casing shear ram on subsea BOPs, third-party verification of BOP testing and maintenance, and laboratory testing of cement slurries, BSEE said.

As part of its approval process, BSEE reviewed BP's containment capability available for the specific well proposed in the permit application.

BP has contracted with the Marine Well Containment Co. to use its capping stack to stop the flow of oil if a blowout occurs, according to BSEE.

The capabilities of the capping stack meet the requirements established by the specific characteristics of the proposed well, it said.

Repsol boosts Libya's production to 500,000 b/d

Libya's oil output has reached 500,000 b/d after Repsol YPF SA began producing 60,000 b/d of oil from its El Sharara field, according to interim Oil Minister Ali Tarhouni.

"As of an hour ago we are up to 500,000 b/d with the Sharara field resuming operation," Tarhouni told a news conference in Benghazi after the Spanish firm resumed work at its field on Block NC115.

Prior to the outbreak of civil war, Libya produced 1.65 million b/d of crude oil, according to the US Energy Administration. Repsol YPF produced 360,000 b/d of that total from its two main blocks, NC-115 and NC-186.

Analyst Samuel Ciszuk of IHS Global Insight said that Libya's recovery is so far "beating many forecasts" and is achieving results that should make the country's ruling National Transitional Council proud.

The current output increase certainly puts Libya well ahead of estimates by the International Energy Agency that earlier said the North African country would produce no more than 400,000 b/d by yearend.

The International Monetary Fund likewise said that the end of the conflict in Libya can set the stage for an economic rebound, "although rehabilitation of the hydrocarbon complex may take considerable time."

However, Ciszuk also sounded a cautionary note against the idea of a continued rapid recovery, saying, "The worst surprises might still be to come as returning some of Libya's oldest and largest fields to full production after the emergency shutdowns might not be straightforward."

PROCESSING — Quick Takes

Commissioning of Punjab refinery delayed

Although construction is nearly complete of the 180,000 b/d Guru Gobind Singh refinery near Bathinda in the Indian state of Punjab, commissioning has been delayed (OGJ Online, May 11, 2011).

Hindustan Petroleum Corp. Ltd., Mumbai, which is building the zero-bottoms refinery in a joint venture with Mittal Energy Investment Pte. Ltd., Singapore, says commissioning will occur in the second half of its current fiscal year, which ends in March. Earlier this year it had projected start-up by July.

In an earnings announcement, HPCL said commissioning is complete of the refinery's crude distillation and vacuum distillation units and of a single-point mooring system and terminal at Mundra, Gujarat. A 1,014-km pipeline laid to carry crude from Mundra to Bathinda in conjunction with the refinery project is operational, it said.

Eagle Rock to expand processing in Granite Wash

Eagle Rock Energy Partners LP, Houston, will build a 125-MMcfd high-efficiency cryogenic processing plant in Wheeler County, Tex., in the Texas Panhandle's Granite Wash natural gas play.

Company plans call for construction of the Wheeler plant and associated systems to be completed in early fourth-quarter 2012.

In addition, the company said construction of the 30-MMcfd expansion of its Phoenix-Arrington Ranch plant is complete and expects it shortly to be operating fully at 80 MMcfd.

Eagle Rock Chairman and Chief Executive Officer Joseph A. Mills noted that, when combined with the Phoenix-Arrington Ranch plant expansion and installation of previously announced Woodall plant (OGJ Online, Aug. 1, 2011), addition of the Wheeler plant will allow Eagle Rock to accommodate producers' increased drilling in the Granite Wash. The Woodall plant is currently under construction and will be in service in late first-quarter 2012. "Once the Wheeler plant is in service, Eagle Rock will have more than 300 MMcfd of high-efficiency cryogenic processing capacity in the area," he said.

Construction of the Wheeler plant and associated gathering and compression is to cost about $100 million. Eagle Rock's announcement said it anticipates no downtime or reduced throughput across its east or west Panhandle systems during completion of the Wheeler plant.

Pembina Pipeline to build NGL extraction

Pembina Pipeline Corp. will build, own, and operate a 200 MMcfd NGL extraction plant and associated NGL and gas gathering pipelines in the Berland area of west central Alberta, the company reported.

The Saturn plant will be connected to Talisman Energy Inc.'s Wild River and Bigstone gas plants through existing and newly constructed gas gathering lines. Once operational, the Saturn Plant will be able to extract up to 13,500 b/d of liquids, said the company. It plans to build an 83-km, 8-in. NGL pipeline to move the extracted NGL from to Pembina's Peace pipeline, which delivers product into Edmonton.

Pembina said it expects the Saturn plant, associated NGL and gas gathering pipelines, and storage to cost about $200 million (Can). Subject to regulatory and environmental approval, Pembina said it expects the plant and associated pipelines to be in-service in fourth-quarter 2013. Pembina has entered into a long-term, firm service agreement with Talisman.

Saturn, combined with Pembina's Musreau Deep Cut plant and its recently announced Resthaven plant, will bring Pembina's total enhanced NGL extraction capacity to about 600 MMcfd, said the announcement, which could add up to about 40,000 b/d of NGL for transportation on Pembina's conventional pipelines by yearend 2013. To accommodate this expected volume increase, Pembina is currently "assessing its mainline capacity to determine potential expansion requirements," it said.

TRANSPORTATION — Quick Takes

Another US LNG terminal begins operations

Operations have begun at what is likely to be the last LNG terminal to be built in North America.

A formal ceremony Oct. 27 at Pascagoula, Miss., inaugurated the Gulf LNG terminal, equally owned by GE Energy Financial Services and El Paso Corp., Houston. A subsidiary of El Paso will operate the 5 million tonne/year terminal.

Start-up of the terminal brings to 87.5 million tpy the amount of LNG import capacity operating along the US Gulf Coast, OGJ data show. Of the six US terminals now operating on the gulf, four are in varying stages of petitioning for permission to become LNG export plants (OGJ, Mar. 7, 2011, p. 100).

Earlier this week, BG Group announced it had signed the first sale and purchase agreement (SPA) for LNG produced on the US Gulf Coast (OGJ Online, Oct. 26, 2011). The LNG producer will be Sabine Pass Liquefaction LLC, a unit of Cheniere Energy Partners LP, which operates the largest import terminal in the Western Hemisphere in Cameron Parrish, La.

Under the SPA, LNG exports could begin as early as 2015.

The Gulf LNG terminal sits near to Bayou Casotte Ship Channel in the Port of Pascagoula. It consists of two 160,000-cu m storage tanks with combined capacity of 6.6 bcf; 10 vaporizers, providing a base sendout capacity of 1.3 bcfd; and 5 miles of 36-in. pipeline connecting to downstream pipelines owned by Gulfstream, Destin, Transco, and Florida Gas Transmission.

The pipelines provide access to the Pascagoula gas processing plant operated by BP America Production Co.

The Gulf LNG terminal is contracted under 20-year firm service agreements for all of its capacity with a group of LNG producers, including several major oil and gas companies, to support the facility and provide a source of LNG.

EPP to expand Eagle Ford gas treatment

Enterprise Products Partners LP will build new gas processing and pipeline capacity in South Texas, expanding its natural gas and NGL infrastructure to accommodate expected production growth from the Eagle Ford shale. EPP will add a 300 MMcfd train at its Yoakum cryogenic natural gas processing facility in Lavaca County, Tex., and 62 miles of 24-in. and 30-in. OD pipeline loops in the region. The company will also add sufficient compression to boost transport capacity by 300 MMcfd.

The newly announced facilities are expected to begin service first-quarter 2013.

EPP is already building an Eagle Ford rich natural gas mainline system and associated laterals consisting of roughly 300 miles of pipeline with gathering and transportation capacity of more than 600 MMcfd. The Yoakum natural gas processing facility already has 600 MMcfd of capacity under construction, expected to begin service second-quarter 2012. The new Yoakum plant will complement the partnership's seven existing natural gas processing plants in South Texas with total capacity of 1.5 bcfd.

To handle the additional NGLs from the cryogenic facility, EPP has increased the OD of its 127-mile Y-grade pipeline running between the Yoakum plant and EPP's fractionation complex at Mont Belvieu, Tex., to 24-in. from 20-in. EPP put a fifth NGL fractionator at Mont Belvieu into service last month, bringing total capacity to 380,000 b/d, and already has a sixth under construction (OGJ Online, Oct. 18, 2011).

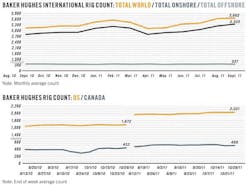

About 195 drilling rigs are active in the play as of end third-quarter 2011, compared with roughly 105 rigs in third-quarter 2010, according to EPP.

Pipelay begins on Papua New Guinea LNG

The initial lengths of the 450-km offshore portion of the planned 700-km natural gas pipeline for ExxonMobil Corp.'s $15 billion Papua New Guinea LNG project have started being laid on the seabed.

The pipe laying has begun near the LNG plant, which is under construction 20 km northwest of Port Moresby.

Two offshore pipelay vessels, Semac 1 and Castoro 10, are scheduled to work on the job for the remainder of this year and through 2012.

The first part of the job was the shore pull, which involved pulling the 36-in. pipe to shore to enable a connection with the land pipe section.

The pipeline will transport gas from the southern highlands and Western Provinces fields to the proposed two-train, 6.6 million tonne/year LNG plant.

LNG is scheduled to come on stream in 2014 and will deliver in excess of 9 tcf of gas during its 30-year life.

ExxonMobil is operator of the project with 33.2%. Oil Search has 29%, Independent Public Business Corp. (Papua New Guinea government) 16.6%, Santos 13.5%, Nippon Oil 4.7%, state-owned Minerals Resource Development Co. 2.8%, and Petromin 0.2%.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com